Goedemorgen, here is what I found interesting this AM:

• Too Bullish for Comfort (Barron’s)

• Sheila Bair: Is BlackRock too big to fail? (Fortune)

• Ultra-Low Interest Rates: Who Wins? Who Loses? (Conversable Economist)

• Why the Dollar Dominates, and Why That’s Not All Good (WSJ) see also Stiglitz: An Agenda to Save the Euro (Project Syndicate)

• REITS, Brokers & Conflicts: The ghost of private placements past (Investment News)

• Home Buyers Are Scarce, So Renters Take Their Place (NY Times)

• How to Burst the “Filter Bubble” that Protects Us from Opposing Views (MIT Technology Review)

• NSFW!: The Porn Industry Goes Social With PinSex (Fast Company)

• Apple, China Mobile Sign Deal to Offer iPhone (stratēchery)

• 5 New Rules of the Office Holiday Party (Fox Business)

What are you reading?

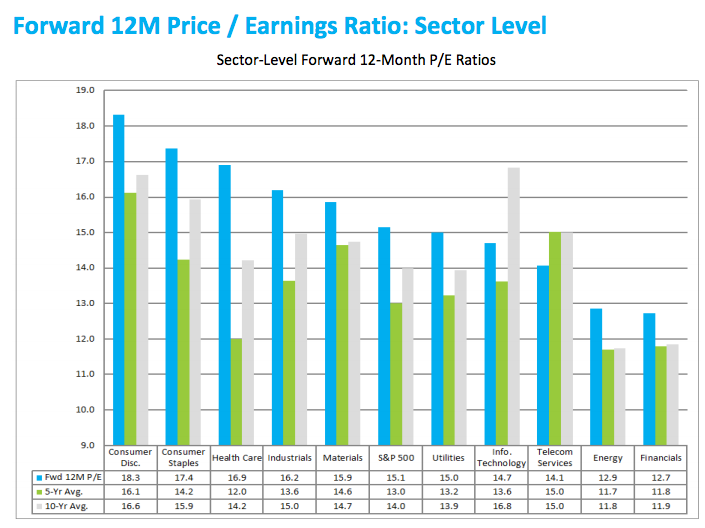

Forward Price / Earnings Ratios By Sector

Source: The Reformed Broker

What's been said:

Discussions found on the web: