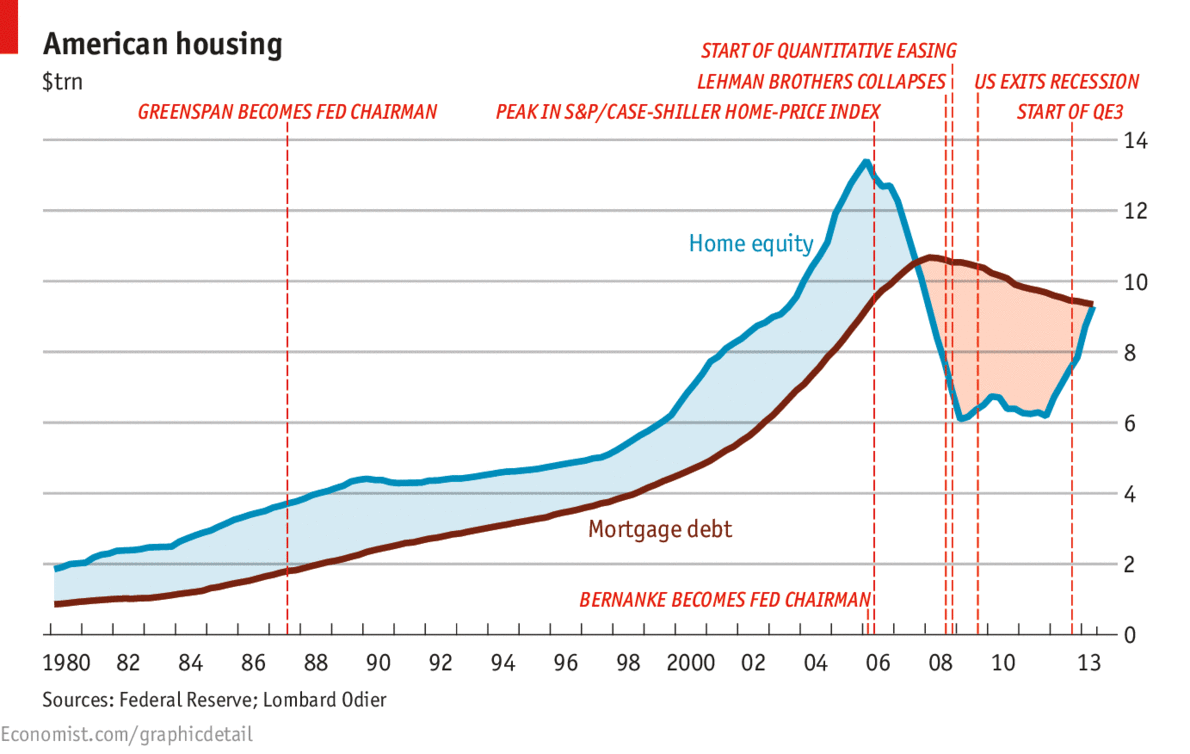

American Homeowners Are Finally Returning to Positive Equity

Source: Economist

Here is a fascinating albeit somewhat confusing chart: Total US residential equity relative to total mortgage debt.

The problem, even misleading part about the chart is some 30% of homes are bought with no mortgage — straight up cash deals.

What's been said:

Discussions found on the web: