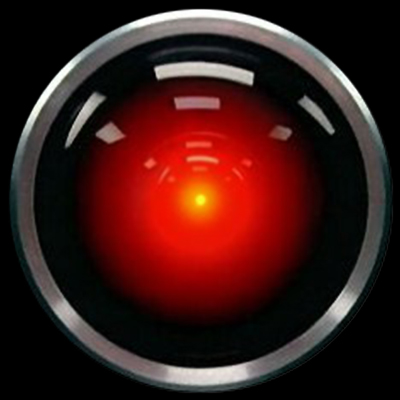

Why, pray tell, is it believed correct by a majority of lawmakers in America that “Gun’s Don’t Kill People – People Kill People”, yet, the same lawmakers fail to apply similar conviction (no pun intended) to the thought that “Banks Don’t Commit Financial Crime – People Commit Financial Crime”? It is quite obvious that in the truest sense, a bank cannot (yet) commit a crime, and until such time as HAL or Holly take over the reins and execution of bank trading and management, there are individuals, and responsible managers, and their Managers (upper-case “M”) who, should be culpable. Yet, in 2013 America, if one pays enough, it seems the perps and perp-enablers and perp-encouragers and perp-incentivizers can walk free.

Why, pray tell, is it believed correct by a majority of lawmakers in America that “Gun’s Don’t Kill People – People Kill People”, yet, the same lawmakers fail to apply similar conviction (no pun intended) to the thought that “Banks Don’t Commit Financial Crime – People Commit Financial Crime”? It is quite obvious that in the truest sense, a bank cannot (yet) commit a crime, and until such time as HAL or Holly take over the reins and execution of bank trading and management, there are individuals, and responsible managers, and their Managers (upper-case “M”) who, should be culpable. Yet, in 2013 America, if one pays enough, it seems the perps and perp-enablers and perp-encouragers and perp-incentivizers can walk free.

The question as to “why” there exists a paradox of culpability is a rhetorical question. The answer is rather obvious: the legislature and its lawmakers have been captured, which leads to laws and standards of convenience, rather than consistent logic. In the game of political rock-paper-scissors, money trumps philosophical consistency each and every day.

While I am admittedly both curmudgeonly and, at times cantankerous, and I am known to be periodically nostalgic, none of these are behind my belief that partnerships-of-old, as compared to publicly-listed joint-stock companies, throttled behaviour in ways that were palpably superior, precisely because there was a semblance of culpability – at the very least to one’s partners. And if you weren’t a partner, you can be certain that the culpable partner would insure potential tumors under his remit were excised, as such a cancer would impact both his partnership and therefore his children’s patrimony. I am of course, using this as an example, and I am not suggesting banks return to a partnership model. But it is important to question precisely what message is being sent by the decided lack of personal culpability, directly, by line managers, and their senior managers. Yes, their Senior Managers. In most areas of the law (it has been pointed out to me on more than one compliance-related occasion) ignorance is no excuse.

So “Pay Away” your sins, while a palliative to the Treasury, is no cure. Only the bona-fide prospect of sharing a cell with a father-raper, near-total asset seizures vs. to most individuals what now appears to be eventual repayment of an interest-free loan (if caught) and a possibly blot on one’s employment record (which BTW others less pure-minded may see as a virtue). In practice, this must mean more than selling out a few of your subordinates to take the rap, and make it go away. Like cancer, if you don’t get it all, it will return, metastasize, and kill the host. And to be clear: WE are the host.

What's been said:

Discussions found on the web: