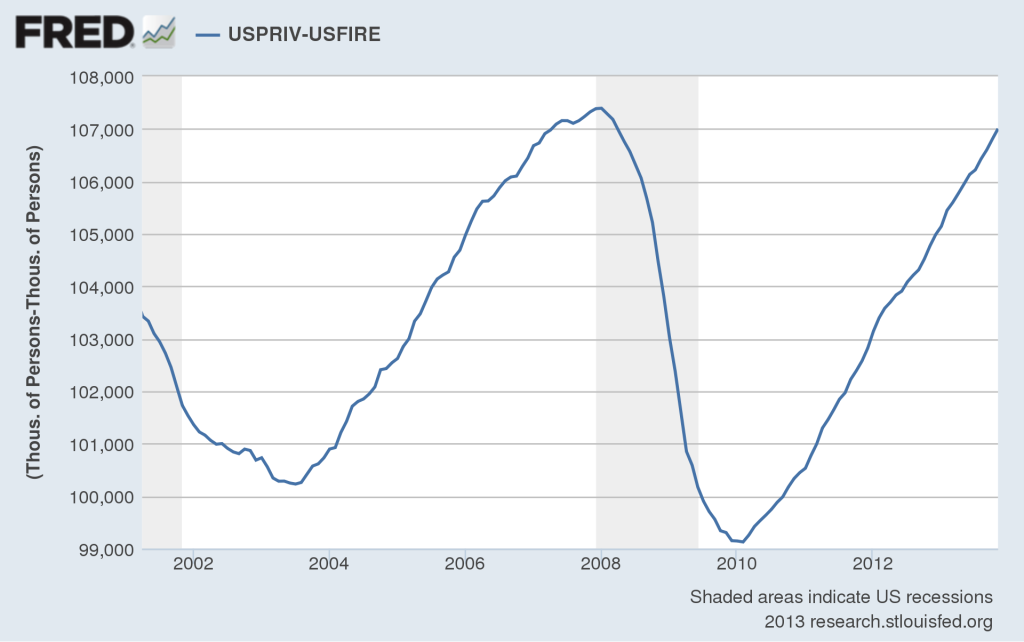

Here is an interesting question: How does the present employment rate compare with the prior peak?

According to Bureau of Labor Statistics data, if we compare the prior recent peak of 139,143,000 of November 2007 with last month’s figure of 137,942,000 (I used non-seasonally-adjusted because it’s November to November), we are still 1.2 million or so below the earlier highs. This suggest that by May or June 2014, the recovery will pass previous top levels. (Perhaps it’s noteworthy that women have already passed their prior peak employment).

But let’s look at this differently. What if we back out all of the artificially driven employment that has disappeared? If that is the case, we have probably already passed the prior “reality adjustment peak employment” — months ago. That is, remove the real estate agents, mortgage brokers, subprime securitizers, construction workers, etc., of the bubble and you end up with much more modest numbers.

Continues here

What's been said:

Discussions found on the web: