For years I have been a regular reader of David Rosenberg’s. Back when he was Merrill Lynch’s chief economist, to more recently at Canada’s Gluskin Sheff, I have enjoyed his daily “Breakfast with Dave.”

Sometimes, it is because we disagree, and I am looking for an intelligent challenge my pre-existing notions. Other times, it is to see where Dave and I agree. And sometimes, as with his missive yesterday, it is simply to see something different and interesting.

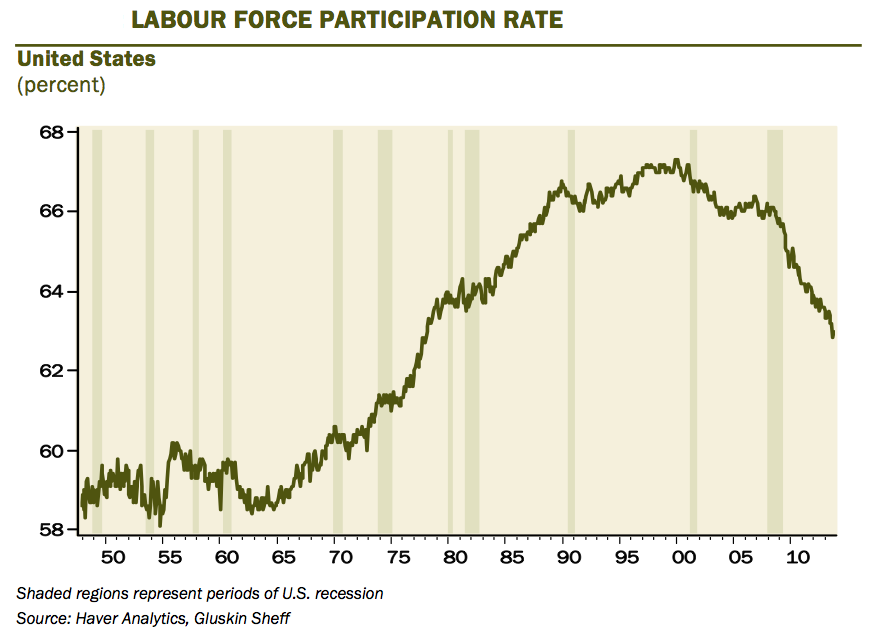

The pair of charts here are what leaped out at me. The first shows Labor Force Participation Rate. It peaked in the late 1990s. Particpation has plummeted since. This usually gets trotted out to show how weak the job market is.

With masses of baby boomers retiring, some of that is a secular issue. But the acceleration during and after the Great Recession suggests that some of this is cyclical.

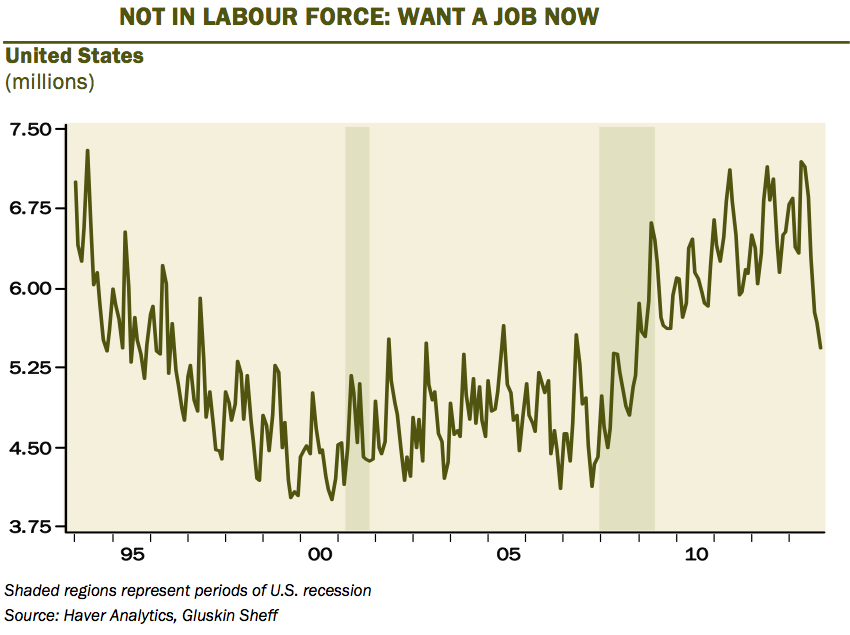

The NILF chart (Not in Labor Force) was the big surprise to me. The rise in the number of people leaving the labor force because they could not find work was deeply troubling. Those who believe the employment situation is bad and getting worse frequently point to this metric as proof.

That seems to be changing. Note the collapse in the number of people leaving the workforce who still want full time jobs:

Dave writes:

No wonder the Fed is now starting to focus back on the inflation part of its mandate. The unemployment rate is falling at a pace that would augur for an end to all the Fed intervention, but these policymakers want to remain aggressive and as such continue to shift the focus and the goal posts to fit their needs. The bottom line is that it is not going to be hard to see the unemployment rate at 6% by the end of next year — even with no change in the participation rate, all it would take is for +250k payroll gains per month (hey — we had nearly +200k in 2013 with sub-2% growth … imagine what we get with 3%+ growth next year!).

I am not quite as rosy as Rosie. I am unsure if we are going to see 3 percent gross domestic product growth next year, but I like his spin on labor force participation rate. The percentage of people who say they are dropping out of the labor pool because they cannot find a job is falling.

This is a positive economic development.

What's been said:

Discussions found on the web: