Why Do Forecasters Keep Forecasting?

It’s that time of year again! All of your favorite prognosticators will soon be trotting out their favorite (albeit worthless) prognostications. You are advised to ignore them with extreme prejudice.

Bloomberg, December 11, 2013

Source: Above the Market

“He who lives by the crystal ball soon learns to eat ground glass.”

Its that time of year again! All of your favorite prognosticators will soon be trotting out their favorite (albeit worthless) prognostications. You are advised to ignore them with extreme prejudice.

This has been a peeve of mine for quite some time, going back to “The Folly of Forecasting” and, more recently, “Get ahead of forecaster folly.” I was reminded of this courtesy of a commentary by Robert Seawright, chief information officer of Madison Avenue Securities. It had the delightful tongue-in-cheek title, “Missed It By *This* Much.”

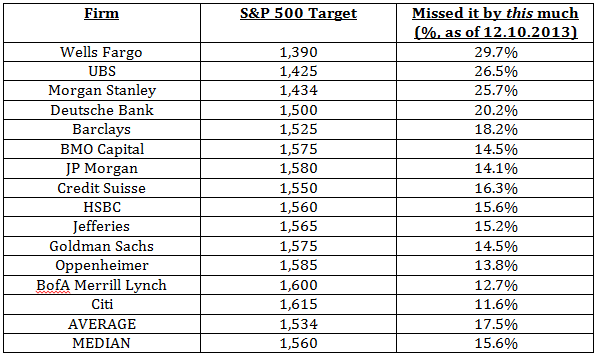

Seawright notes that the “one forecast that is almost certain to be correct is that market forecasts are almost certain to be wrong.” His table, which I have reproduced here, reveals just how true that was for S&P 500 predictions in 2013. As of yesterday, the best of the major broker forecasts was only off by about 12 percent, the worst by 30 percent. All told the seers’ average miss was a full 17.5 percent.

The simple truth is that, as a species, you humans are terrible about making predictions. Forget forecasting big events that are not in your control, such as the economy or the market, you cannot even forecast your own behavior. If you could, the fitness and diet industries would be bankrupt.

Back in 2007 (when I still participated in this silliness), I ended up winning a Wall Street Journal contest for such predictions. Ironic for someone who does not believe in them. At the time, I noted that getting incredibly lucky and nailing the numbers was based purely on chance. To be blunt, it was nothing more than dumb luck, and much to the chagrin of my employer at the time, I told CNBC anchor Mark Haines as much.

On occasion, I still get the occasional TV anchor asking me questions such as, “Where will the Dow be in 1 year?” It is amusing to respond honestly — “I haven’t the slightest idea” — and see their faces contort.

Regardless, the true danger of forecasting is not that you will be wrong — the odds are you will — but rather the natural tendency to stick to a forecast regardless. Instead of adjusting to changing conditions, we have the odd tendency to marry the old prediction.

Ned Davis summed this up in his book “Being Right or Making Money.” There is a tendency to want to be right, to want your prediction to come true. Once you let go of this hope to be correct in the face of mounting evidence to the contrary, you can change your positioning to reflect reality instead of wishes.

Hence, our advice for the silly season: Ignore the forecasts, and instead, make money.

What's been said:

Discussions found on the web: