Here is my afternoon train reading:

• How to Invest as Interest Rates Rise (WSJ)

• Why 2014 could be the most interesting year in technology in a long time (Quartz) see also Q&A with Marc Andreessen: Bubble Believers ‘Don’t Know What They’re Talking About’ (WSJ)

• Investors grow confident — or is it overconfident? — as stocks hit record highs (Yahoo Finance)

• Dr. Doomlove, or How Nouriel Roubini Learned to Stop Worrying (Businessweek)

• Hilsenrath’s Takeaways: Highlights From Bernanke’s Speech (WSJ) see also A Weekend of Fedspeak (Tim Duy’s Fed Watch)

• 30 Under 30 (Forbes)

• MIT Economist Seeks Facts in Health-Care Policy Debate (Bloomberg)

• Ronald Rubin: How the ‘Wolf of Wall Street’ Really Did It (WSJ) see also Leonardo DiCaprio Addresses ‘Wolf’ Controversy: ‘We’re Not Condoning This Behavior’ (Variety)

• This is Your Brain on Religion: Uncovering the science of belief (Salon)

• How Nobel-Winning Economic Theories Can Help Your Online Dating (WSJ)

What are you reading?

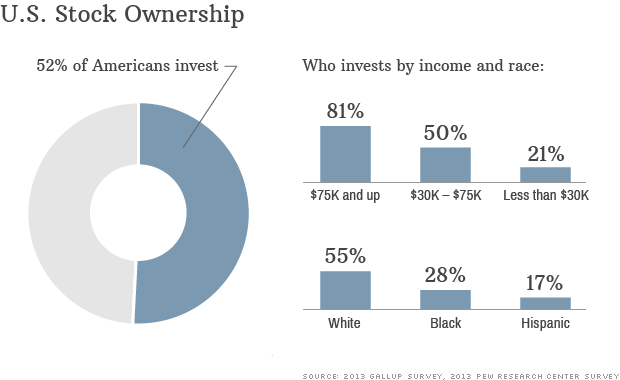

Millions See No Benefit From Soaring Stock Prices

Source: CNN

What's been said:

Discussions found on the web: