My Monday afternoon reading:

• 3 Popular Economic Warnings That Are So Much More Complicated Than They Look (Motley Fool)

• Buffett’s Fourth Law of Motion: Your Behavior (A Wealth of Common Sense)

• The US is nowhere near another housing bubble (Quartz) see also The Tale of a House, and an Entire Market (NY Times)

• Why Aren’t App Designers as Famous as Chefs? (Digits)

• Make ISPs into “common carriers,” says former FCC commissioner (Ars Technica) • A Vindicated Snowden Says He’d Like to Come Home (New Yorker) • Ezra Klein Is Joining Vox Media as Web Journalism Asserts Itself (NY Times) see also Q&A: Ezra Klein Promises “A Completely Different Product” (BuzzFeed)

• How to Talk to a Climate Skeptic: Responses to the most common skeptical arguments on global warming (Grist)

• Tech billionaire compares self to Jews under the Nazis, fears pogrom (LA Times)

• The Village Voice’s Pazz & Jop Critics’ Poll: Top 10 Albums By Year, 1971-2013 (Village Voice)

What are you reading?

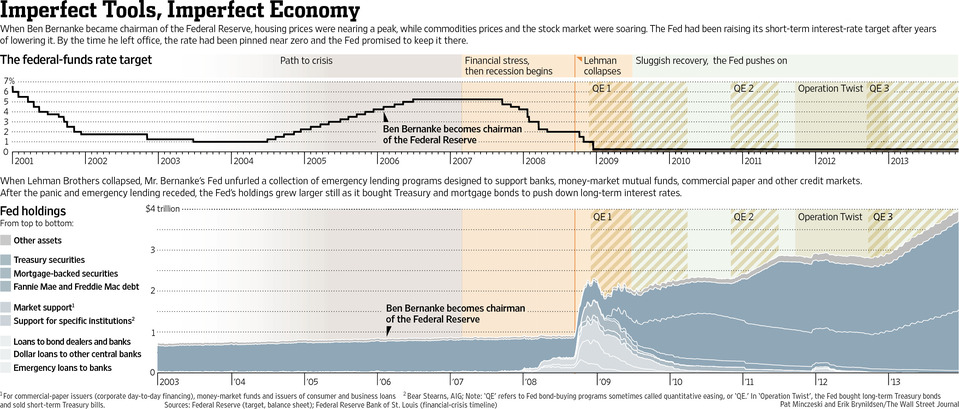

The Fed’s Imperfect Tools for Growth

Source: WSJ

What's been said:

Discussions found on the web: