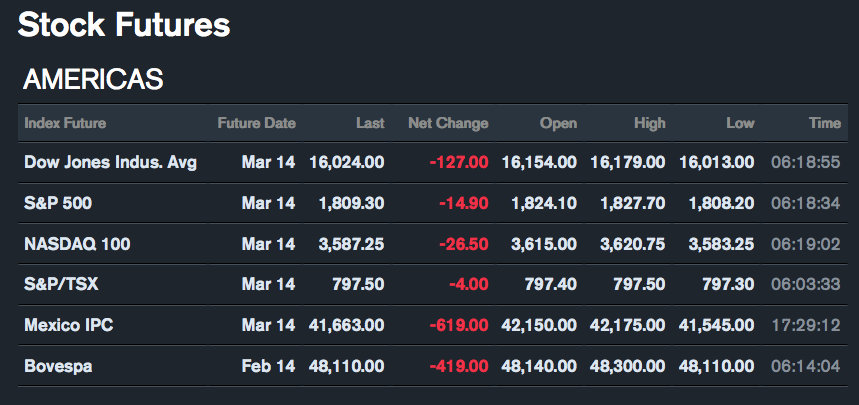

click for updated futures

Yesterday, we discussed the likelihood of an equity correction versus the end of the bull market. Today, futures are deep in the red, looking like another 1 percent sell-off or worse awaits us. European stocks are down 1 percent or more, with the IBEX off more than 2 percent. In Asia, it is a 2 percent whackage, although China has (so far) managed to hold on to small gains.

Perhaps on this philosophical Friday, it might be a good time to wonder aloud as to the causes of this change in fortunes. Why the sudden shift, from excess bullishness and exuberant expectations of more double-digit gains, to a recognition that perhaps the party won’t go on forever? You humans seem to desperately search for a simple narrative that explains complex events of unknown causation. An explanatory need not be accurate, only understandable and comforting. This is inherent in a species that has a rich tradition of storytelling. The narrative trumps data almost all of the time. The price action and misbehaviors of markets are certainly no different.

Hence, a correction is not simply the random meanderings of a complex system comprised of the buying and selling activities of millions of participants, but rather must have been caused by stocks that were too pricey, or earnings that have not lived up to expectations, or the development of big trouble in China. The problem with these rationalizations is that all of these things were well understood by markets — and have been for some time. None are surprises, and none reflect information that is new or was especially unknown previously.

What's been said:

Discussions found on the web: