Source: JP Morgan

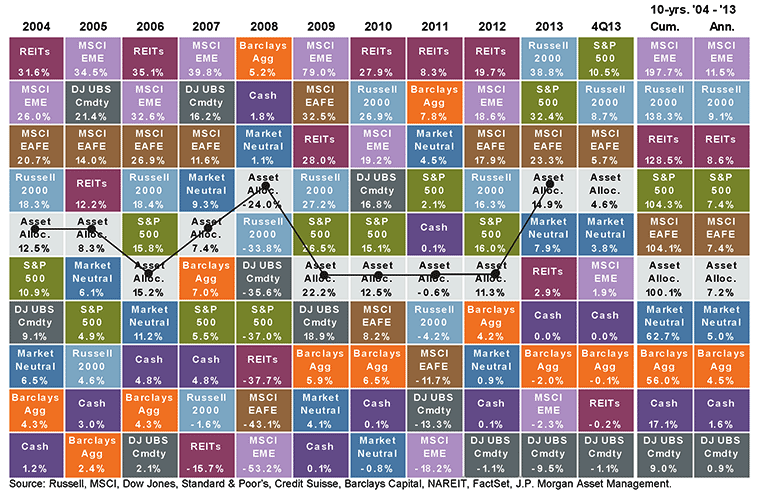

Whenever anyone asks me about my favorite sector or market for the coming year, I like to show the table above. While not quite a quintillion-to-one bet, the table reveals what a challenge it is to consistently identify the best asset class for the coming year. No one seems to be able to do it regularly.

The recognition of that truth hasn’t stopped anyone from trying, as noted in the Bloomberg News story earlier this week: Hedge Funds’ Assets Increase 17% to Record $2.63 Trillion. Hence, the romancing of alpha continues even if it means forsaking beta.

What's been said:

Discussions found on the web: