My afternoon train reading:

• The Single-Best Metric: EV/EBITDA (Crossing Wall Street)

• American Idle: Five Reasons We Hate the Stock Market (Reformed Broker) see also Stock traders with need for speed turn to laser beams (WSJ)

• Current liquidity-driven markets may be an Aberration, but Stubborn Aberrations Are Worth Paying Attention to (Tocqueville Funds)

• Is U.S. Housing Unaffordable? It Depends on How You Chart It (Real Time Economics)

• The Vampire Squid Strikes Again: The Mega Banks’ Most Devious Scam Yet (Rolling Stone)

• Characteristics of the Monied “Like” Button (Civilization Systems) see also Who ‘likes’ my Virtual Bagels? (BBC)

• Leaked Records Reveal Offshore Holdings of China’s Elite (ICIJ)

• 25 Horrible Things That Happen If You Don’t Get Enough Sleep (Business Insider) see also Does a More Equal Marriage Mean Less Sex? (NY Times)

• Google Earth: how much has global warming raised temperatures near you? (The Guardian)

• How the Beatles Went Viral: Blunders, Technology & Luck Broke the Fab Four in America (Billboard)

What are you reading?

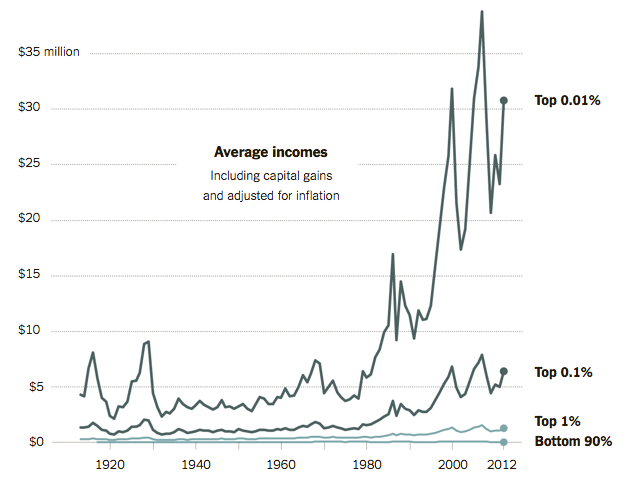

Even Among the Richest of the Rich, Fortunes Diverge

Source: NYT

What's been said:

Discussions found on the web: