Here’s what I’m reading over my Sunday morning coffee:

• 2008 FOMC Laugh Track: Gallows Humor at the Federal Reserve (Real Time Economics)

• Zweig: The ABCs of Investors’ DNA (MoneyBeat)

• Two-Speed Recovery: US vs. EU (World Affairs)

• Are You Ready for a Long Retirement? (WSJ) see also Five Really Dumb Money Moves Retirees Make (WSJ)

• The Exotic Animal Trade (Pricenomics)

• Cooling U.S. Home Sales Only Partly Due to Weather (Bloomberg) see also Wall Street Landlords Buy Bad Loans for Cheaper Homes (Bloomberg)

• Drone Meet DroneShield (Climateer Investing)

• How Obamacare Could Unlock Job Opportunities (NYT Mag) see also Stop Saying “Do What You Love, Love What You Do.” It Devalues Actual Work. (Slate)

• Fun & Interesting article: A Young Inventor, Finding the Crunch Factor (NYT)

• Beck talks about his new album ‘Morning Phase’ and why it’s simple and subdued (WSJ)

What’s for brunch?

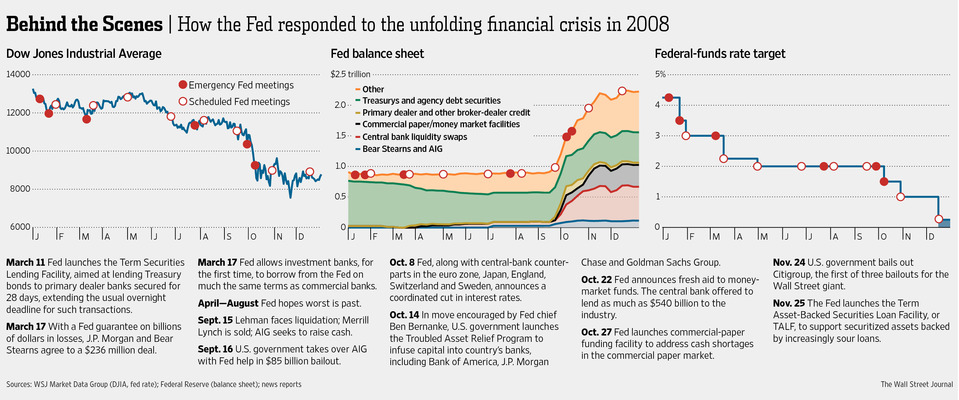

New View Into Fed’s Response to Crisis

Source: WSJ

What's been said:

Discussions found on the web: