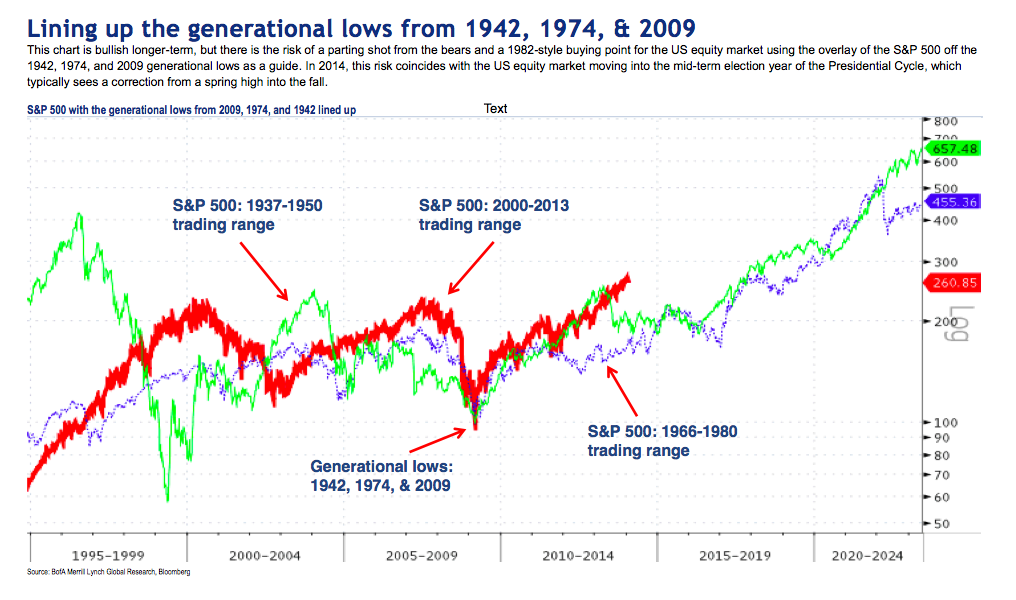

Source: Monthly Chart Portfolio of Global Markets, Bank of America Merrill Lynch

It seems that every 30 years or so, markets make what can be described as a “Generational Low.” We can define this as a capitulatory bottom, one that might be caused by a variety of factors, but usually includes some combination of fear and panic in the mix.

This equity market low point is likely to be unchallenged over the next 10-20 or so years. After that point, the combination of population growth, technological gains and of course, inflation, means that we will are highly unlikely to ever see stock indices at those prices again.

Towards that end, have a look at the chart above, courtesy of the technical team at Bank of America Merrill Lynch. “History may not repeat, but it rhymes” goes a quote which is often credited to but has never been verified as written by Mark Twain.

What's been said:

Discussions found on the web: