Source: Crestmont Research

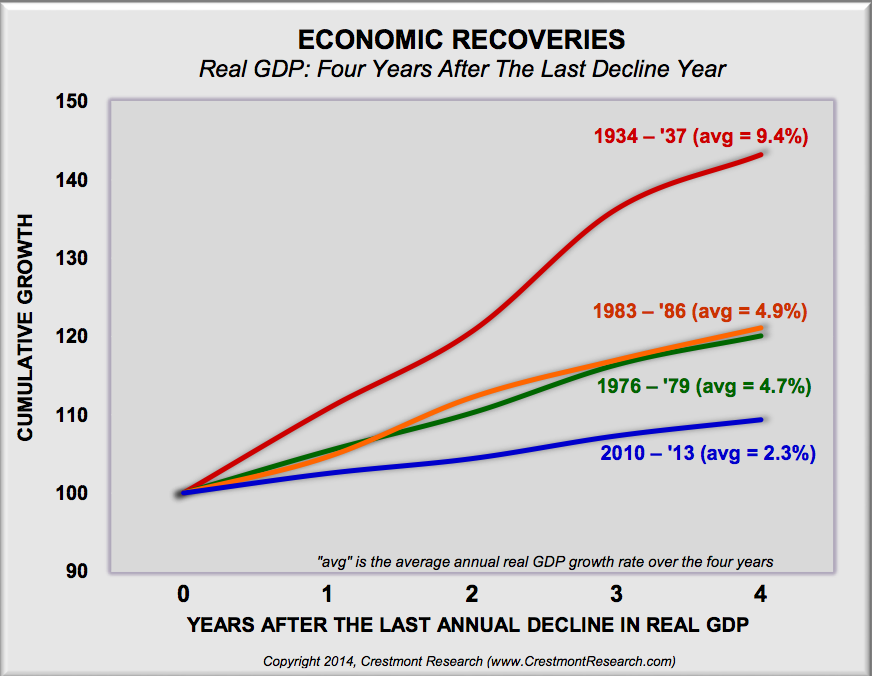

Ed Easterling, president of Crestmont Holdings LLC, created the chart above comparing various economic recoveries. He selected those that followed similar annual declines in real gross domestic product.

As the chart shows, the present economic recovery is the most sluggish we have seen.

What's been said:

Discussions found on the web: