My afternoon train reading

• Jeremy Grantham: The Fed is killing the recovery (Fortune)

• Luck and Skill Untangled: The Science of Success (Wired)

• Shiller: The Global Economy’s Tale Risks (Project Syndicate)

• The article that got Doug Kass banned from FinTV: CNBC cheerleaders (NY Post)

• History of Money (Millenial Invest)

• Author Elizabeth Kolbert talks to Ezra Klein about a possible sixth mass extinction (Vox)

• Wind Industry’s New Technologies Are Helping It Compete on Price (NY Times)

• NYC Is America’s Dirtiest City, Says Magazine That Belongs In The Trash (Gothamist)

• Meet Cloak, the ‘antisocial’ network that helps you avoid people (The Style Blog)

• Jackson Brings Sun Tzu With Nietzsche for Knicks Melo Drama (Bloomberg)

What are you reading?

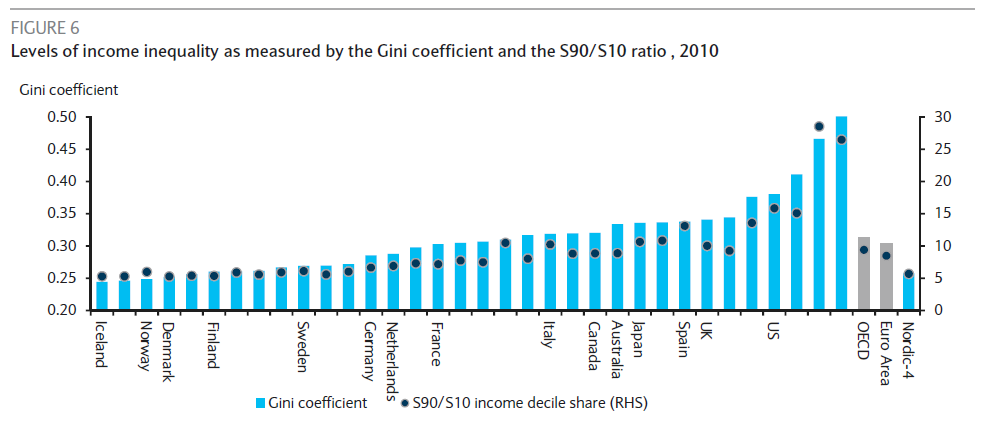

Levels of Income Inequality as Measured by the Gini Coefficient & S90/S10 Ratio

Source: Barclays

What's been said:

Discussions found on the web: