My Sunday morning reads:

• Tesla Is a Car, Not a Revolution (Bloomberg View) see also Tesla No DeLorean as 619% Jump Makes Hottest Auto Stock (Bloomberg)

• Are the robots about to rise? Google’s new director of engineering thinks so… (The Guardian)

• Stop trading! Now, before 2014 turns into 1929 (MarketWatch)

• The philosophical anthropology of the 1% (Potlatch)

• The Baloney Detection Kit: Carl Sagan’s Rules for Bullshit-Busting and Critical Thinking (Brain Pickings)

• Does the ‘Hot Hand’ exist in basketball? (WSJ)

• Netflix and Net Neutrality (stratēchery)

• ‘Unsubscribe’ button is Gmail’s best new feature in ages (Daily Dot)

• Food nutrition labels are set for an overhaul. (WSJ)

• The Biggest Losers In Oscar History And Other Things You Didn’t Know (Digg) see also All 85 Best Picture Oscar Winners Ranked (BuzzFeed)

What are you reading?

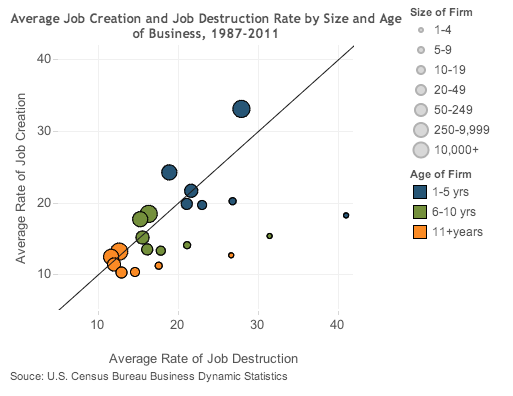

Average Job Creation and Destruction Rates by Size and Age of Business (1987 – 2011)

Source: Macroblog

What's been said:

Discussions found on the web: