Some reads to kick off your Sunday morn:

• Shut up already! It’s not 1929 (Marketwatch)

• The Lone Ranger of the 401(k)’s (NYT)

• Hedge Funds Unlikely Saviors for New York-Area Homeowners (Bloomberg)

• As Cash Use Drops, Do Crime Rates Follow? (BusinessWeek)

• It turns out Cuba actually needs the rest of the world (Quartz)

• Cultural production of ignorance provides rich field for study (LA Times)

• Enjoy Your $500 T-Shirt: Kickstarter Backers Get Nada in Oculus Sale (Businessweek)

• UNC’s fake classes were very fake (SB Nation) see also UNC Academic Scandal: Whistleblower, Former Athlete Speak Out (ESPN)

• A Nation of Takers? (NY Times)

• Here’s how a kid from Long Island became a king of Japanese ramen (PRI)

Whats for brunch?

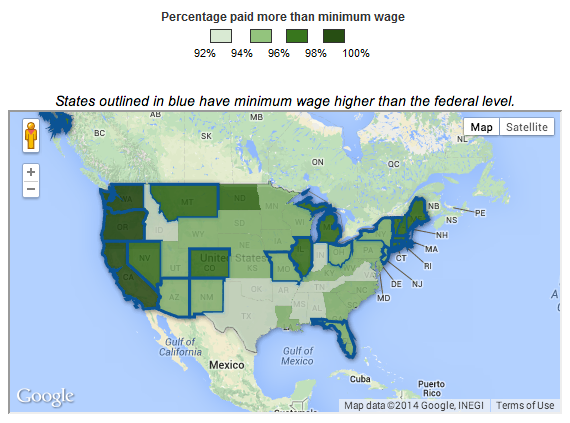

Fewest Americans Earning Minimum Wage Since 2008

Source: Real Time Economics

What's been said:

Discussions found on the web: