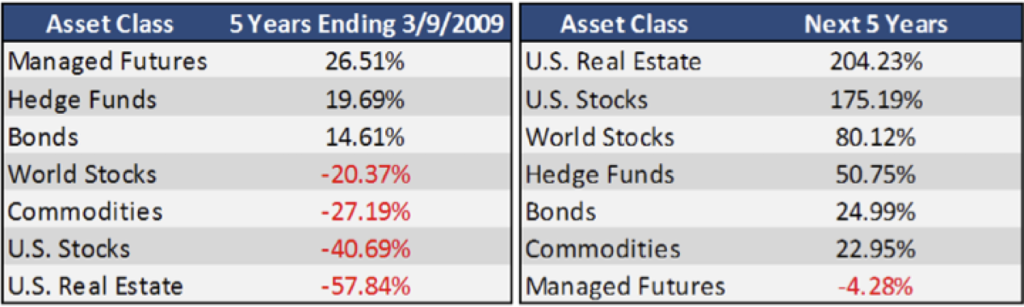

Have a look at the tables above showing the performance of various investments during the five years leading up to the financial crisis lows, and the five years after. It leads us to a rather fascinating exercise, looking at complexity, cost and performance.

Let’s start with the worst performers pre-crash: US Real Estate and Equities. Prior to the collapse, stocks had nearly doubled (March 2003 to October 2007). Note that doubling began just 3 years after the tech/dot com implosion. The peak to trough collapse of the S&P500 is even worse than that five-year track record suggests, falling 57% in about a year and a half ending March 2009. Ouch.

The Real Estate collapse was even worse: Off 58% in that five-year period. Perhaps a little context might help. Residential real estate was fairly flat (in real terms) from 1986-1996, before moving upwards until the end of the century, then exploding from 2001-06. Vacancy rates for office space in the 1990s was near zero; Shopping malls were getting built and sold off to REITs soon as they opened. Commercial real estate boomed in the 1980s, 1990s and early 2000s as real returns on fixed income was falling. The ROI for commercial real estate – and the low cost of capital – attracted lots of buyers looking for alternative to low bonds yields.

What's been said:

Discussions found on the web: