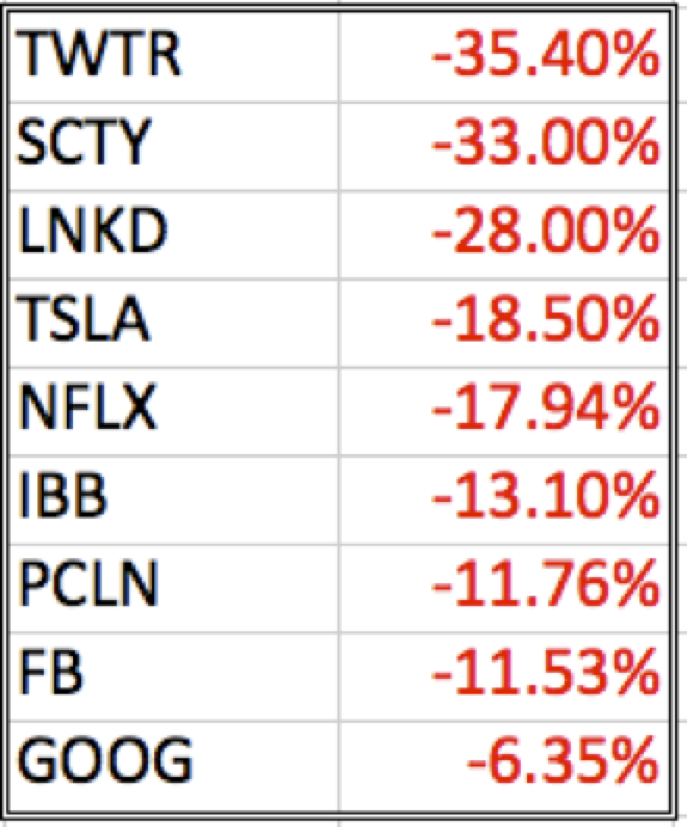

Fall from recent highs

Source: RWM

Some of the most prominent names in technology are getting shellacked today. These companies got way ahead of themselves and now they are, well, to be polite, let’s just call it “retrenching,” as they give up a large percentage of their gains.

I don’t think that Twitter Inc., LinkedIn Corp., Netflix Inc. or Tesla Motors Inc. are the force that has been driving the market higher — but they certainly garner an enormous amount of attention from the trading public and financial press.

It’s noteworthy that Google Inc. and Facebook Inc., ostensibly two of the industry’s leaders, are off only about 3 percent and 5 percent, respectively, having made up some of their earlier losses.

But let’s not put lipstick on this pig. The technology sector was down almost 2 percent today while the broader market is down less than half a point. And while technology is off a little more than 4 percent from its peak, as you can see, some names are just getting knocked down from their peaks.

What's been said:

Discussions found on the web: