Source: BAML

Earlier today, we discussed why the new market highs are so bullish.

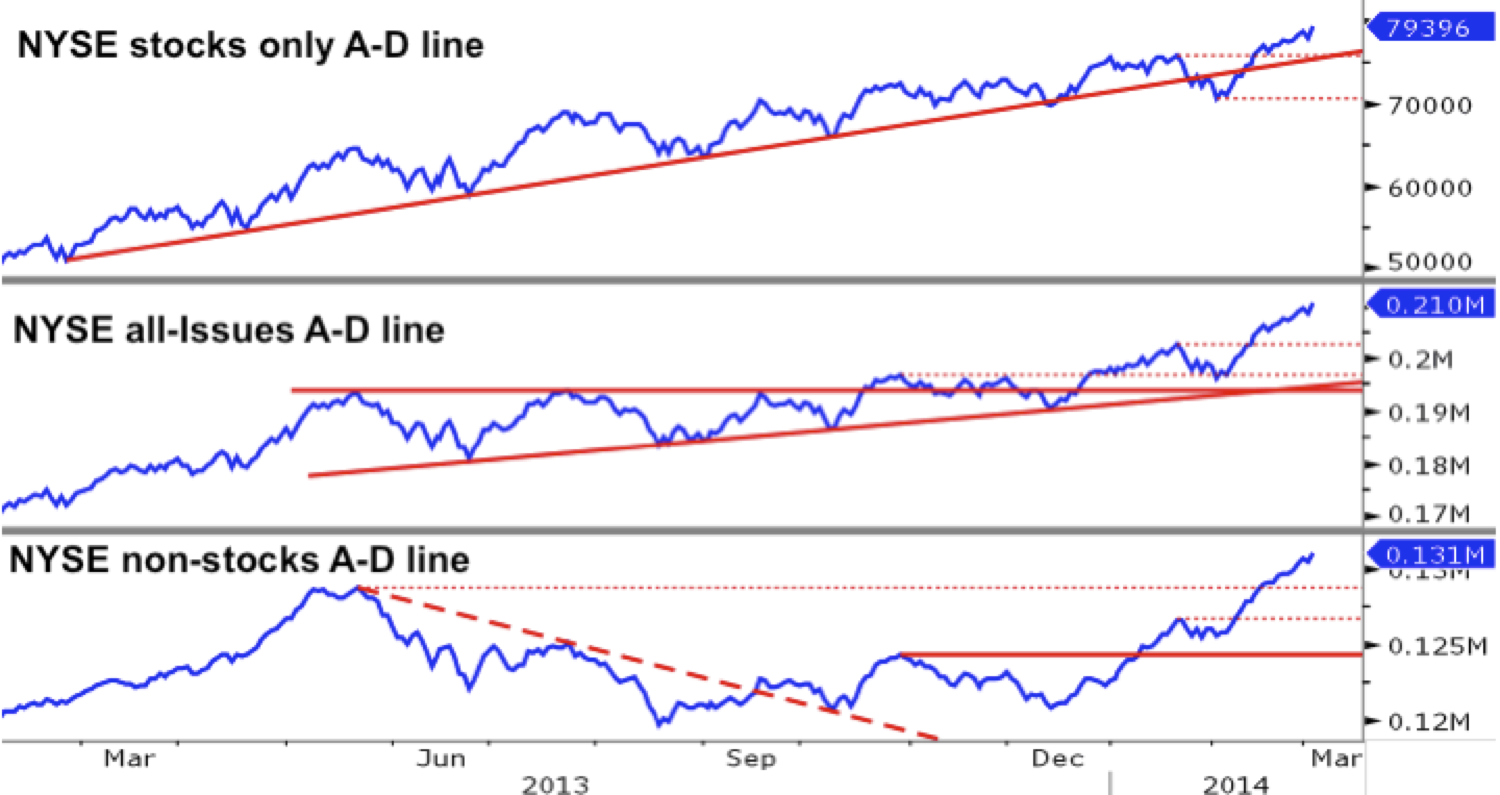

Technicians like to look at determinants beyond prices to get a read on how a market’s internals are behaving. Stephen Suttmeier, a technical research analyst at Merrill Lynch & Co., points out that volume and breadth are just as important as prices in understanding a market. Continues here

What's been said:

Discussions found on the web: