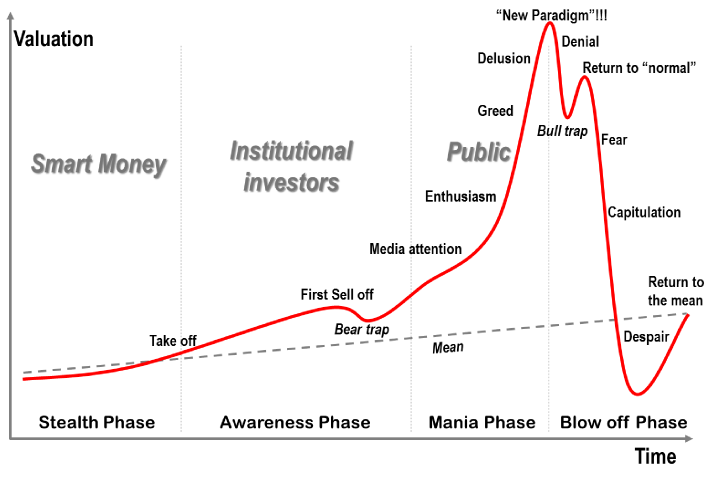

Bubbles and Manias

Source: Jean-Paul Rodrigue, Dept. of Global Studies & Geography, Hofstra University

Josh Brown reminded us yesterday of this terrific chart from Jean-Paul Rodrigue, a professor in the department of global studies and geography Department at Hofstra University.

Of course, the key question is: Where are we on the chart? My view is that we’re through the “Awareness” phase as many of the bears have already thrown in the towel (Jeremy Grantham is the latest one).

What's been said:

Discussions found on the web: