My afternoon train reading

• If Capital Grows This Fast, How Come Fortunes Disappear? (Bloomberg)

• Beware Of The Walking Dead In Your Portfolio (Forbes)

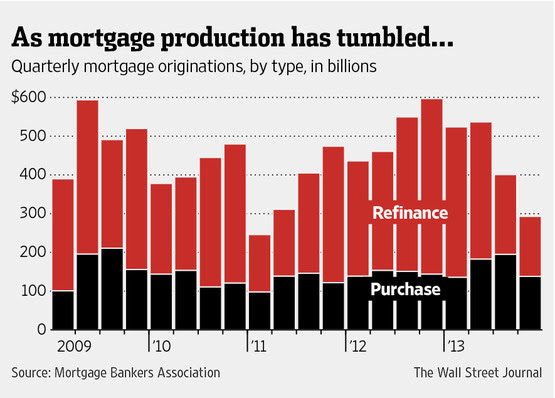

• Mortgage lenders ease rules for home buyers in hunt for business (WSJ)

• Average credit card interest up to shocking 21% (NY Post)

• Your Environment Matters If You Want To Make Better Decisions (Farnam Street)

• Will Sales Taxes Doom Amazon? (Bloomberg View)

• We actually get nicer as we get older—and it’s possible to speed change along (WSJ) see also Why do some politicians cross party lines more? They’re nicer (Vox)

• For legal pot sellers, finding a bank is still a pipe dream. (WSJ) see also A Day in the Life of Your Friendly Neighborhood Weed Messenger (Runnin’ Scared)

• How Americans Hate Each Other (Priceonomics)

• Viral ad encourages Danes to have sex on vacation (Daily Dot)

What are you reading?

Mortgage Lenders Ease Rules For Home Buyers in Hunt For Business

Source: WSJ

What's been said:

Discussions found on the web: