click for larger graphic

Source: Calculated Risk

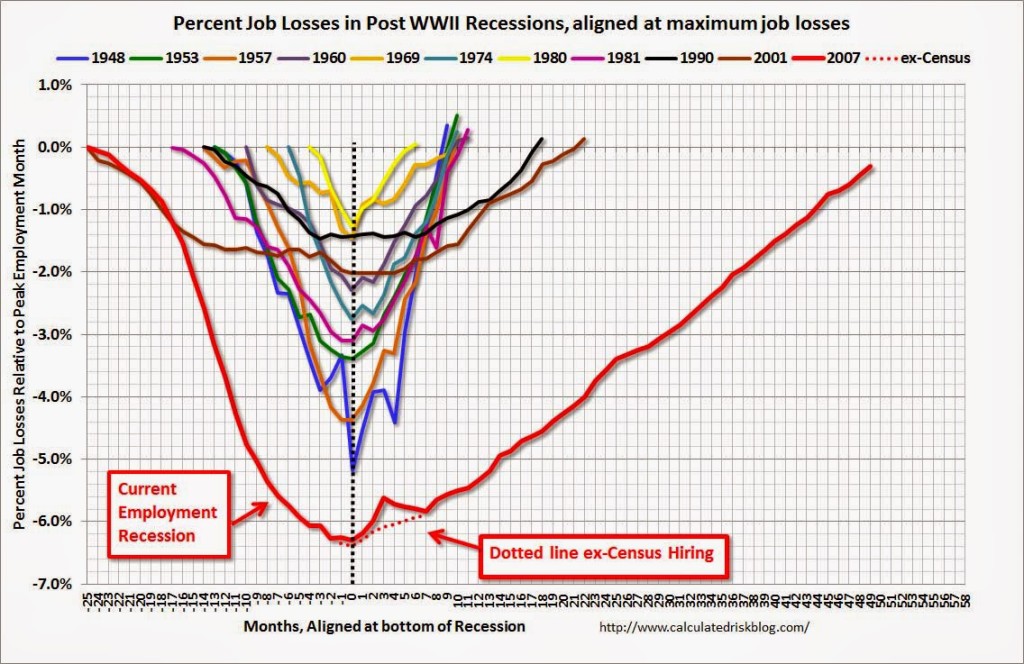

Have a look at the chart above, via Calculated Risk. It aligns the depths of all eleven post WW2 recessions, showing how long it took them to recover all of the jobs lost. The outlier is the 2007-09 contraction, which according to the chart above, is still somewhat below the prior employment level.

Friday’s Employment situation report pegged private sector (nongovernmental) employment back above 116 million. We now have more private sector employment than we did in January 2008, the prior highs in employment. During the recession, and not too long after, the private sector shed 8.8 million jobs; It has since added 8.9 million private sector jobs.

What's been said:

Discussions found on the web: