If you want to know what someone’s views of society are, ask what they believe is the best long-term investment.

I am fascinated each year when Gallup Poll asks Americans to choose the best option among real estate, stocks and mutual funds, gold, savings accounts and CDs, or bonds. The results are a pop psychologist’s dream of cognitive issues, belief systems and ideologies.

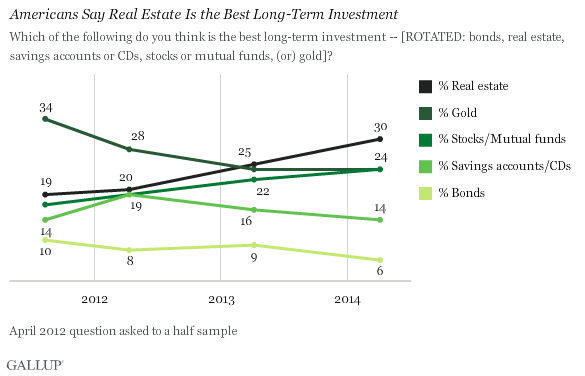

See the following chart:

Source: Gallup

Source: Gallup

Now, before we get into the details, some caveats: First, people often don’t really know what they want or think. Instead, when questioning people about their hopes and desires, we end up with a distorted mass-media version of a bad Robin Leach television series. Sad but true, often we don’t know what we want out of life.

Second, survey responses are not all they appear to be. There is value in the collective data, but we need to dive into the details to tease out some fascinating cultural differences.

Consider what happens when we divide the survey responses along income lines. We discover some very telling things about the American psyche. Continues here

What's been said:

Discussions found on the web: