Good morning. Here are my favorite long form articles from this week:

• 5 Slumps That Shaped Modern Finance (Economist)

• Clean Coal Is the Future (Wired)

• The Germ Theory of Democracy, Dictatorship, and Your Cherished Beliefs (Pacific Standard)

• Greed Is Good: A 300-Year History of a Dangerous Idea (The Atlantic)

• Krugman: Why We’re in a New Gilded Age (New York Review of Books)

• How to Buy Warhol, Degas and Renoir on the Cheap (WSJ)

• Herbalife: How lobbying dollars prop up pyramid schemes (The Verge)

• The Invention of the Slurpee (Priceonomics)

• The Crossroads of Should and Must (Medium)

• The Cube: A surprisingly sprightly history of the glum designs behind the world of modern work (Book Forum)

Whats up for the weekend?

Teen Survey On Device Ownership

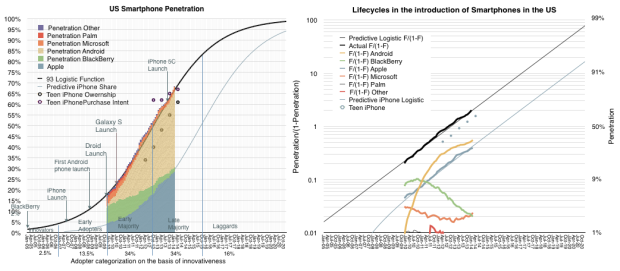

Source: Asymco

What's been said:

Discussions found on the web: