You made it through Monday. Enjoy some reads as a reward:

• London Enjoys Record-Setting $237 Million Penthouse Sale (World Property Channel) see also 20 million U.S. families could buy homes, but don’t (MarketWatch)

• Jeremy Grantham on Bubbles: ‘I Am Sure It Will End Badly’ (MoneyBeat)

• Fund Management: Cheap is cheerful (Economist)

• How Jon Stein plans to make the most of $45 million of VC money in remaking the RIA business (RIABiz)

• The iPad discontinuity (Asymco)

• Seven things we now know about Obamacare enrollment (Vox)

• Why can’t we? Indonesia to Boost Financing for Roads and Airports (Bloomberg)

• Why Gun-Rights Backers Win While Other Conservative Causes Lose (The Atlantic)

• How Russia Conquered Eastern Ukraine Without Firing a Shot (Vice)

• The 11 Defining Features of the Summer Blockbuster (FiveThirtyEight)

What are you reading?

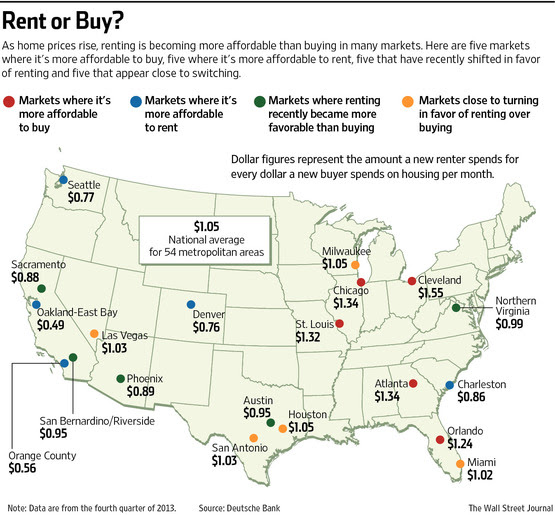

The New Math of Renting vs. Buying

Source: WSJ

What's been said:

Discussions found on the web: