Source: Amazon

Any reader of this site has likely heard about the book currently setting the world of economics aflame. “Capital in the Twenty-First Century” was written by a French economist named Thomas Piketty. It is on the New York Times best-seller list and is currently sold out, with its publisher scrambling to print more copies.

If you haven’t heard of Piketty, he is director of studies at the École des hautes études en sciences sociales and associate chairman at the Paris School of Economics, where he specializes in the study of economic inequality. If you had heard of him before the book’s publication, it probably was for his now infamous chart of income inequality in the U.S. It was widely adopted by many, especially the Occupy Wall Street crowd.

The book has dominated the media like no other work of economics since the writings of Milton Friedman or even John Maynard Keynes. I won’t spend too much space recounting the reviews, but suffice it to say they have been spectacular. The book has so dominated the economic debate, that it is hard to compare it to anything in recent memory.

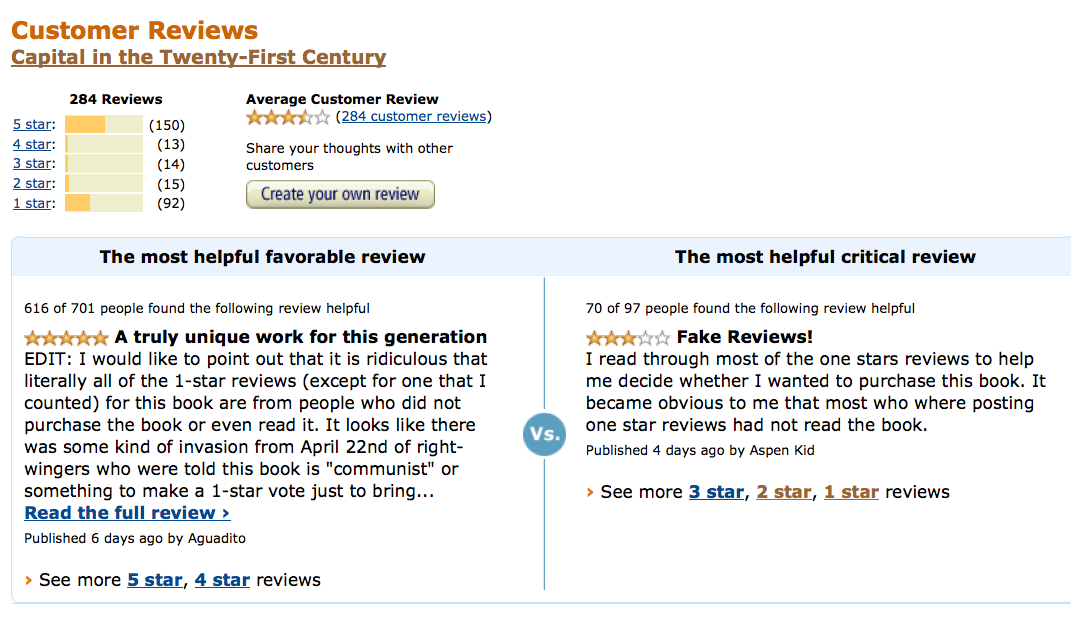

The data-driven demolition of trickle-down economics has the Ayn Rand crowd panicked. But what I find so fascinating about this debate (having not yet read the book, though I plan to) is the inability of the economic right wing to respond. Thus far they have been rendered impotent, unable to construct an intelligent counterargument. The strongest response so far — and I am not making this up — has been to give the book a single-star rating on Amazon.com’s website.

Alexander Kaufman at the Huffington Post collected some of the more amusing one-star reviews. There wasn’t a single verified purchaser of the book on the entire, absurd list.

Which raises a question about John Stuart Mill’s notion of the marketplace of ideas: Is the debate driven by the quality of ideas, or by the marketing, branding and PR behind it?

Ralph Waldo Emerson wrote “Build a better mouse trap and the world will beat a path to your door.” All tech entrepreneurs quickly learn that this isn’t true. The better mouse trap is merely the first step, which might get you some venture-capital funding if you have a good pitch book and a winning personality.

Regardless of your views on Piketty’s thesis, it raises an interesting epistemological question: Was Mill wrong? How could the “worse” idea win in the market place? If you believe trickle-down economics is a fraud, how did it dominate the world of economics for so many decades? If you think Piketty’s work is just so much nonsensical Marxism, why has it received so much acclaim from the economics profession and public alike?

Perhaps Mill’s marketplace of ideas suffers the same flaw as the efficient-market theory, or the idea that prices reflect all information and investors can’t beat the market over time. A decade ago, I called it “The kinda-eventually-sorta-mostly-almost Efficient Market Theory.” Markets are filled with all sorts of inefficiencies and friction. They eventually get it more or less correct, but along the way, they can deviate from the true path of efficiency. We just need to wait a decade or three for that efficiency to sort itself out.

What's been said:

Discussions found on the web: