My afternoon train reads :

• Trader A Steal at $15 Million (Bloomberg View)

• What is the difference between investing and speculation? (CFA Institute)

• Beware of reading too much into fear gauge (WSJ) see also Inflation is showing signs of picking up. So what does that mean for inflation? (WSJ)

• Japan stock rise signals global approval of Abe plans (WSJ) see also Record Japan Buybacks Salvaging Stocks Left Out of Rally (Bloomberg)

• 19 Supermarket Mind Games That Get You to Buy More Junk Food (Buzzfeed)

• Time is running out to solve our transportation funding crisis (WonkBlog)

• Five ways the American health care system is literally the worst (Vox)

• WTF? Incoming House majority leader won’t support re-authorizing Export-Import Bank (WSJ) see also Reasons Why Washington, DC, Is the Worst Place Ever (Vice)

• Dave Chappelle’s Triumphant Return to New York City (Daily Beast)

• Every Russian Novel Ever (The Toast)

What are you reading?

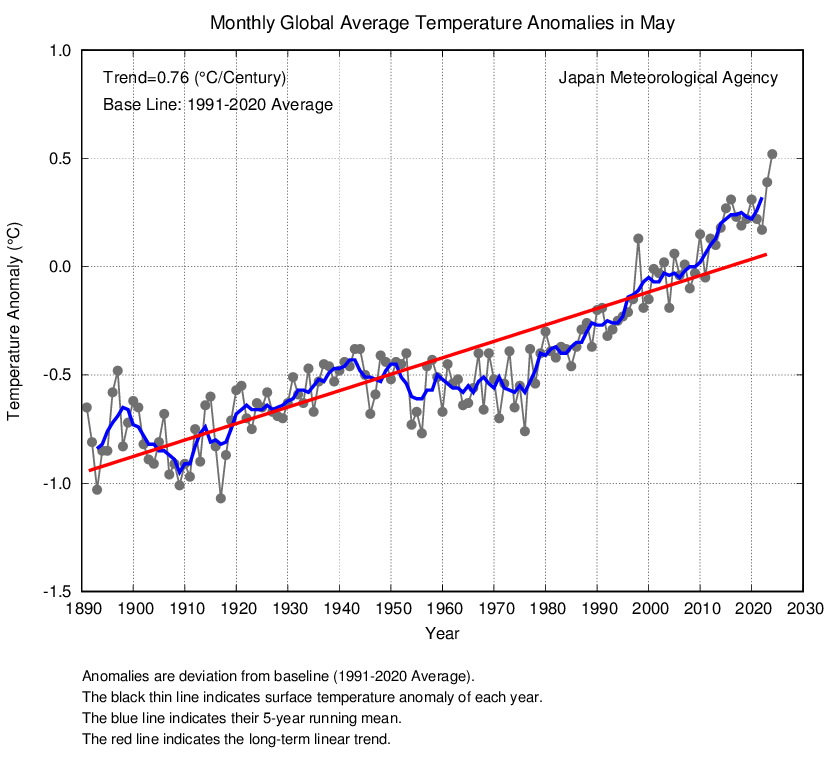

Spring 2014 Was the Hottest on Record Globally

Source: Wonk Wire

What's been said:

Discussions found on the web: