My afternoon train reading (assuming I can keep my eyes open):

• 5 brain flaws that make you a lousy investor (USA Today) but see 10 Lazy Ways to Appear Smarter (PsyBlog)

• Definition of ‘Rich’ Changes With Income (NY Times)

• Teens politely inform bank they can crack all its ATMs (DailyDot)

• Orszag: It’s time for some optimism about health care spending (Vox) See also Five ways the American health care system is literally the worst (Vox)

• YouTube to destroy its own business model, seeks to become useless commercial drivel (FT.com)

• Five charts that show how conservatives are driving partisan rancor in DC (WonkBlog) see also The sad, sorry decline of George F. Will (The Week)

• Download Speed by Country (Net Index)

• The economics of “everyone’s private driver” (Medium)

• Bergdahl Critics Didn’t Howl When Bush Freed Prisoners (NYT) see also Bush’s toxic legacy in Iraq (CNN)

• 11 Octopuses Caught in the Act of Being Awesome (Mental Floss)

What are you reading?

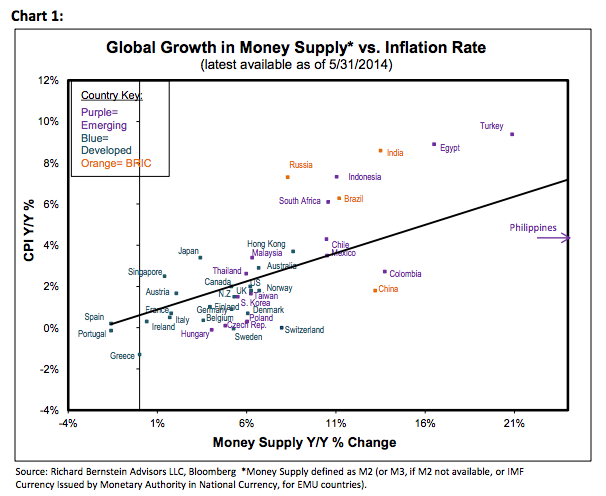

Global Growth in Money Supply vs. Inflation Rate

Source: Richard Bernstein Advisors

What's been said:

Discussions found on the web: