Source: Research Affiliates

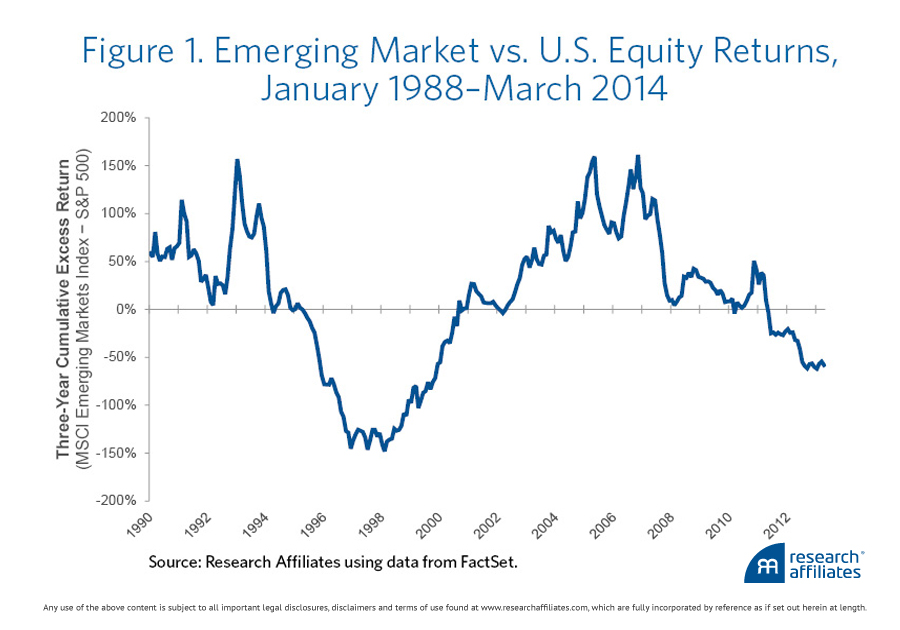

The chart above comes to us from Research Affiliates. It notes:

Through March 31, 2014, the three-year cumulative return of emerging market stocks as measured by the MSCI Emerging Markets Index is — 8.35%, while that of U.S. stocks as measured by the S&P 500 Index is 50.73%.

That raises a very interesting issue. The long-term trends favor emerging markets but they are nowhere to be found in the equity markets. Those weak numbers may be mean reverting soon. Continues here

What's been said:

Discussions found on the web: