Inquiring minds want to know: What is up with Yields ?

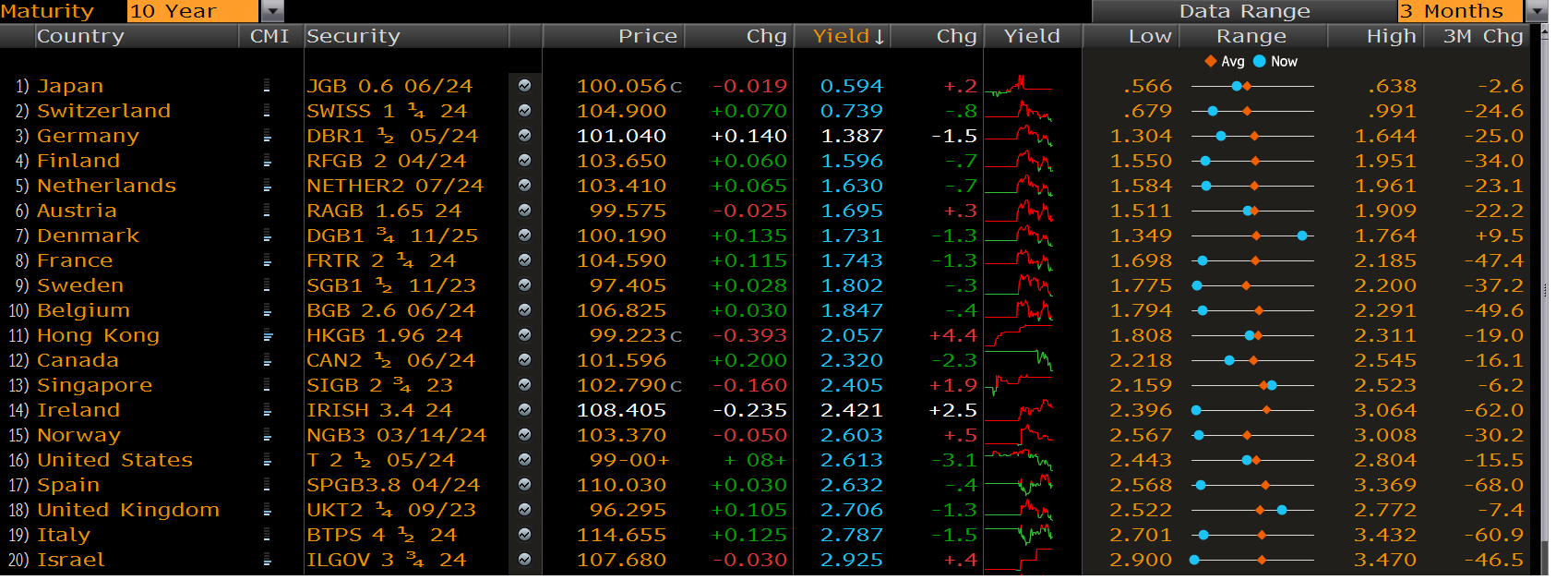

Yesterday, Seabreeze Partners fund manager Doug Kass sent me a Bloomberg chart showing the 20 lowest developed nations’ 10 year bond yield.

Astonishingly, the United States is number 16. The US Treasury 10 year bond yields a little better more than Norway (#15), but a little less than Spain (#17).

I am not sure exactly what this means, but it is worthy of further study and analysis.

What's been said:

Discussions found on the web: