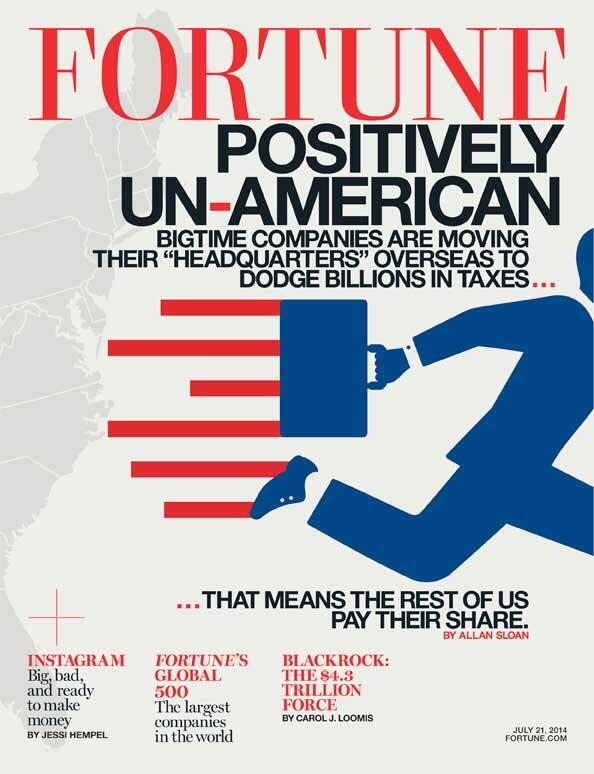

Today’s must read comes to us from Fortune, where editor at large Allan Sloane rails against “Positively un-American tax dodges.” Its your must read for today.

Let’s see if the our elected representatives can manage to stop behaving like 10 year olds long enough to resolve this.

What's been said:

Discussions found on the web: