Home sales, at least in the U.S., seem to be rising. Existing home sales in June increased to 5.04 million annualized. That number may be affected by the weather, as June sales most likely come from contracts signed after the depths of winter.

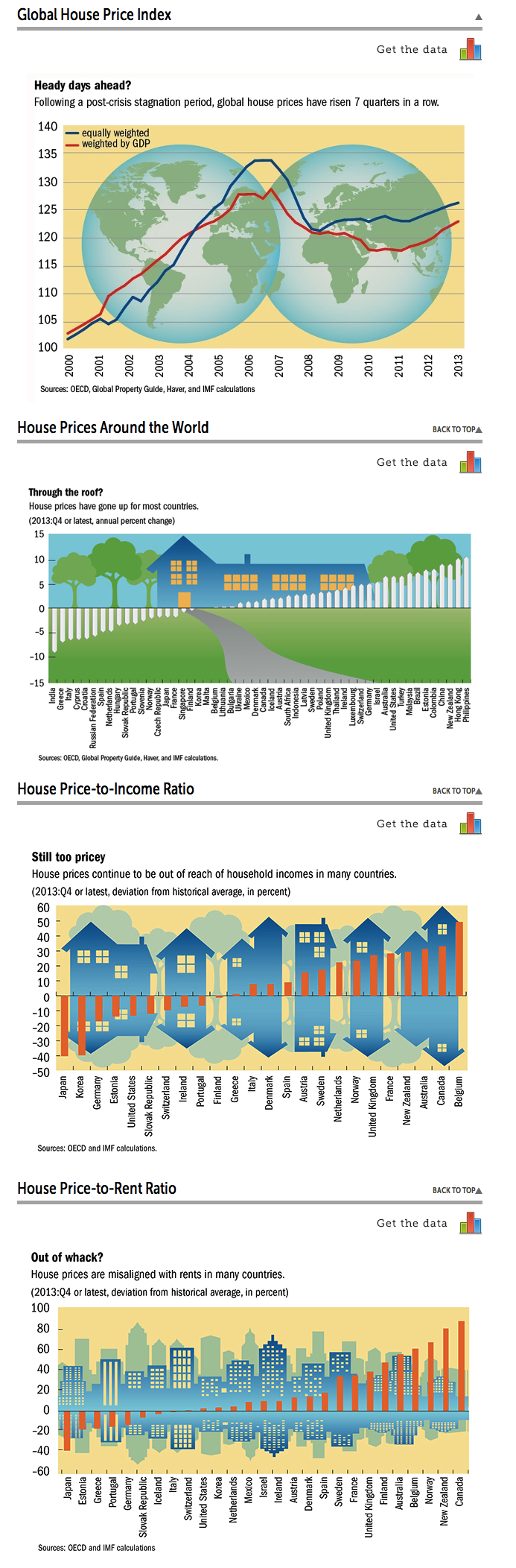

To find out if this is a global improvement, we can take a look at the International Monetary Fund’s Global House Price Index. Its data and lovely infographics give us a few interesting things to digest. (You can also use the BIS data or OECD statistics).

The first chart shows the annual percentage change in housing prices. The U.S. is 10th, and housing prices in the country are still far below (35 percent, or so) their 2006 peak.

Source: International Monetary Fund

What's been said:

Discussions found on the web: