cick for bigger chart

Source: JP Morgan

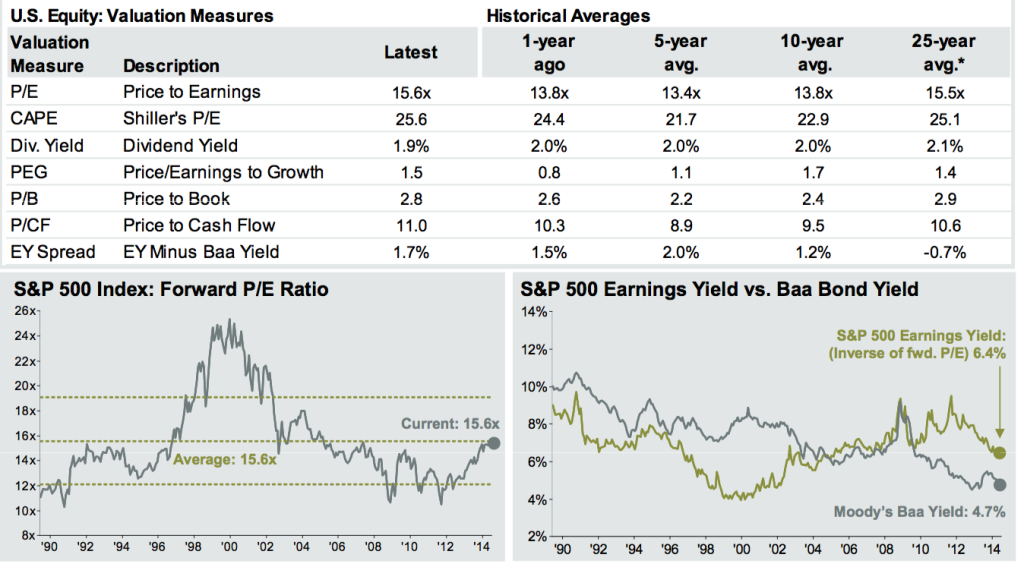

It has become commonly accepted that stocks are very expensive, overbought and perhaps even in a bubble.

JPMorgan Chase & Co.’s latest quarterly chart book (you can download it here) takes issue with those conventions.

As you can see from the chart above, U.S. equity prices closely match their long-term average price-to-earnings ratio of 15.5. That’s precisely at fair value if you are comparing it to the Standard & Poor’s 500 Index earnings-per-share average of analyst estimates for the next 12 months. Continues here

What's been said:

Discussions found on the web: