Hat tip Josh Brown

Today’s chart comes to us from Patrick O’Shaughnessy, author of the forthcoming book, “Millennial Money: How Young Investors Can Build a Fortune.” O’Shaughnessy makes the observation that investing is “almost free” and investor behavior tends to matter more than their actual investments.

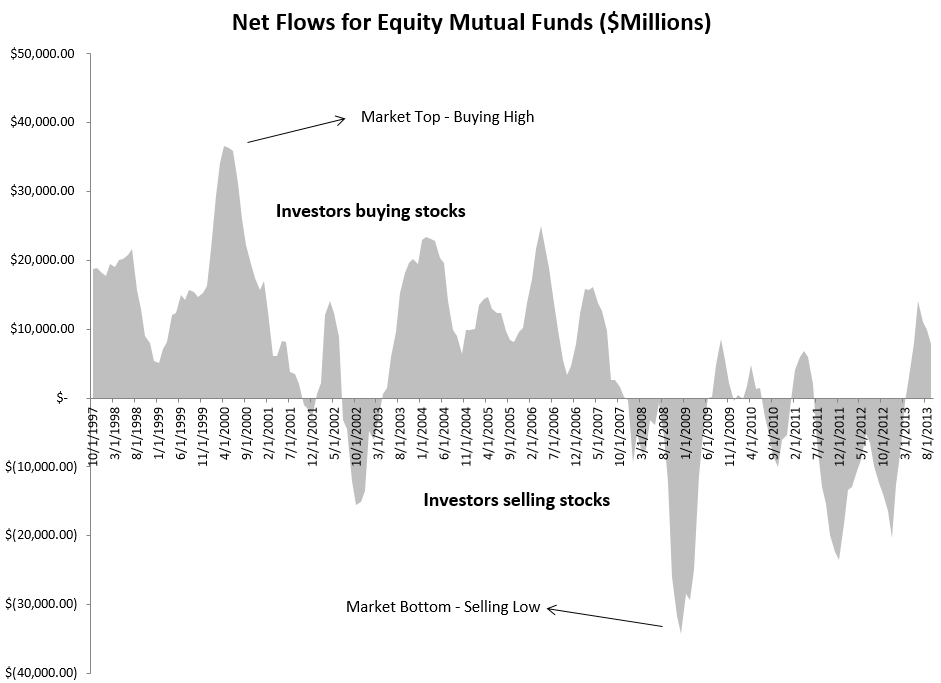

As an example, he cites this chart. Continues here

What's been said:

Discussions found on the web: