>

My Sunday Washington Post business section column is out. This morning, we look at the impact of taxes on personal trading accounts. The print version used the headline A harsh reality for all you stellar

active traders; the online version is So you’re the world’s greatest trader? Taxes will fix that.

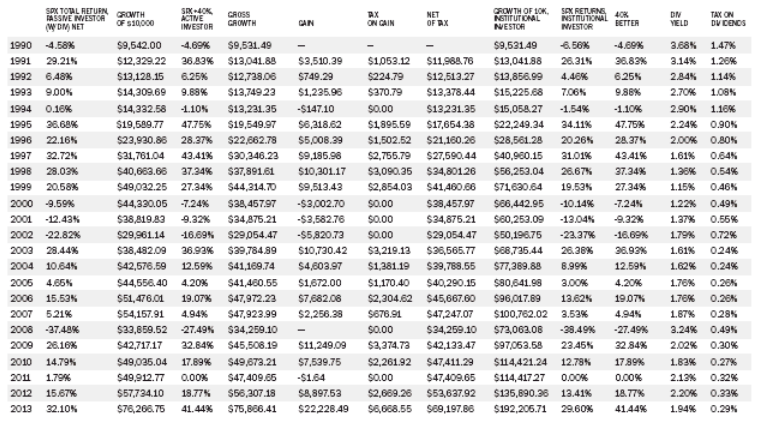

The bottom line is that even a 40% gain over broad indices is insufficient to beat the taxman’s short term 30% bite.

Here’s an excerpt from the column:

“Imagine that 24 years ago, your best friend invested $10,000 in the S&P 500 and held on through last year. He would have amassed $76,266. That number includes taxes paid annually on whatever dividends came his way at the highest taxable bracket.

Compare that with you, the World’s Greatest Trader. Had you put that $10,000 into a trading account that same year and annually crushed the S&P 500 by 400 basis points, you would have amassed an after-tax return of only $69,197.

In other words, your passive-index buddy would have beaten you, the World’s Greatest Trader, by about 10 percent. (Note that I am ignoring all of your trading costs.)”>

The post included the spreadsheet we used to test this. A screen grab is below, or you can download this and play with it yourself.

trader tax.xls

>

click for ginormous version of print edition

Source:

So you’re the world’s greatest trader? Taxes will fix that

Barry Ritholtz

Washington Post, July 27 2014

http://wapo.st/1xjB4kW

What's been said:

Discussions found on the web: