Source: Novel Investor

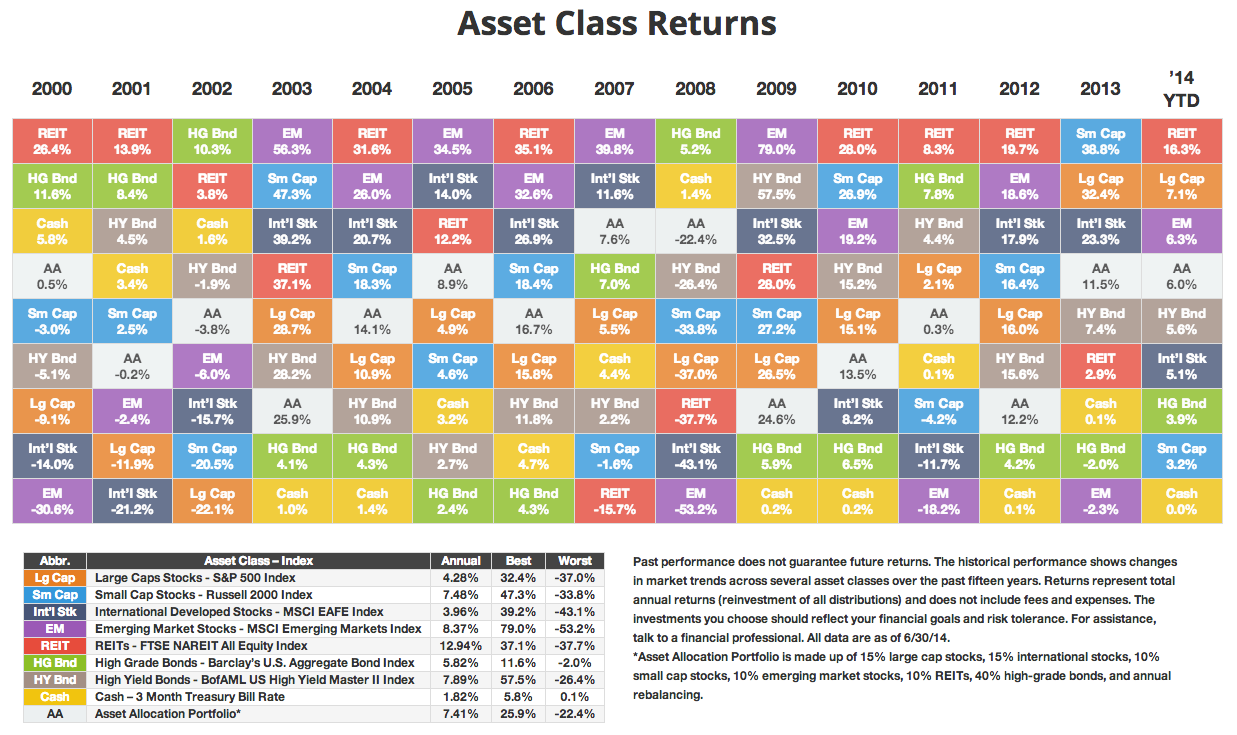

Have a look a the chart above (click on the chart for a larger interactive version). This chart ranks the past 15 years of returns for eight major asset classes (large-cap stocks, small-cap stocks, developed-market stocks, emerging-market stocks, real estate investment trusts, high-grade bonds, high-yield bonds and cash). We can divide these categories even further but we’ll use these for now.

What you should take away from the chart is how difficult it is to predict the best-performing asset class in any given year. To choose the right class consistently is almost impossible.

What's been said:

Discussions found on the web: