From IMF: “An Overview of Macroprudential Policy Tools”:

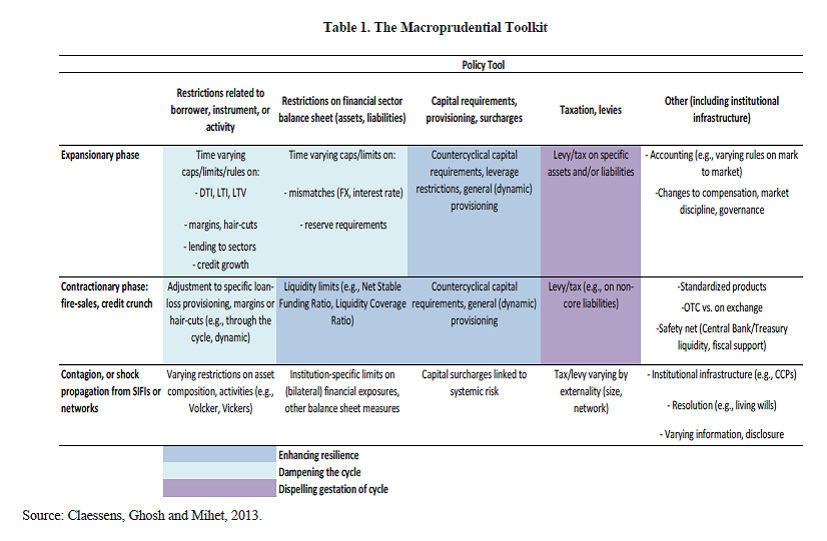

Macroprudential policies – caps on loan to value ratios, limits on credit growth and other balance sheets restrictions, (countercyclical) capital and reserve requirements and surcharges, and Pigouvian levies – have become part of the policy paradigm in emerging markets and advanced countries alike.

A long-standing puzzle in international finance is the durability of the dollar’s share of foreign exchange reserves – which remains above 60%, while the weight of the US economy in global output has fallen to less than a quarter. We argue that the dollar’s role may reflect instead the share of global output produced in countries with relatively stable dollar exchange rates – the “dollar zone”. If a currency varies less against the dollar than against other major currencies, then a reserve portfolio with a substantial dollar share poses less risk when returns are measured in domestic currency. Time series and cross-sectional evidence supports the link between currency movements and the currency composition of reserves.