Its a vacation week in the States, but thats doesn’t mean we stop reading, and neither should you. My morning train reads:

• Physics in finance: Trading at the speed of light (Nature)

• Credit Suisse Global Investment Returns Yearbook 2015 (Credit Suisse)

• Josh’s awesome investment mix (Reformed Broker)

• Goldman Sachs Doesn’t Care What You Think (Epicurean Dealmaker)

• Gary Shilling – Why You Should Own Bonds (Advisor Perspective)

• The Huge Historical Bull Market Bias in International Stocks (Irrelevant Investor)

• Forget Greece; Italy is Europe’s ticking time bomb (WonkBlog)

• Ten Years of Google Maps, From Slashdot to Ground Truth (Re/code)

• This new Tesla battery will power your home, and maybe the electric grid too (The Switch) but see Apple’s Electric Car Dreams May Bring Auto Industry Nightmares (Bloomberg)

• How P.R. Is Killing Journalism: And why that’s a problem even if you’re not a journalist. (Take Part)

What are you reading?

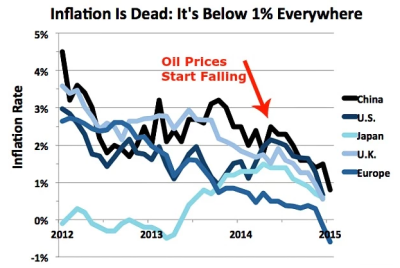

Inflation is below 1 percent in the US, UK, Europe, China, and Japan

Source: Washington Post

The rolling disaster of John Boehner’s speakership

http://www.washingtonpost.com/blogs/plum-line/wp/2015/02/16/the-rolling-disaster-of-john-boehners-speakership/

John Boehner occupies the district of Bill McCulloch, a Republican, who was a primary force behind the passage of the Civil Rights Act of 1964. He is one of the little know giants of the legislature who is the epitome of what bi-partisanship can look like in Congress to create world-shaking legislation while still holding firmly onto conservative principles. Very quietly, he is one of the most important people in American history that few people have heard of.

http://www.politico.com/magazine/story/2014/03/the-movers-behind-the-civil-rights-act-105216.html#.VOOlpswo7Z4

German investor morale hits highest level in a year

http://in.reuters.com/article/2015/02/17/germany-economy-zew-idINL5N0VR1TM20150217

As opposed to the Obama rally that ideologues have denied for six years, the nuts with their simple nostrums have been shown very quickly how wrong they are on Europe.

Japan’s recession is over

http://money.cnn.com/2015/02/15/news/economy/japan-gdp-recession-abenomics/

Spain grows at fastest rate in seven years

http://www.ft.com/cms/s/0/97510932-a861-11e4-bd17-00144feab7de.html

German confidence, DAX reach highs.

http://www.reuters.com/article/2015/02/17/germany-economy-zew-idUSL5N0VR1TM20150217

But Rupert Murdoch wants you to know the German Survey didn’t meet forecasts!

http://www.foxbusiness.com/markets/2015/02/17/survey-shows-german-investor-confidence-highest-in-year-though-bit-short/

…and wants to “explain” why the DAX is is at all time highs.

http://blogs.wsj.com/moneybeat/2014/12/05/why-the-daxs-all-time-high-needs-some-explaining/

You’re missing the global recovery. Get in now. You missed the Obama rally, don’t miss the global rally. Imagine how angry you’ll be.

The Supreme Court ruling on Obamacare this term should have interesting political effects down the road. If the subsidies are repealed, then it is likely that a lot of lower middle class voters in the states without exchanges and got Federal subsidies will suddenly realize that Mitt Romney, the governors of their states, and their representatives in Congress have actually been talking about THEM, not the folks down the street who they thought were the target of the rhetoric. It could make for interesting discussions in primary season.

http://www.washingtonpost.com/national/health-science/millions-at-risk-of-losing-coverage-in-supreme-court-health-law-case/2015/02/16/0597f6aa-ae50-11e4-ad71-7b9eba0f87d6_story.html

Lyndon Johnson predicted to Bill Moyers that he feared the South was lost to the Republicans for a generation or more when he signed the Civil Rights Act. I doubt if millions losing subsidies for healthcare insurance will necessarily reverse that, but it should make the lines of argument much clearer now that many more people will really understand from personal experience what is on the table.

I have been saying the same thing for awhile. Many older white people on the government teat think that Paul Ryan and Romney were talking about those with the darker skin hue when they talked about cutting government spending. Well as you pointed out they mean all but the most well off. And those savings will be passed on to the same elite in tax cuts and subsidies.

Greece’s Finance Minister lays it out.

Yanis Varoufakis: No Time for Games in Europe

I am often asked: What if the only way you can secure funding is to cross your red lines and accept measures that you consider to be part of the problem, rather than of its solution? Faithful to the principle that I have no right to bluff, my answer is: The lines that we have presented as red will not be crossed. Otherwise, they would not be truly red, but merely a bluff.

But what if this brings your people much pain? I am asked. Surely you must be bluffing.

The problem with this line of argument is that it presumes, along with game theory, that we live in a tyranny of consequences. That there are no circumstances when we must do what is right not as a strategy but simply because it is … right.

NB: My bet remains — Greece and its economy will be much better off next year (and so also Europe generally once the experience reminds everyone what the Euro experiment was really for) — even though the finance ministers of northern Europe are digging in their heals for austerity and otherwise doing their best to muck things up.

Europe is made up of the people who stayed behind during waves of emigration in past crises. In the 1800s and early 1900s, economic periods like this would have resulted in a wave of Greeks emigrating to the US and Canada which relieved much of the pressure back home allowing a status quo to continue to fester. What if this time, Greece decides to mentally emigrate as a country while still remaining in Greece?

I think the Eurozone leadership may be misreading this. At a certain point when a population feels it has essentially nothing else to lose, as well as historical backgrounds of enmity and tyranny (WW II has not entirely gone away in people’s minds) then just about anything is possible as an outcome. Bankers want to view everything as accounting on a ledger sheet. However, every few decades the entire desk gets tipped over. This might be one of those times.

A very interesting discussion here on the “incredible threat” scenario in the Eurozone game theory. One thing not discussed is there is actually a bit of a Bayesian aspect to the Eurozone game theory now. The “crisis” has become almost status quo with several years of on and off crises. A number of the players have been engaged throughout (e.g. Merkle) while others are relatively new. So a number of the players have well-established past positions (ossified potentially?) while others (Greek Prime Minister) are essentially brand-new. So there is a priori information available on some, but not necessarily others.

I think we are watching a massive game of chicken going on with cars on both sides that are in relatively poor repair and drivers with varying levels of daredevilness. It will be interesting to see how it plays out, but hopefully not as interesting as 2008.

http://www.businessinsider.com/greece-yanis-varoufakis-using-game-theory-2015-2

I have no inside information but my own read on Tsipras and Varoufakis is that they are willing to negotiate within realistic boundaries but completely unwilling to negotiate based on fantasies and morality plays much less betray those who elected them.

IOW it’s no game and either the leadership of northern Europe ‘de-ossifies’ or Greece defaults and all hell breaks loose.

If Greece is broken then IMHO an already weakened Euro project will be irreparably damaged: It’s raison d’etre was peace and democracy through shared prosperity, not a policing operation or enforcement mechanism for bond holders.

Today and tomorrow will tell the tale; may wisdom prevail.

It has been interesting to me that I have heard no mention of converting some or all Greek bonds to “perpetual bonds” like the British consols so that Merkel et al could retain the fiction that they will get full payment of principal while still requiring Greece to pay interest income.

http://en.wikipedia.org/wiki/Consol_(bond)

it is interesting that Britain is now looking to pay off its WW I debt that Chruchill issued as new consols in 1927. The 1751 consols are still hanging out there. Jane Austen would be proud that one key financial thing from here era is still around.

Based on what I saw of the new Greek government’s platform — the public terms of their election — I don’t believe the debt itself is a real issue nor even any fresh infusion of capital from the ECB: I think all the players know the former will probably not be completely repaid and the latter would probably not be forthcoming on any terms.

The real issue is negotiating a rate of repayment allowing the Greek economy to grow at a rate that might plausibly lead to prosperity and that requires a greater portion of government annual surplus* be devoted to growth rather than debt maintenance. The current deal with the German-led troika does not permit that, the (repudiated) offer that the Greeks thought they were getting yesterday did; either that offer or something very close to it is returned to the table or I do believe the game is over.

*Some pundits and various hoi palloi — none of whom are in a position to actually know — claim the Greeks are lying and there is no government surplus but this wouldn’t be particularly relevant even if true: reactionaries and the self-righteous (did I just repeat myself) may like to deny it but it is pretty clear what a nation in economic depression has to do in order to support its citizens.

LAWMAKERS PUSH FOR AMTRAK TO ALLOW SMALL PETS ON TRAINS

“…Now, Denham wants to expand the service nationally. He has filed a bill that would require Amtrak to come up with a pet policy for passengers traveling less than 750 miles…”

http://hosted.ap.org/dynamic/stories/U/US_PETS_ON_TRAINS

Here’s the the GOP is doing in stead of immigration, which forced the president to act, and now will shut down Homeland security.

Let’s force private businesses to get pets on the trains! ROFL!

Thanks GOP voter.

Big Telcos fight to dominate thanks to GOP voter, lobbyists.

http://arstechnica.com/tech-policy/2015/02/big-telecom-tried-to-kill-net-neutrality-before-it-was-even-a-concept/

Interesting paper by a Professor Rose that looks at income inequality over the past decade (referenced by David Leonhardt in the NYT).

However, the analysis looks incomplete as it is focused purely on cash income and doesn’t look at all at asset growth. It hints that assets are in play a couple of times as they do some analysis of sources of income and note that the wealthiest rely heavily on dividends, interest, and capital gains. This is important because capital gains in particular are very discretionary on when they get realized. They note that impending increased capital gains rates caused a spike of capital gains in 2012 and a plunge in 2013. wage and salary income gets paid in the year it is earned. Options can just sit there for a long time, not looking like anything at all until they are exercised. Wealth can be accumulated at a rapid rate but income statements won’t show it.

http://www2.itif.org/2015-inequality-rose.pdf

The Honorary Board of ITIF that published this study is interesting. Not many political biases there.

http://www.itif.org/content/board

”…Berkshire Hathaway also reported a new stake of 4.7 million shares in Twenty-First Century Fox Inc…”

http://www.businessinsider.com/r-buffetts-berkshire-hathaway-discloses-new-stake-in-deere-filing-2015-2

He’s see’s a Democratic sweep in 2016. The Right does better as the minority party pretending things, predicting things, threatening to shut things down (See Boehner right now) and this will drive Fox rantings… er… a… ratings higher.

If the stock ever drops he can go on all the other networks and ask rich people to give away half their money and raise the taxes on the returns on whatever they have leftover causing conniption fits with the angry old white demographic who will swear to never watch the Liberal Media again.