That was some week! The S&P is now positive year-to-date, and is at record highs, as the Nasdaq is coming up on its 2000 highs. Settle in with a big cup-o-joe, and enjoy our longer-form weekend reads:

• Life in the Algorithm: The searches we make, the news we read, the dates we go on, the advertisements we see, the products we buy and the music we listen to. The stock market. The surveillance society. The police state, and the drones. All guided by a force we never see. (Adbusters)

• Ten years ago, a video-sharing site called YouTube was born. Then, this happened (Telegraph)

• The life, death, and rebirth of BlackBerry’s hometown (Fusion)

• How The New York Times Works (Popular Mechanics)

• At 92, the man who brought you the lithium-ion battery is still having creative breakthroughs (Quartz)

• Last to see: The future rise of extinction tourism (Factor) see also The monarch massacre: Nearly a billion butterflies have vanished (Washington Post)

• Send in The Weathermen (NBC News)

• The Birth of the Cheesesteak (Priceonomics)

• Bill Carter on Covering ‘SNL’ and Lorne Michaels: “Many Lost Their Minds in Pursuit” of His Approval (Hollywood Reporter)

• To Fall in Love With Anyone, Do This (NY Times) see also No. 37: Big Wedding or Small? (NY Times)

This weekend, be sure to checkout our Masters in Business interview with 1-800 Flowers CEO and Founder Jim McCann.

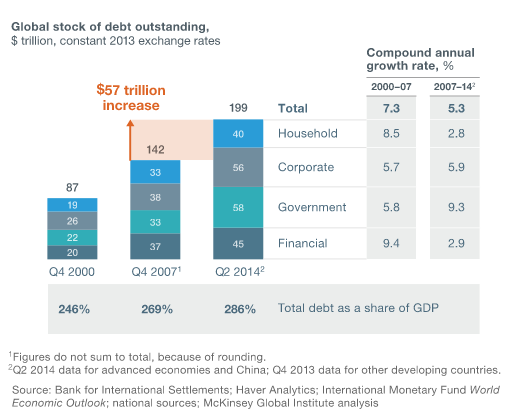

Debt and (not much) deleveraging

Source: McKinsey & Company

Finance vs. WalMart: Why are Financial Services so Expensive?

Despite its fast computers and credit derivatives, the current financial system does not seem better at transferring funds from savers to borrowers than the financial system of 1910. …

Historically, the unit cost of intermediation has been somewhere between 1.3% and 2.3% of assets. However, this unit cost has been trending upward since 1970 and is now significantly higher than in the past. In other words, the finance industry of 1900 was just as able as the finance industry of 2010 to produce loans, bonds and stocks, and it was certainly doing it more cheaply. This is counter-intuitive, to say the least ….

Very interesting article. My primary reason over the past 5 years for thinking that we are not out of the woods yet with regards to the secular bear market is because the financial sector is still too fat. Historically, these cycles don’t end until the financial sector is much, much leaner. That came close to happening in 2008-9 but governments around the world made the fundamental error of equating a fat financial sector with a fat economy. As a result, much of the rescue funds were pumped into the bloated financial sector with the hope that it would trickle out to the general economy. That has been a very inefficient mechanism and has led to slow growth with increasing inequality. The fact that the US still has a Fed Funds rate that is significantly less than the inflation rate is evidence of how badly that particular part of the plan worked. As a result the financial sector, instead of the parts of the economy that fuel day-to-day economic activity, contributes a large percentage to the record high margins holding the stock market prices up. We saw in 2008 how fast that can change.

The financial sector has used the cheap funds to play with itself, creating numerous unnecessary, expensive investment vehicles for people to invest in with the hopes of doing better than average as well as making massive financial bets with other finance players. The first round of those securities collapsed in a heap of dust and smoke in 2008. Only massive, extraordinary interventions prevented the financial sector from going back to 3%-5% of GDP.The next go around will probably finally result in a shrinking of the financial sector that will be the start of a re-allocation of investment into more productive parts of the economy. That is when we will see the next 20 year economic run like 1946-1966 and 1982-2000.

The tools have moved into place so that much of the financial sector could vanish and the average person and company would not even be aware. Diversified inexpensive investing options are available with Vanguard, iShares, Schwab, T Rowe Price etc. RIAs that charge 1% or less with robo-advisors charging a fraction of that are locked and loaded ready to replace the traditional broker network. Two-thirds of hedge funds serve no purpose other than they were a place that financial people went to in the hopes of making a billion by raking off large fees on poor performance – the next crash could easily take out half or more of the hedge funds as clients finally realize there are only a few that provide real value. It has taken 5 years to rebuild “faith” in the financial sector. The next crash will probably take longer than that.

Am I missing something or did you just call a 5-year period where the Dow went up 78% and the Nasdaq went up 124% a “secular bear market”? Can you explain that to me?

The inventor of YouTube went to my alma mater- Indiana University of Pennsylvania….Take that Stanford!

Most of the agricultural subsidies are really subsidizing obesity and ecological destruction. The subsidized industrial agricultural is producing only a few crops for processed food production leading to widespread fertilizer runoff into water bodies creating massive dead zones in estuaries and lakes, while the pesticide and herbicide use coupled with reduced bio-diversity is wiping out terrestrial ecosystems.

Especially note the comments. It is obviously faked data.

http://www.businessinsider.com/damaging-effects-of-hottest-year-2014-2015-2?op=1

tigerlilac,

Look up the 15 year annualized total return for the S&P 500 (not counting any friction; taxes and comissions), and shudder. Why there’s still an argument we are in a equity dead zone.

I know, the universe began 5 years ago, and only will last another 5 – how most investors seem to act.

(when it comes to American politics, it’s more like +/- 3 years). Still, some of have, by necessity, a generational perspective.

of course there is the other argument: that cycles are just figments of mind, our innate desire to find patterns, regardless.

The comments sections on global warming articles have some of the most tinfoil hat, stupidest shit that you can find on the Internets.

That being said, it is fair to say that 2014 may not have been much hotter than 2005 or 1998. However, it is pretty clear that no reasonable person could look at the data and suggest there has been a trend reversal.

The climate is complex, the data are noisy. Anyone who thinks that we can continue to pump greenhouse gases into the atmosphere with no consequences is a dumb shit. I’m sorry if that hurts anyone’s delicate dumb shit feelings.