Good morning. Round out your weekend with our easy-like-Sunday-morning reads:

• China: This Could Be Apple’s Secret Apple Watch Strategy (Time)

• The Billion Prices Project Thinks Inflation May Have Turned a Sharp Corner (Real Time Economics)

• Nikkei Stock Average Finishes Above 19000 Mark (WSJ)

• Will Fed Rate Hike Create a Horror Show in Markets? (Barron’s)

• This is why the euro is collapsing (WonkBlog)

• Larry Ellison, Model Executive (Bloomberg View)

• Fake IRS agents target more than 366,000 in huge tax scam (Yahoo Finance)

• Why America’s Internet Is So Shitty and Slow (Gizmodo)

• The Rise and Fall of RedBook, the Site That Sex Workers Couldn’t Live Without (Wired)

• ‘We Are the World’: A Minute-by-Minute Breakdown on Its 30th Anniversary (Rolling Stone)

What’s for brunch?

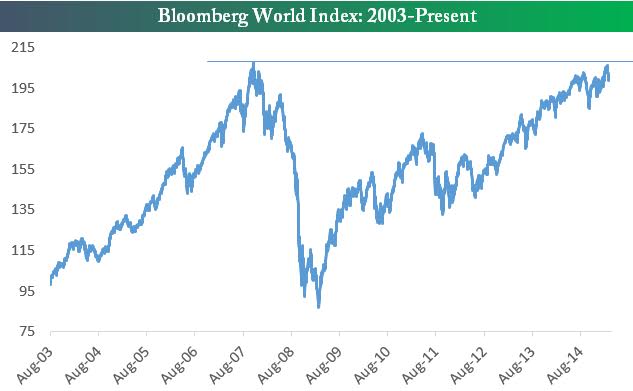

Bloomberg World Index: 2003 – Present

Source: Bespoke Investment Group

It appears that divorce and remarriage rates are proportional to the number of politicians talking about family values. It is not clear which one is cause and which is effect.

http://www.slate.com/blogs/moneybox/2015/03/13/the_states_where_second_marriages_are_most_common_we_ve_mapped_them_for.html

We can only assume that Donald Trump will be speaking a lot about family values if he runs for President on the GOP ticket.

The 2009 FOMC Laugh Track: Fed Humor in a Bleak Economic Year

Federal Reserve policy makers faced a dark economic outlook as 2009 began. They cut some of the tension at Federal Open Market Committee meetings with their usual brand of central banking humor. The FOMC’s 11 meetings and phone calls in 2009 featured 303 moments of laughter–marked in the transcripts, released Wednesday, by a “[Laughter]” tag. We’ve collected some of the best and worst ones here. ….

The Republicans are continuing to discover how hard it is to get legislation through the Senate even with a majority. So they are using the same threats as when they were in the minority.

http://www.cnn.com/2015/03/15/politics/mitch-mcconnell-loretta-lynch-confirmation/index.html

The Republicans are continuing to discover how hard it is to get legislation through the Senate even with a majority. So they are using the same threats as when they were in the minority.

http://www.cnn.com/2015/03/15/politics/mitch-mcconnell-loretta-lynch-confirmation/index.html

One-trick monkeys: When you don’t get what you want legitimately, extort rents.

Negotiate and compromise are now four-letter words

What’s the Matter with Wall Street?

It seems likely that the Fed open market committee (FOMC) will raise the target federal funds rate some time this summer. This is an odd choice since inflation is below target and the dollar is rapidly appreciating. Why would the FOMC even consider doing something so odd?

It is reasonably clear that financiers and policy makers who are in constant contact with financiers support tight money. …

Why?

1. Economics as a morality play. …the rich are eager to assume that the market rewards virtue — they have been rewarded by the market and wish to believe they are virtuous. …

2. Sub sub class interest. Within the 1%, there is an organized, energetic subset who benefit from tight money. …

3. Partisanship. …it isn’t odd that rich investors tend to favor the GOP, since Republicans are very dedicated to attempting to serve their interests (incompetently) and sincerely praise them. Republicans favor tight money and austerity if and only if the President is a Democrat. …

I think it is very possible that financiers favor their flatterers over those who actually make them richer.

Of course the thought does occur that the problem is not really “Wall Street’s” (finance), the problem is really ours.

The power of financial markets

You might imagine that the global financial crisis had reduced the power and influence of finance and those involved in financial markets. After all, the excesses shown by participants in those markets had caused the largest recession since WWII. ,,,However I wondered yesterday if the opposite might be true.

This was during a debate at the Houses of Parliament, in which Jonathan Portes and I were debating austerity with Roger Bootle and Doug McWilliams. A constant refrain from our opponents was that (a) the stock of government debt was very large, (b) you needed the confidence of markets to be able to maintain this level of debt, (c) markets were fragile beasts, so best take no chances, and (d) therefore we needed austerity to reassure those markets. ….

The financial crisis may have told us about the power that financial markets have, and how it is important to understand how they behave. But the way to do that and to make good policy in the meanwhile is through economic science, and not to rely on the wisdom of priests. As I said in my little speech at the debate, the cost of UK austerity in 2010 and 2011 was at least 5% and probably more like 10% of GDP, numbers which neither of our opponents challenged. The gods it seems require big sacrifices nowadays. But if the only reason for making this sacrifice is that the high priests tell us that this is what the gods require, then I think the time for enlightenment is well overdue.

NB: I suppose we should be grateful that we don’t sacrifice virgins or drown witches these days but frankly impoverishing families and starving children doesn’t seem like a great deal of progress.

The most common interest rates that consumers pay are virtually unaware that there is a 0% Fed Funds rate. I am not convinced that a small (0.25% to 0.5%) increase in the Feds fund rate would impact consumers much.

Credit card interest rates are still often double-digit and are largely based on credit default rates.

Mortgages are based largely on the 10-yr T-bond. While QE impacted these for a while, the current 10-yr rates are based more on the prospects for inflation than anything else. The Fed Funds rate could probably rise 0.5% or more before they would drive the 10-yr rate.

Car loans are probably the main thing driven by the Fed Funds rate at this time.

I think moving away from a 0% Fed funds rate would impact the financial sector more than anybody. If for no other reason , a whole generation of employees would need to learn how to do financial calculations where there is an actual cost of money.

101 Startup Failure Post-Mortems

No survivorship bias here. A compilation of startup failure post-mortems by founders and investors.

On his many failed experiments, Thomas Edison once said,

I have learned fifty thousand ways it cannot be done and therefore I am fifty thousand times nearer the final successful experiment.

And so while we have dug into the data behind startups that have died (as well as those acqui-hired) and found they usually die 20 months after raising financing and after having raised about $1.3 million, we thought it would be useful to see how startup founders and investors describe their failures. While not 50,000 ways it cannot be done, below is a compilation of startup post-mortems that describe the factors that drove a startup’s demise. Most of the failures have been told by the company’s founders, but in a few cases, we did find a couple from investors including Roger Ehrenberg (now of IA Ventures) and Bruce Booth (Atlas Venture). They are in no particular order, and there is something to learn from each and every one of them.

* Second Update (9/24/2014)

* First Update (6/3/2014)

* Original 51 Startup Failure Post-Mortems (1/20/2014)

https://www.cbinsights.com/blog/startup-failure-post-mortem/

Two keys to success:

1. Sell stuff people want

2. Sell that stuff for more than it costs you

#1 is trickier than it sounds, especially for startups. That’s why you hear VCs talk about “product/market fit” so often, and why “pivoting” is so popular. You “pivot” when you discover that what you thought you were selling turns out to be something nobody wants.

#2 isn’t really all that tricky, but it is related to #1. If people don’t really want what you have, you might get some nibbles, trials, etc., and you might have a little money coming in — enough to fool you that you might really have a business.

Everything beyond satisfying #1 and #2 is optimization.

«The Billion Prices Project Thinks Inflation May Have Turned a Sharp Corner»

The BPP does not measure “inflation” in the sense that is understood by most people, that is the change in the total cost (price times quantity) of a *constant* set of monthly purchases by a “representative” family, which is usually a narrow set of products that get bought a lot, plus a lot of services like healthcare, transportation, education.

The BPP essentially measures the mere prices of stuff (few services are sold online) sold online, and averages the prices regardless of quantity consumed by any “representative” family.

In practice that means that it measures the cost of importing stuff manufactured in China and other exporting countries.

That has rather little to do with “inflation” as most people understand it as “changes in the cost of a given standard of living”. It is indeed not a surprise that the CPI and ther BPP indices are usually fairly close, because the CPI is not a measure of “inflation” as most people understand it either.

re: Howard Stern: I miss listening to that show and they would be dumb to lose him. That said, no one is worth that kind of jack.

Finally, Madonna just doesn’t do it for me. Pretty calculating – her ‘outrageous behavior – and not just not good music: unlistenable. (My opinion and many disagree of course.)

The billion dollar price project is not saying that inflation is turning the corner.

Rather, it is saying that prices did not fall as much this month as last month.

But they are still saying that prices fell this month.