Round out your weekend with our Sunday morning reads:

• Financial Advisers Don’t Care About Millennials, and the Feeling Is Mutual (Bloomberg)

• You wanna be right? Or make money? (Adam Grimes) see also Finding the Limitations in Your Investment Process (WOCS)

• Why Stocks Belong in a Retirement Portfolio (NYT)

• The View from the Front Seat of the Google Self-Driving Car (Medium)

• “Vanity capital” is the new metric for narcissism, and its value is greater than Germany’s GDP (Quartz)

• The Verbally Challenged John Taylor Strikes Again (Uneasy Money) see also John Taylor Misunderstands Hayek (Uneasy Money)

• Is David Gurle’s Symphony a Big Threat to Bloomberg? (Institutional Investor)

• Feds Tell Insurers To Pay For Anesthesia During Screening Colonoscopies (NPR) but see also Obamacare making insurers more responsive, efficient (MarketWatch)

• Göring’s brother was another Schindler: A German book reveals how Albert Göring saved the lives of dozens of Jews (The Independent)

• The Magic of Moss and What It Teaches Us About the Art of Attentiveness to Life at All Scales (Brain Pickings)

What are you reading?

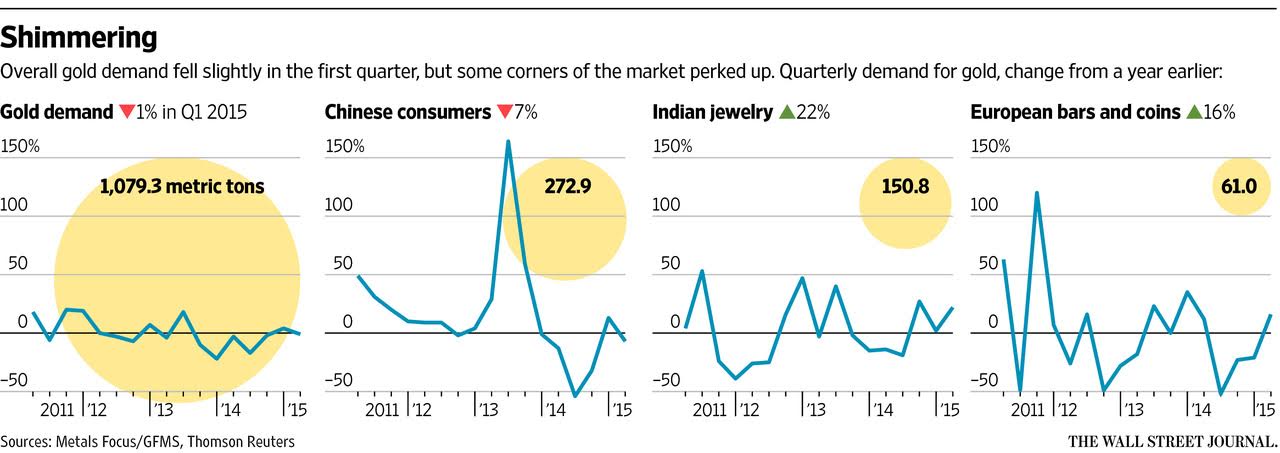

Global Gold Demand Falls

Source: WSJ

Financial Advisors Don’t Care About Millenials:

The Baby Boomers are going to contribute one more major revolution in personal finance: how to spend down your money in a time of low return portfolios with no safety net of pensions or 6% treasury bond interest rates etc.

Bengen started the spend-down thinking rolling in the early 90s, but the initial cut at a very simple rule developed in the 90s hasn’t been surviving reality. So there are now more complex strategies being thought through in research and practice. The same realization of the lack of ability to predict the future, so just watch costs and diversify, that has led to a widespread adoption of index and target date funds is coming to spend-down strategies.

Dynamic actuarial withdrawal approaches will be very amenable to robo-advisor platforms in the future. The next two decades will provide millions of lab rats using various spend-down approaches. By the time Generation X and millenials hit retirement, the same robo-advisors helping in the accumulation phase will be able to provide sophisticated, time-tested withdrawal strategies for a typical ,mass affluent person. Those withdrawal strategies will have been forged and tempered in a very difficult period for spend-down strategies, so application to what is more likely to be a more “normal” investment environment should make the strategies portable.

The boomers’ financial advisor will have to hope that they can pluck new rich clients from the kids that inherit money or they will have seen an entire generation pass them by. Advisors currently in their 40s or older should still do fine. However, advisors in their 20s may be working in the buggy whip industry unless they are dealing in the very wealthy category with complex estate plans etc.

> Obamacare making insurers more responsive, efficient

This is debatable, at least in the case of serious mental care coverage. It has always been difficult to receive adequate insurance coverage in this area, despite state and federal parity laws. ACA, I suspect, has made this more difficult because of more narrow networks. In the case of the Los Angeles market, for example, which we’re intimately familiar with, Blue Shield’s ACA plans reimburse at rates well below what Medicare pays out and the “usual and customary charges” there. This forces the best providers – those that are most qualified – outside the network. There are few ACA plans in CA that support the use of out-of-network providers. The few that Blue Shield offers pay out 50% of their covered expense for mental health care. Attaching some numbers, Blue Shield’s covered expense for therapy for a 45 minute out-patient session for treating bulimia nervosa, a serious eating disorder, is $66. They will reimburse $33 of this. Standard fees in the LA market by the most qualified providers, almost all of whom are out-of-network: $120 – $200. If you rely on Blue Shield’s ACA providers, you are receiving inadequate care . . . if you rely on out-network providers, you are paying large sums out-of-pocket. Few individuals/families can afford these costs.

FBI claims security researcher took control of plane

http://www.cnet.com/news/fbi-claims-security-researcher-took-control-of-plane/

New Ways to Crash the Market

By James Surowiecki

http://www.newyorker.com/magazine/2015/05/18/new-ways-to-crash-the-market

It’s sunny today. Destroy your umbrellas!

Just a brief note of confusion and befuddlement regarding a position on currency in the TPP that’s been uncritically picked up by news sources lately, including the WaPo today.

The position touted by the piece is that since China’s currency has floated down relative to the dollar in recent years (see figure), and their trade surplus is also significantly diminished, we don’t need to worry about them or other trading partners managing their currencies to get an export edge over us in the future.

This is wrong for at least three reasons. ….

For the what goes around, comes around or the plus ça change, plus c’est la même chose file:

“The decadent international but individualistic capitalism, in the hands of which we found ourselves after the War, is not a success. It is not intelligent, it is not beautiful, it is not just, it is not virtuous – and it doesn’t deliver the goods. In short, we dislike it and we are beginning to despise it. But when we wonder what to put in its place, we are extremely perplexed.” –John Maynard Keynes (1933)

Iraq war judged a mistake by today’s White House hopefuls

http://www.csmonitor.com/USA/2015/0517/Iraq-war-judged-a-mistake-by-today-s-White-House-hopefuls

George Bush: the worst President ever.

Cheney may be the worst America ever for torturing people ex-poste to “confess” that Iraq had WMDs.

Can’t wait for the debates eight years hence where all the GOP agree “Obama did a great job.”

Super bugs are coming. er they are already here. Antibiotics have been misused. They are fed in massive quantities in the US to cattle and hogs and chickens. Roughly 75-80% of the pounds of antibiotics used in the US are fed to animals as growth promoters. They have also been over used in humans. Now we are close to the big crunch.

http://www.reuters.com/video/2015/05/14/superbug-warning-to-drug-giants?videoId=364225493&videoChannel=118169