Ahh, its delightful out here. From the northern climes, my morning train canoe reads:

• This Precious Metal Needs a Silver Bullet: In the past 12 months alone, the benchmark silver-futures contract has declined 27% (WSJ)

• Advice From Antiquity Economic Lessons From Ancient Greece (Foreign Affairs)

• The Five Best Ways to Waste Your Money (Scott Fearon)

• Is Something Weird Going on With Apple? – Nope. (Irrelevant Investor) see also Why I’m Keeping an Eye on the New iPod (Re/code)

• Regulating Fintech: Getting the Response Right (End of Banking)

• Market economics don’t explain high pay for CEOs (Star Tribune) see also New rule could reveal huge gap between CEO and worker pay (Washington Post)

• Technology is driving Amazon delivery times to near zero (LA Times)

• How the Press Fell in Love With The Daily Show (Slate) see also Where Would Jon Stewart Be Without Fox News? (Bloomberg)

• Philae finds life’s ingredients on surface of comet (Sen)

• The Official GOP Debate Drinking Game Rules (Rolling Stone)

What are you reading?

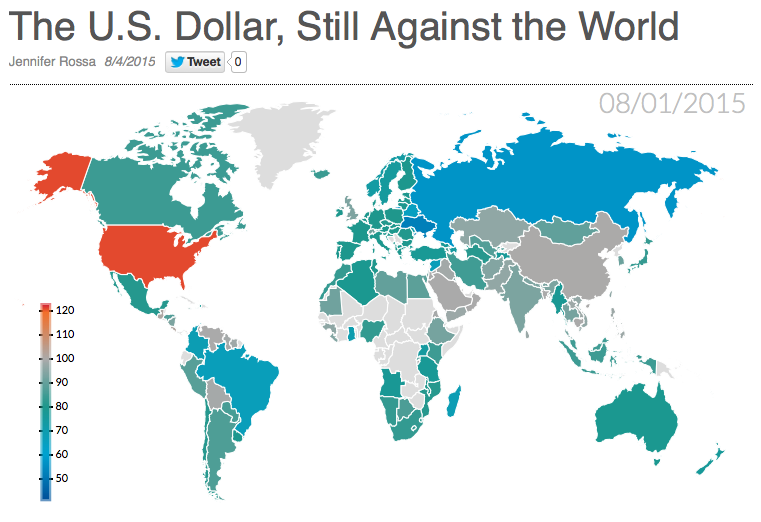

The US Dollar, Still Against the World

All these people bemoaning China’s lock up who turn around and put money with a Private Equity firm for ten years are hypocrites.

The Chinese markets are simply a big private equity firm.

Will the New York Times ever finish cleaning up Clinton story?

https://www.washingtonpost.com/blogs/erik-wemple/wp/2015/08/03/will-the-new-york-times-ever-finish-cleaning-up-clinton-story/

Everybody in the media prefers a horse race.

the thumb on the scale?

http://baselinescenario.com/2015/08/04/so-tom-hayes-is-guilty-who-else-is/

seems like Congress has made it easy to underestimate the impact of their preferred tax cuts. even if they impact their other favorite balancing the budget. but maybe thats the point. if they cut revenue then they are ‘forced’ into cutting spending they dont like?

a small fry got caught?

http://baselinescenario.com/2015/08/04/so-tom-hayes-is-guilty-who-else-is/

say what? Sweden privatizes their schools. and the results are dreadful

http://angrybearblog.com/2015/08/swedish-privatization-of-education-fails.html

Indeed shocking – nobody could have predicted!

When something is handed to the for-profit sector it becomes all about the profit and the quality sink to the lowest level specified in the contract.

you mean there was supposed to be a quality standard in the contract? there was a contract?

so you have to sue your schooling provider when the quality isnt what ever the contract says its (o doesnt say)? what are the odds some one (thats not a lawyer) will actually do this?

Apparently there are some differences between children and widgets.

werent conservatives suppose to be good financial managers?

http://angrybearblog.com/2015/08/california-pays-off-arnies-15-billion-2004-loan-from-wall-street.html

seems not.

take out a long term loan for short term needs? say what?

I find these articles extolling the virtues of defined benefit plans and berating 401k/403b plans annoying. Defined benefit plans work great when you have very good job stability and can be at an organization for 20+ years, which is why many public sector workers have them and do well with them. However, employment in general in North America has been a precarious thing and particularly so over the past 30 years. As a result, most people are like me, having held multiple jobs during that period of time.

There was never a majority of private-sector employees that had defined benefit plans. Historically, most private sector employees had no retirement plan whatsoever, other than their own savings. 401ks/403bs opened up the door to making retirement plans much more widespread. A big problem is that many employers contribute very little or have the maximum vesting period allowed so that employees do not get much from their employer contributions.

For the first 35 years, 401ks had high fees and relatively poor investment choices, so there was virtually no way they could perform as well as a professional pension fund. That is changing now as fees are declining and the portfolio options are looking much better. Plans with low-fee target date retirement funds are a major game-changer as the average person just has to focus on saving. Based on my experience helping family members, confusion is the most common state of understanding of investing strategies with many having thrown their hands up in the air or turned their accounts over to high-fee “advisors” out of sheer frustration and bewilderment – the look of relief and relaxation on their faces when I simply direct them into a decent target date or fixed multi-asset allocation fund that is buried in the weeds in their plan is amazing and gratifying. The next revolution will be a much greater focus on efficient and low-cost withdrawal strategies.

The US retirement account system is very complex with account types randomly popping up in various tax code bills. As a result, somebody who has worked for several employers and has saved on their own likely has a litterbox full of different accounts. The $60k median account value may or may not have meaning because a person may just have that one account or several of them. If tax simplification ever occurs, the account types should be simplified so that it would be possible to have only two: a Roth -type or a standard tax-deferred IRA type.

Defined benefits are only as good as the guarantee behind them – just look at all of the companies that have gone bankrupt and handed their pension plans over to PBGC. The shift to transferring these liabilities to insurance companies hasn’t really been tested for multi-decade safety yet. Individual defined contribution accounts, if positioned in well-diversified low cost funds, are as safe as the global economy because it is unlikely that entire major stock and bond markets will declare every company and country bankrupt where you could lose everything. these days the two biggest dangers to people in defined contribution plans that I have seen is a lack of understanding of their investment options (usually explained in Wall Street legal gibberish) and the “solution” of turning to non-fiduciary advisors for advice (I have seen family member rollover accounts with lots of 5.75% front end loads and 1%-2% annual ER).

http://www.marketwatch.com/story/theres-a-glimmer-of-hope-that-the-retirement-system-isnt-broken-for-good-2015-08-06?page=1

Sounds like a lot of money

Southern Europeans are stuck in a dynamic of low trust, excessive localism, and extreme reliance on family networks. There is a lack of impartiality in institutions and an ethic that “doing what’s right for my family” rather than “following the law” is the right thing to do.

…the biggest relevance of Southern Europe to the United States is the current high social prestige enjoyed by the twin ideas that the social responsibility of a corporation is to be profitable and that the primary moral and legal obligation of a corporate manager is to enrich shareholders. These ideas combine to create a toxic moral climate that is undermining the social context in which a successful market economy can flourish. …

NB: Right-wing economics requires that in making their economic decisions people and businesses focus only on how they themselves profit. …the corporation that is acting immorally if it maximizes anything other than its stock price bears more than a passing similarity to the bureaucrat who regards himself as acting immorally if he does not embezzle and transfer funds to his family.

Or Clarence Thomas and the Primacy of “natural law” Where God Demands Citizens’ United.

Can’t we acknowledge that profit is a necessary condition of corporate existence, but not the sole one? Like admitting that land-based life needs water, but it needs food and air too. And too much water will kill you.

“Can’t we acknowledge that profit is a necessary condition of corporate existence,”

In the case of for-profit corporations, certainly, of course but what does that have to do with the argument in the article?

Suspect in latest theater attack had psychological issues

http://www.chron.com/news/texas/article/Suspect-in-latest-theater-attack-had-6428190.php

Really?

GOP puts guns into these crazies hands directly.

The Bobby Jindal culture…

http://www.reuters.com/article/2015/08/06/us-usa-louisiana-shooting-idUSKCN0QB0OZ20150806

Dennis Gartman just warned CNBC viewers to get out of stocks.

Time to buy.

when faced with employees leaving because of low pay

http://www.msnbc.com/rachel-maddow-show/kansas-teachers-have-bold-plan-relocate

just cut the requirements to do the job.

course that will likely lead to less education. but that may actually be the point of the exercise

They could probably handle the English as Language Arts, World History, and Science portions of the curriculum with local pastors with just the Old and New Testaments for a textbook. Comparative Literature would be a snap as you could compare and contrast the King James Bible with one of the newer translations. The Foreign Language requirements could also easily be met using the Bible in its original Greek, Aramaic, and Hebrew as well as the Latin version – this could be tough because they might need to import some Catholic priests for this. They don’t need to teach other languages, since Spanish-speaking people will all be deported by Trump and French and German are dead European languages as those countries are just going to become Moslem speaking Arabic in a few years.

” …compare and contrast the King James Bible with one of the newer translations. The Foreign Language requirements could also easily be met using the Bible in its original Greek, Aramaic, and Hebrew as well as the Latin version …”

Where the bible is considered to be the literal word of God a curriculum that fostered comparisons between bible editions wouldn’t make the cut: Letting people see how much each edition of the bible differs from the other even within the same language might cause somebody to question something.

But I’m sure Kansas could reprint some old readers and similar texts in the public domain and that would help larn the kiddies their letters and numbers as well as scrape up a few more dollars to kick upstairs.

The Tribune lets you know that Bush had nothing to do with the West’s appeasement to Russia’s invasion of Georgia…

http://www.chicagotribune.com/news/sns-wp-blm-news-bc-russia-warships-comment06-20150806-story.html

…. and the Russian Hawks have won, again.

Why would anyone pay for this “opinion” paper?

jon stewart vs wall street

http://www.bloomberg.com/news/videos/2015-08-06/watch-jon-stewart-s-sickest-wall-street-burns

so why is it wall street recovered. but the rest of us are still trying to?

Police Say Suspect in Custody in Louisiana Officer’s Death

http://abcnews.go.com/US/wireStory/shreveport-police-officer-shot-killed-manhunt-ongoing-32923088

If only this policeman had a gun to protect himself the way the GOP/NRA said always happens.

you know that on rushing train where your phone company will replace your copper wires with newer stuff? seems the newer stuff doesnt have power back up so when the power is out, your phone is too. well the FCC is pushing a requirement that the companies offer it, but you the consumer will have to pay the company to actually do it

http://www.theverge.com/2015/8/6/9109727/fcc-copper-transition-backup-power-requirement

course there is that minor down side of not having backup power, if you need to make a call in an emergency, your just SOL