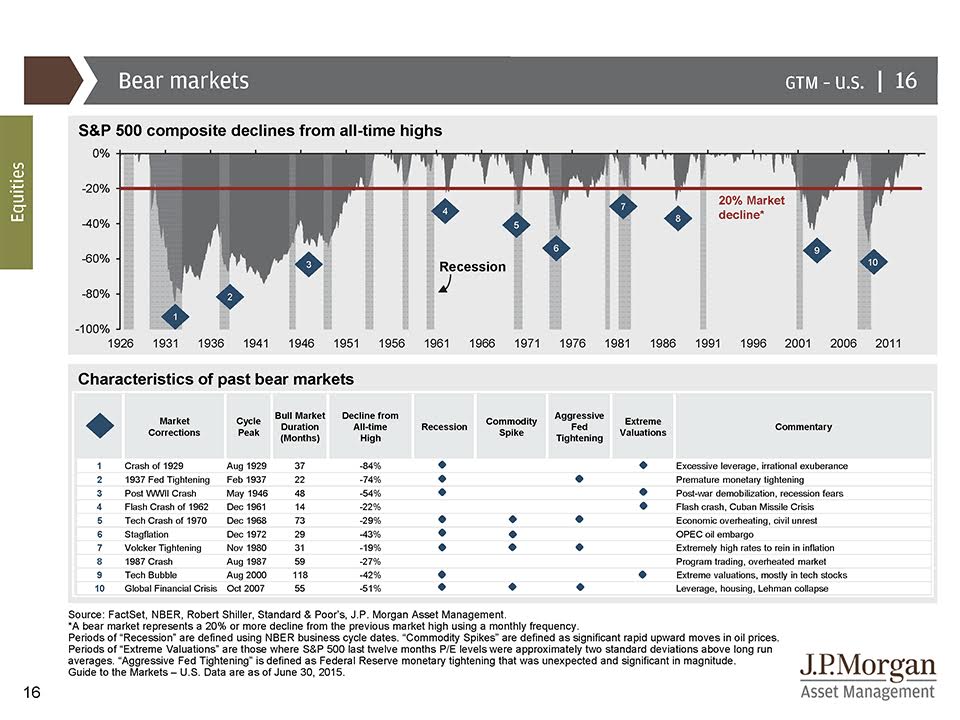

Today is as good a day as any to show this chart from my favorite quarterly slide deck:

click for ginormous graphic

Source: JP Morgan

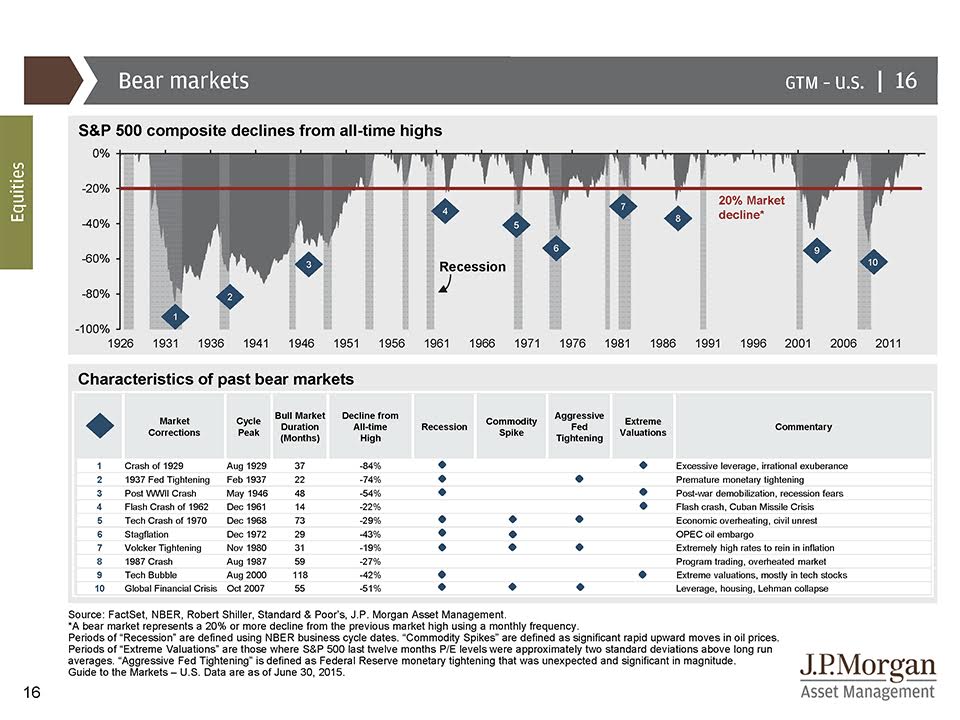

Today is as good a day as any to show this chart from my favorite quarterly slide deck:

click for ginormous graphic

Source: JP Morgan

Get subscriber-only insights and news delivered by Barry every two weeks.

Interesting they don’t list “Extreme Valuation” as a cause for the 2007 Financial Crisis bear market. The reason that stocks “only” fell 42% in the 2000 crash was because much of the S&P 500 was not significantly over-valued and value funds were almost untouched by that bear market while the NASDAQ did an 80% swan dive. However, everything had gone up a lot by 2007 and everything went down a lot in 2008-2009 which is why the stock market dropped 52%. Most valuation measures were among some of the highest peaks for those measures in the past century in 2007, as they are today.

http://www.advisorperspectives.com/dshort/updates/Market-Valuation-Overview.php

Valuations are intellectual creations. They are not always right.

I suppose the point here is that there is a huge correlation with bear markets occurring only from recessions, and since have not been in a recession for a while (since spring of 2009 – although perhaps a touch of depression lingers on), this current volatility should not be construed as indicating the onset of a bear market.

Unless it happens to unfold that way.

Pretty cool chart. I’m really shocked that the tech bubble and financial crisis look so similar given how much worse the latter was on the real economy.

rd’s comment addresses this — the dot-com bubble represented only a tiny slice of companies and a relatively few people, while the housing/mortgage market impacted millions.

Or put another way, the stock market and the economy are only very loosely connected.

If the “we were never wrong” clowns were only running for POTUS it would be bad enough but to actually have them running congress, the supreme court and certain Fed banks too, well …it’s just downright disheartening.

If It’s A Day Ending in ‘Y’

Charles Plosser wants the Fed to raise interest rates.

We could have another recession any time and boneheaded policy could make it worse any time.