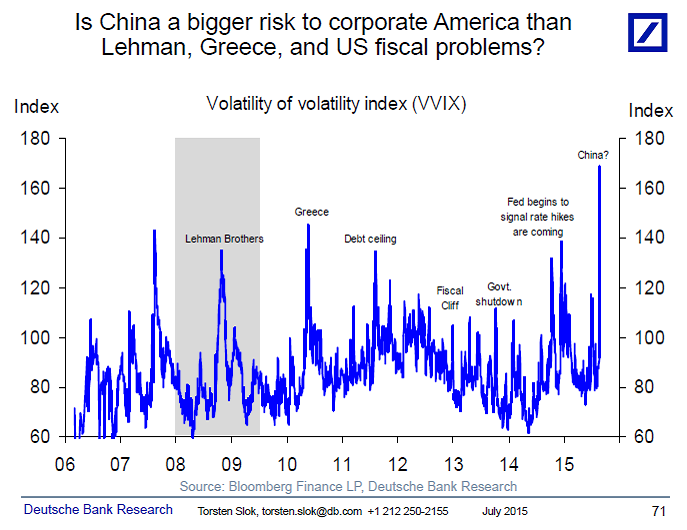

I found this chart, via Torsten Sløk of Deutsche Bank Securities. It is a quite fascinating look at the VVIX index.

If you are unfamiliar with the VVIX, it is a measure of the volatility of the VIX, itself a volatility measure of the equity market. More precisely, it represents the expected volatility of the 30-day forward price of the CBOE Volatility Index (VIX INDEX).

One caveat: We have been coming off very low levels, so I am not sure how fair it is to compare Lehman Brothers and the financial crisis after 10 months of falling markets and rising VIX with this past month. Still, it is a surprising comparison between the two:

VVIX is a measure of the emotional fervor of the markets, and most of the non-Wall-Street players in the markets believe that China is a larger factor than Lehman Bros in the US economy. Wall Streeters likely have a different perspective.

The flaw in this ideological ointment is that the economy and the stock market are only loosely connected … and the VVIX is one of the points where fears about the economy are translated into fears about stocks.

I’m not at all sure that the VVIX has any utility, other than as a measure of emotional fervor in the equity markets, and thus might serve as a dinner bell for traders. It is ringing rather loudly at present.

Classic Torsten. Trying to connect two parameters because of ideology, even though there is little mechanistic model support for their connection. How is the second order of “stock market volatility” supposed to represent “risk to corporate America”? Volatility is about surprise and VVIX is about how surprising surprise is for those owning stocks. The surprisingness of a surprise is almost exclusively depending on complacency, but corporate “risk” is dependent on the size of the shock and the ability to ride it out.

It could be China is more earthshaking than Lehman, though I suspect it reflects the increased market share of machine trading, nothing more.

Is it China, or is it the looming Fed rate hike?

Stanley Fischer is going to want to go in September, and he is the adult in the room.

In case somebody was wondering what risk really is:

http://www.nytimes.com/2015/08/25/science/mount-tambora-volcano-eruption-1815.html

Media will find something as the “cause” of this correction, but in the end, whatever they choose is likely only a contributing catalyst to what we’re experiencing. I think what we’re experiencing is technically and mechanically driven. Technicals, because the algos use them as factors in the decision making of the programs. Mechanical, because the algo’s combined with other flawed products like ETF’s are creating a downward spiral situation much like Portfolio Insurance did in the 1987 debacle. I would be very interested in know what Richard Bookstaber thought about this market. He’s the author of “A Demon of our own Design”