My Two-fer-Tuesday morning train reads:

• Negative Momentum Weighs On All The Major Asset Classes (Capital Spectator) see also Why Morning Is the Worst Time to Trade Stocks (WSJ)

• The Not-So-Surprising Truth About Gold Bugs (Fund Reference)

• Many of the Companies That Went Public in the Past Year Are Trading Below Their Offering Price (Bloomberg) but see Fears grow over US stock market bubble (FT)

• How to ruin your financial life, #badadvice (Washington Post)

• Fischer’s 2014 Why-Wait Wisdom Points to Fed Liftoff This Week (Bloomberg) but see Why The Fed Is Likely to Stand Pat This Week (Bloomberg)

• Something Most Investors Simply Cannot Accept (A Wealth of Common Sense)

• Insiders Beat Market Before Event Disclosure: Study (WSJ) see study The 8-K Trading Gap (SSRN)

• The cofounder of Apple talks about what it was like to work with Steve Jobs when the company was failing (BI)

• Libor’s Mastermind: The Unraveling of Tom Hayes, Convicted in a Global Financial Scandal (WSJ) see also Was Tom Hayes Running the Biggest Financial Conspiracy in History? (Bloomberg)

• Odds of a Kanye West Presidency: 90% (Scott Adams)

What are you reading?

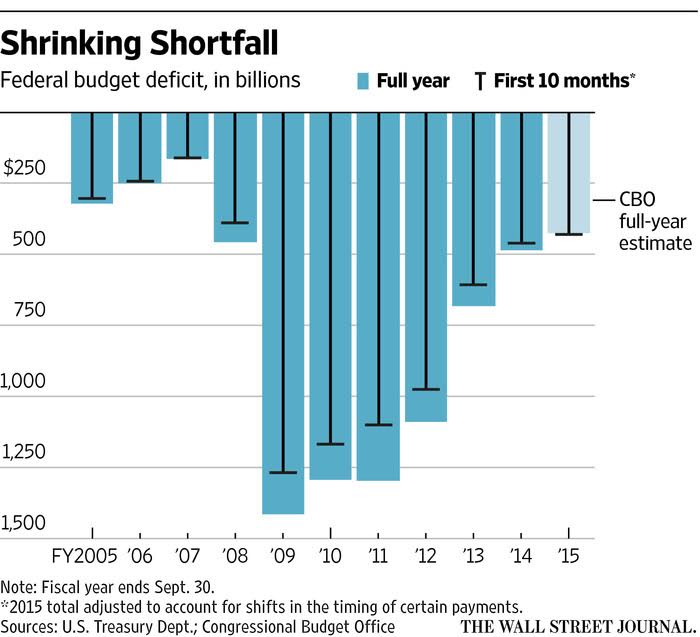

Shrinking Shortfall

Source: WSJ

judges and government officials at a loss as to what to do about banks and their mortgage fraud

https://theintercept.com/2015/09/14/officials-cover-housing-bubbles-scummy-residue-fraudulent-foreclosure-document/

seems some rules to operate in some states were just ignored. but the banksters still want to foreclose. even if they cant legally be operating

It will be interesting to see how the title insurance industry handles all of these foreclosed homes moving forward. That is when we will see the free market pricing the impact of MERS. Many were snapped up for cash by private funds as rental properties and they probably didn’t focus on this. If they try to sell them to individuals on the open market down the road, it could be interesting.

Student Loan Distress Goes Beyond Defaults

…there’s a crisis in which poor communities have very large debt balances relative to income, forcing such distress that the results are large default rates. But there’s another issue, and that’s the life effects of student debt. …

…a wide body of research …finds that student loans could “impair students’ abilities to finance first homes and to live independently of their families, or could constrain their occupational choices, reducing rates of homeownership and marriage, or entrepreneurial risk taking.” That’s a lot of impacts! …

NB: Private debt was always the central problem and cuts to government spending, including previously supported benefits such as education, could only make that problem worse. This and an infrastructure slipping into third-world condition are the real burdens our children and grandchildren face going forward.

It reduces their ability to travel, eat and drink out, buy clothes, etc.

Oddly enough, S&P 500 companies are struggling to get their revenues up.

it also helps that when they get their first job that their income is lower than it should be. and that their are fewer of those entry level jobs. but its odd how that seems to have impacted sales at many companies.

As the deficit tapers, stimulus tapers.

Isn’t this more significant than a possible quarter-percent Fed rate increase… which is what captures the spotlight?

Keynesianism Explained

Attacks on Keynesians …rely heavily on an army of straw men …So here’s …a quick summary …in terms of four points:

1. Economies sometimes produce much less than they could, and employ many fewer workers than they should, because there just isn’t enough spending. Such episodes can happen for a variety of reasons; the question is how to respond.

2. There are normally forces that tend to push the economy back toward full employment. But they work slowly; a hands-off policy toward depressed economies means accepting a long, unnecessary period of pain.

3. It is often possible to drastically shorten this period of pain and greatly reduce the human and financial losses by “printing money”, using the central bank’s power of currency creation to push interest rates down.

4. Sometimes, however, monetary policy loses its effectiveness, especially when rates are close to zero. In that case temporary deficit spending can provide a useful boost. And conversely, fiscal austerity in a depressed economy imposes large economic losses.

NB: Follow the link for more background as well as a sample of bogus arguments against Keynesian policy under the conditions noted above.

“Economies … employ many fewer workers than they should”

Should? Who decides?

“Who decides?”

Policy and the conditions it promotes or supports.

Should have added “as implemented” since even well-established policy can be neglected or given short shrift; e.g., the full employment mandate of the Fed is essentially only honored in the breach.

and only partially then. mostly a PR thing. except that one party tends to name all of their bills as being job creators, even if they do no so such thing

Re: Tom Hayes and Libor

Is it actually conceivable that major international banks would be setting their primary overnight lending and borrowing rate without even review from senior executives? If so, how could this possibly be viewed as competence?

Putin!

https://www.washingtonpost.com/world/europe/putin-defends-deliveries-of-russian-weapons-to-syrian-army/2015/09/15/ad032c4e-0eda-4e17-a2b9-205157128df4_story.html

Why doesn’t the For-Profit Media describe this as Putin being “sucked into Syria?”

Because he’s propping up his existing puppet? And establishing a middle east base from which to affect oil policy? Putin isn’t doing this to do good. It’s colonialism.

Putin didn’t learn from Afghanistan. He thinks he can “colonize” Syria? Protect the beloved Assad family?

ROFL.

Barry:

Regarding your article on #badadvice, I had a financial advisor tell me that putting money into a tax-deferred account was a bad idea because taxes will have nowhere to go but up; and that you would end up paying more taxes in the future. And therefore that you should put all of the money available in a Roth IRA, because the savings grow tax-free.

Is there really any advantage of one over the other? Because in a traditional one, the investments grow pre-tax and are tax-deferred.

I cannot speak on behalf of our host, but its pretty obvious what he would say:

1) Thats a prediction as to future legislative/political outcome;

2) When you remove the money from a tax deferred account, you are likely to be in a much lower tax bracket than today — this gives you the benefit of all that tax-deferred growth at a lower rate.

3) Many firms offer free money — a corporate match, that is also tax free;

That advisor was an idiot . . .

1. Always put money into a 403b/401k to get a match if the employer offers one. I can’t think of a tax strategy that will outrun a 50% to 100% employer match in a tax deferred account.

2. If you are in a low tax bracket, especially if your state doesn’t have income tax, the Roth IRAs/401ks are a great deal. Most young people not making a lot of money should be socking money away in a Roth. Roth 401k/403b usually allow you to put in after tax money while the employer match goes into a regular tax-deferred account, so you get both at the same time which could be very efficient at retirement.

3. At higher income levels where you start getting into 25%+ combined tax brackets with federal and state income taxes, you need to really look at your personal tax and retirement situation. The value of future Social Security, pension etc. can play an important role in that decision since they may define what your future marginal tax bracket is likely to be.

The advisor is basically speculating on tax policy. Maybe he’s right. Maybe he’s wrong. But its not a given that taxes are going up and its certainly not a given that the anticipated tax increase would be an increase in ordinary income taxes. You could instead see an increase in FICA, Medicare, capital gains, or the addition of a sales tax. Or they could even start slapping some special tax on Roth withdrawals.

As far as the Roth or traditional, there’s no easy answer to that. If you’re paying higher taxes now than you expect to in retirement then you want to go traditional. Otherwise you want to use the Roth. So the big thing is to make a guess at your retirement tax rate and compare it to where you’re at today. Don’t forget to include state taxes especially if you plan on relocating for retirement.

Also, if 401k withdrawals are going to constitute a large share of your retirement income then you really shouldn’t just compare marginal rates. The deductions are of course coming at the marginal rate but the retirement income will be taxed at sort of an average rate. If you already have substantial retirement income from SS, a pension, and rental properties or business interests or whatever then that’s less of a factor and a marginal rate to marginal rate comparison might be appropriate..

With all that said, if you’re on the fence about tax rate there’s a couple reasons to go Roth. First, there’s no minimum withdrawals once you hit 70. Second, you can withdraw the principal at any time. Third, you can essentially contribute more money to the Roth since a large chunk of your traditional contribution is future taxes (only matters if you’re maxing it out). And with that said, if the debate isn’t Roth vs Traditional but Roth vs. 401k then the latter has the advantage that it takes income off of your W2. That could bring you all kinds of benefits depending on your income level as your eligibility for various tax credits/deductions phase out at different levels of income.

So basically the problem isn’t as simple as it may first appear but you definitely should be considering other things than future congressional actions.

What it costs to live the Apple life – interesting analysis:

http://www.marketwatch.com/story/what-it-costs-to-live-an-apple-life-less-than-4-a-day-2015-09-15

Google expanding production of driverless cars

Jeff Causey

September 12, 2015

According to a new report, Google X Head of Policy Sarah Hunter recently appeared before the California Public Utilities Commission where she reported the company is increasing production of their electric self-driving cars from 100 to “a few hundred” in 2015. This expanded production may indicate testing is going much better than anticipated.

Hunter also informed the commission that the company has started working a little more earnestly on how to market and sell the vehicles. Google appears to be trying to decide whether their target market should be individual buyers or perhaps operating them as a service for people who just need a temporary ride similar to Uber.

…

http://www.talkandroid.com/264683-google-expanding-production-of-driverless-cars/

Utica College slashes tuition price because it turned out nobody ended up paying anything close to it.

http://www.syracuse.com/schools/index.ssf/2015/09/a_cny_college_is_taking_a_gamble_by_cutting_its_tuition_42_percent.html#incart_river

Meg Hitman to Cut ANOTHER 30K form HP

http://www.businessinsider.com/hp-to-cut-another-25000-30000-jobs-2015-9

Is she the face of more females in tech? ROFL!

only as a percentage of the total employment. maybe

ALBERT EDWARDS: There’s a 99.7% chance we’re in a bear market

http://www.businessinsider.com/albert-edwards-thinks-were-in-a-bear-market-2015-8#ixzz3k74dJT69

http://www.businessinsider.com/socgen-permabear-albert-edwards-quotes-2011-12

https://www.caseyresearch.com/gsd/edition/socgens-albert-edwards-gold-will-still-climb-to-10000-the-ounce-when-the-correction-comes.

This guy is a comedian not a prudent investment thinker.

Mitch McConnell Ties Iran Deal To Recognition Of Israel

http://www.huffingtonpost.com/entry/senate-iran-nuclear-deal-vote_55f88337e4b0d6492d6350b4

So the day North Korea threatens to nuke America, Mitch McConnell is doing this? Great

seems that new jersey has this deal with verizon but doesnt actually use it, and new jersey seems to ignore that. hm, wonder if this is another side deal from the governor?

http://www.theverge.com/2015/9/14/9322481/verizon-fios-access-new-jersey-deal-loophole

@Willid3–The same thing happened to me at Dollar Rent a Car at Denver International Airport last spring. The rental car companies should be required to provide the whole menu of add-ons and prices when you reserve on-line and allow you to choose and see the total price before you land at your destination. I spent more on insurance and other add-ons. than the nominal price to rent the car.

A complete scam. Say what you will about how airlines have unbundled and individually priced each element of the flying experience, but it is much more transparent than renting a car.

The preceding comment is actually a response to Willid3’s comment of 7:43 a.m.

do not deal with thrifty or dollar rental car companies

http://www.ibtimes.com/driven-deceive-life-behind-counter-dollar-rent-car-2091895

unless you want to pay way to much for that car.