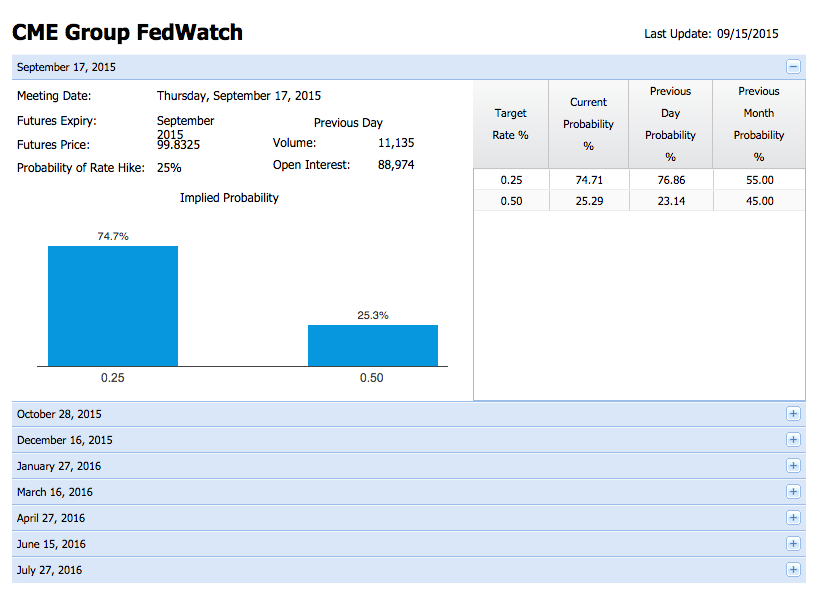

Source: CME Group

CME Group FedWatch Odds

September 16, 2015 9:00am by Barry Ritholtz

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client. References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers Please see disclosures here: https://ritholtzwealth.com/blog-disclosures/

What's been said:

Discussions found on the web:Posted Under

Previous Post

10 Wednesday AM ReadsNext Post

Recalling the Smart Money Index

I have come to the simple conclusion that the Fed needs to push the Fed Funds rate up 0.25% just so that everybody can shut up and focus on the many other important things in the world. NPR Morning Edition is covering this with (almost) bated breath which means this discussion is getting to the point of ridiculous.

If the economy can’t accept a 0.25% rate rise, then it really sucks and the Fed should just say that (using the normal opaque code words), putting the pressure back on Congress to not do stupid things like shut the government down over spending they have already approved. If it can take the 0.25% rise, then do it, thereby sending the message that the US won’t tolerate an over-heating economy in the future which should keep long bond interest rates down, helping the mortgage sector.

The one thing I do hope is that the Fed is not focused on how the stock market might react. It is too full of manic-depressive types to try to guess how it might react to any decision, especially over a 1-2 yr period.

Now I am seeing pieces about a “surprise” Fed rate hike. How can this be? This would be the most anticipated interest rate hike in the history of economics. The Fed has been signaling they want to raise rates this fall for a year or more. I think ZIRP has become the financial version of crack cocaine where the desperate need for it is over-riding the ability to read and think.

http://www.businessinsider.com/fed-rate-hike-uncertainty-in-1994-2015-9

Every other major source I follow shows about a 30% chance. CME has been about 75% for a long time.They seem to be an anomaly.

@rd – the issue is not so much a 0.25% hike as what a hike indicates about the Fed’s plans. A Fed that would hike in the face of low (and not increasing) inflation, recent market moves which have are about the same as a 0.50% hike, etc. is a lot more hawkish than generally believed. Tim Duy had a good post on the subject http://economistsview.typepad.com/timduy/2015/08/does-25bp-make-a-difference.html

funny, the CME isn’t calculating the probability correctly. Keep in mind that the expiration price of the Fed Funds contract the CME is using to calculate rate hike probabilities expire at the AVERAGE daily Fed Funds rate for the contract month.

I sent the following to the fixed income traders at my firm a few months ago……..

This could have to do with the timing of the FMOC meeting. The meeting is in the middle of the month, so for the first 17 days of September, the overnight rate is going to average somewhere between 0%-.25%. The July and Aug contracts are telling us the actual fed funds rate is trading .13%, the middle of its range.

Say the fed moves rates in Sep, but target a range instead of an exact rate, from 0-.25% to .25%-50%. If the FF rate trades in the middle of it’s new range, .375%, the implied contract price is 100-.0375= 99.9625. If they DO move rates, the Sep contract should expire at 100 minus the average of the two expected rates, .13% and .375%, 99.7475. If they DO NOT move rates, the Sep should expire at the same price as July and Aug, 99.870.

Currently, the Sep contract in trading 99.815 (From late July) which is right in between the two possible values that it can expire at. I think the CME website is assuming that the contract expires at 100 if FF rate is 0%. In reality, the true FF rate which the contract pricing is derived from, is a rate range. I believe this is what’s causing the discrepancy. MKT seems priced very close to 50-50 for a sep rate range change.

***It’s also possible that the FF rate has averaged lower than 13bps for the first 16 days of September or will trade on the lower end of the new target if the fed hikes the range 25bps.

Hope this helps

Once interesting aspect of the new “rate range” policy is that we do not know which end of the range the actual rate will trade at after the fed changes policy. It looks like the market is assuming that the FF rate will settle in the middle of the range, as it has in the past. This may not be true in the future.