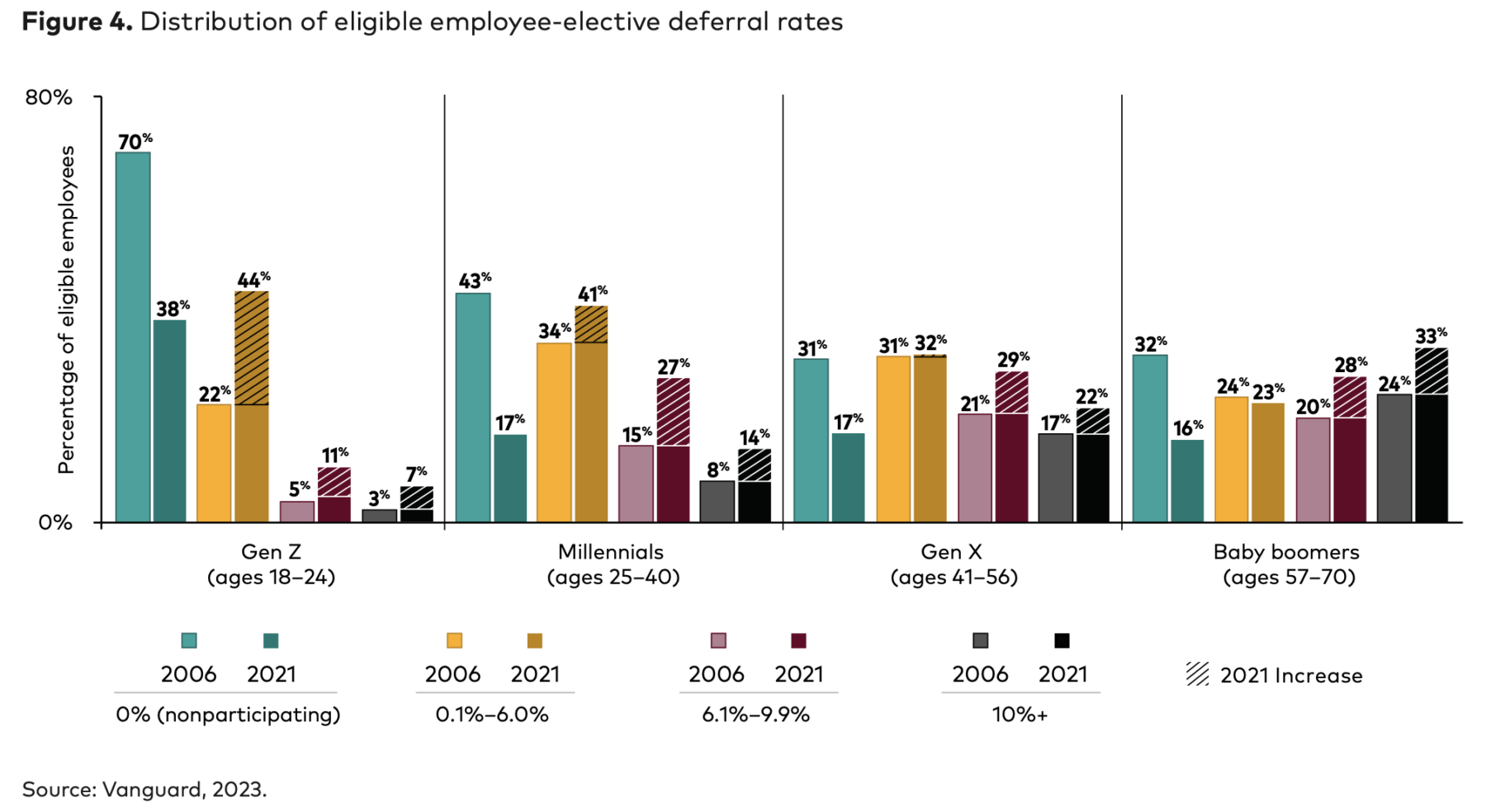

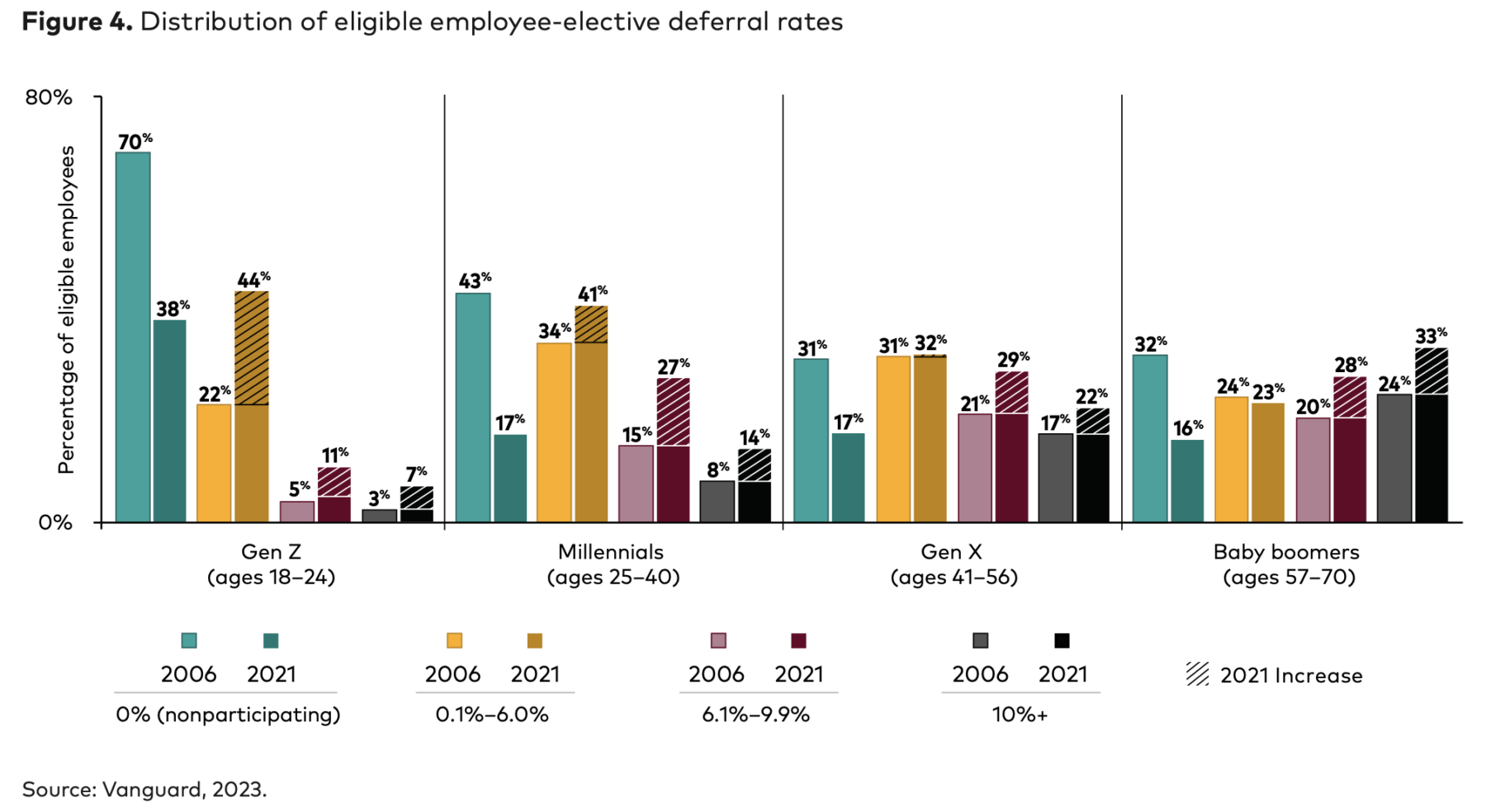

Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America...

Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America...

Read More

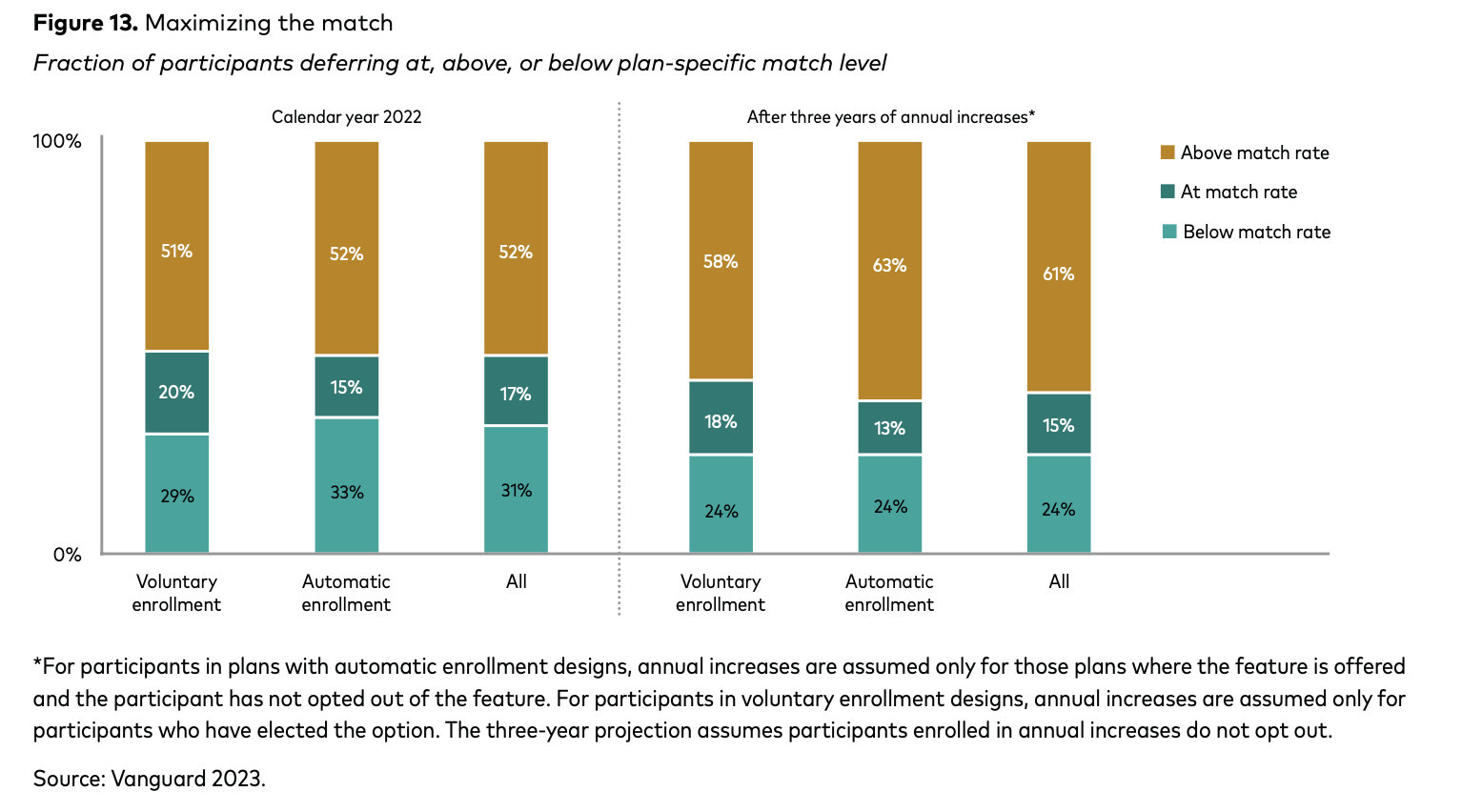

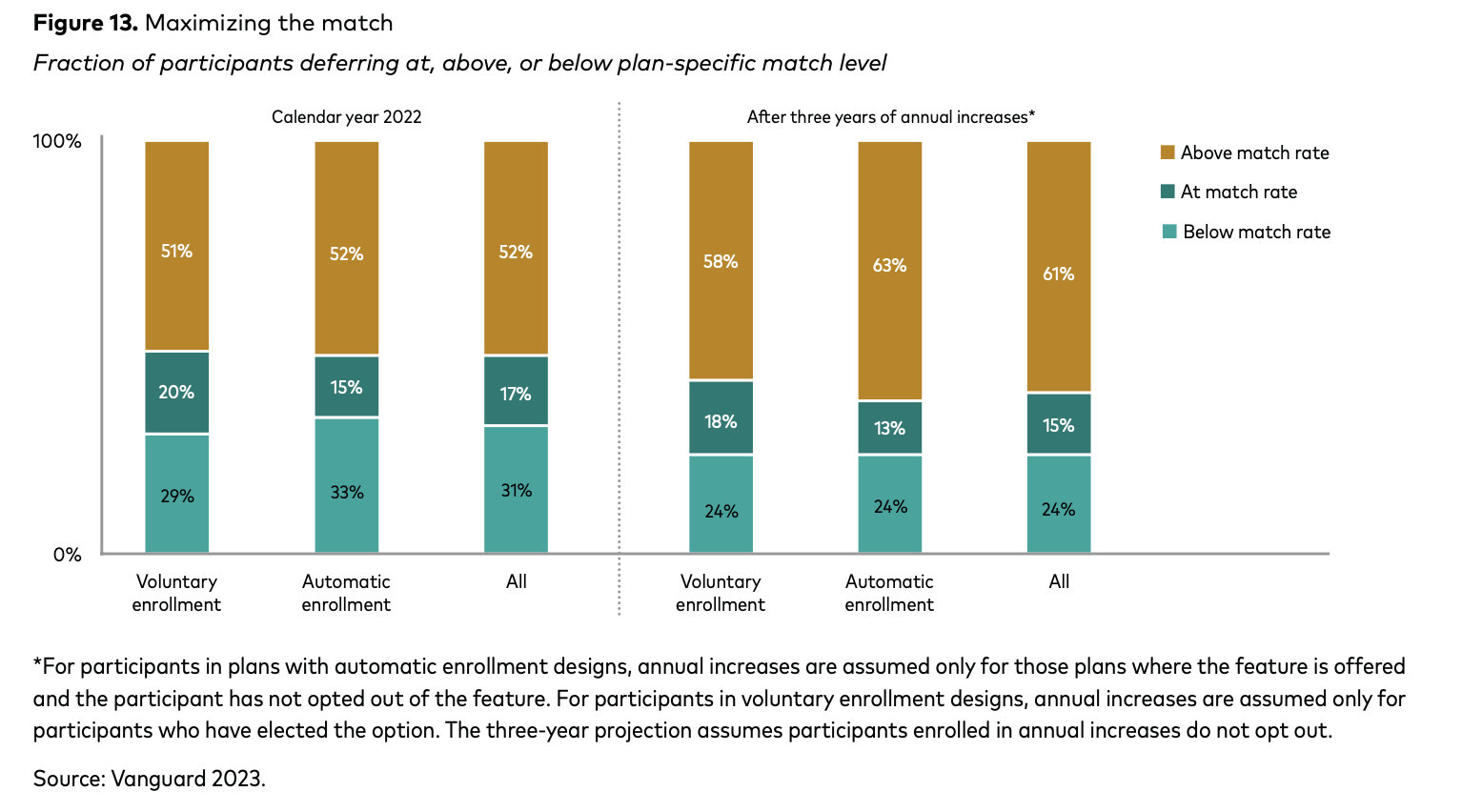

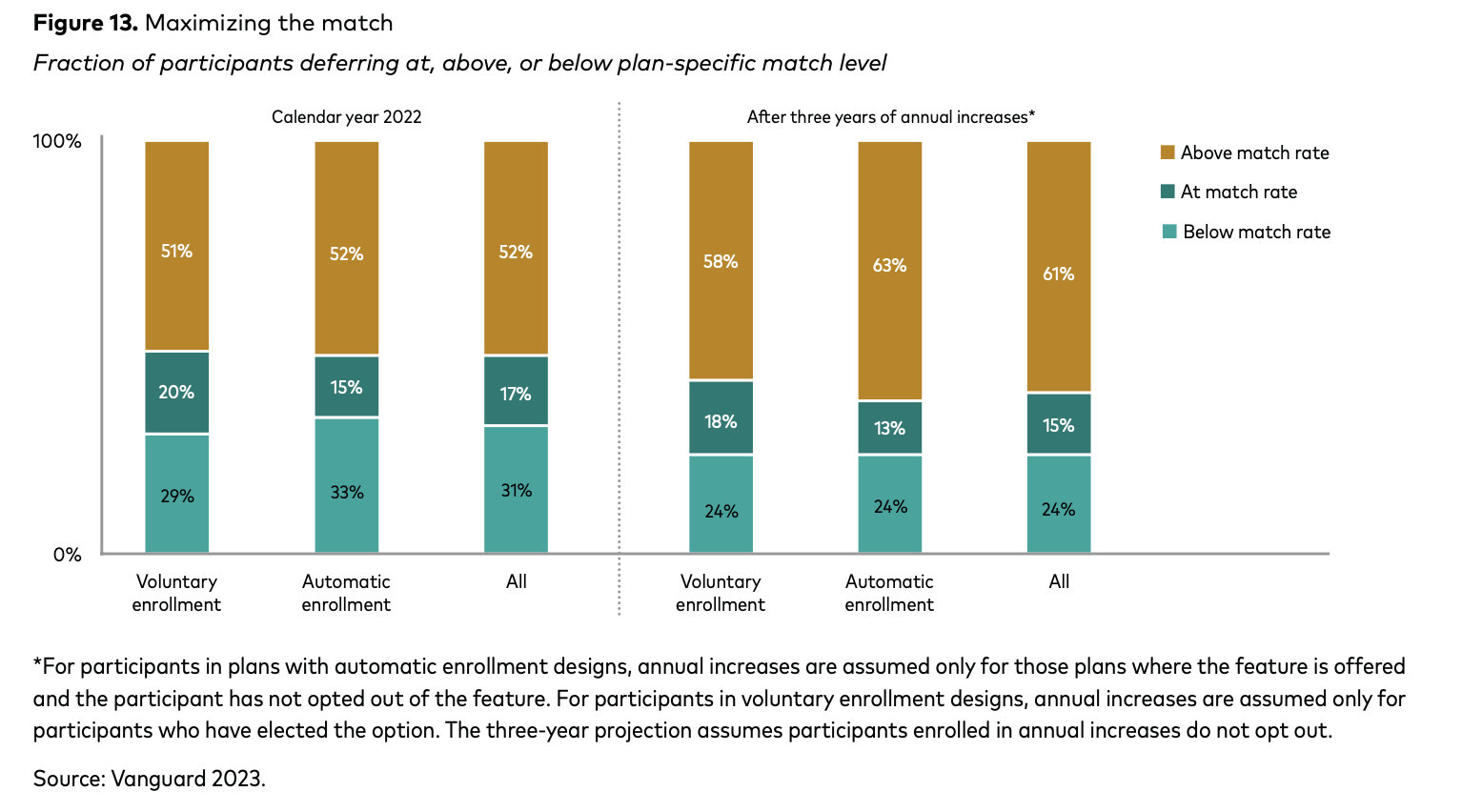

Some encouraging news about people saving for retirement: A study by Vanguard Group found that “Automatic enrollment and the...

Some encouraging news about people saving for retirement: A study by Vanguard Group found that “Automatic enrollment and the...

Read More

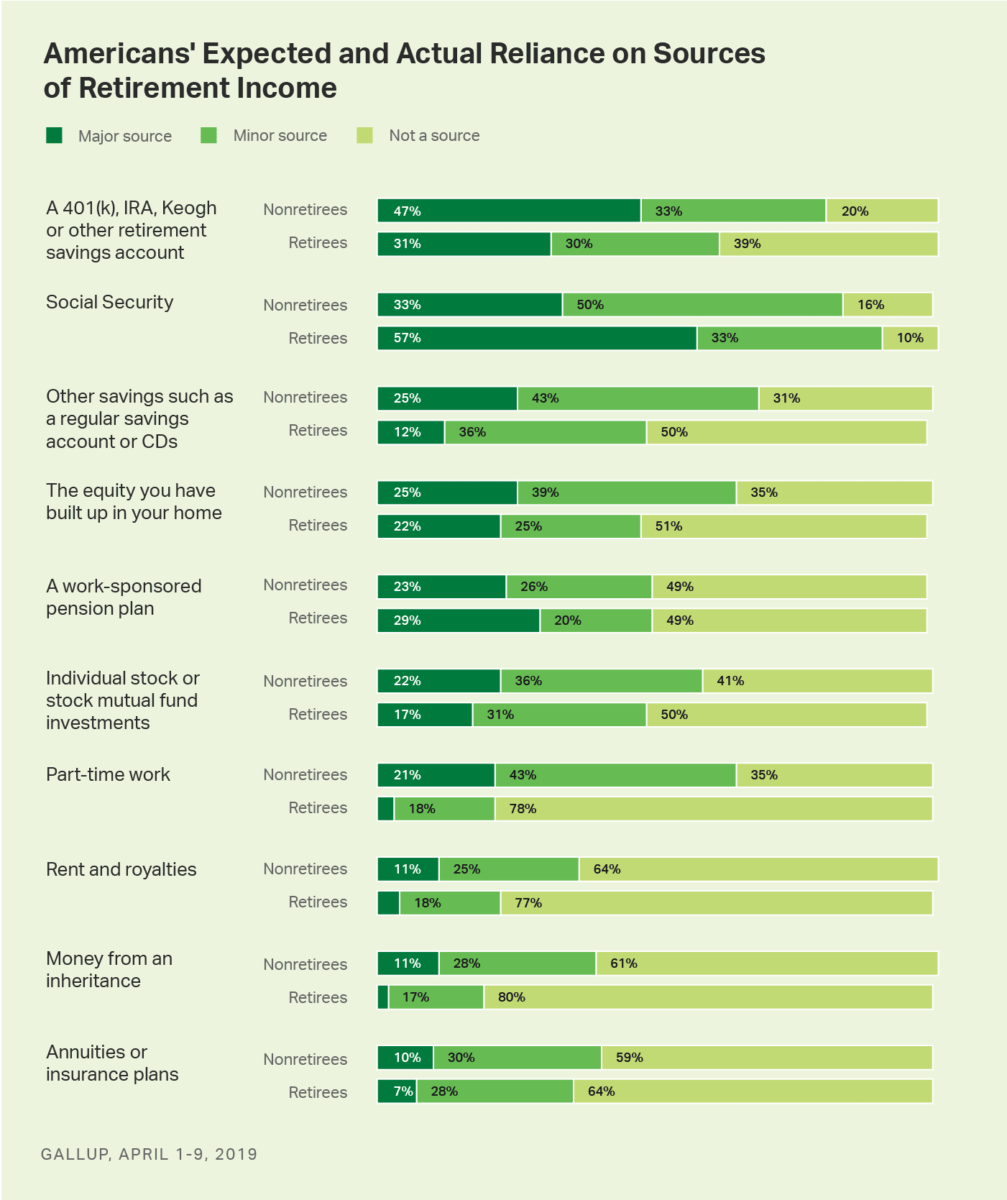

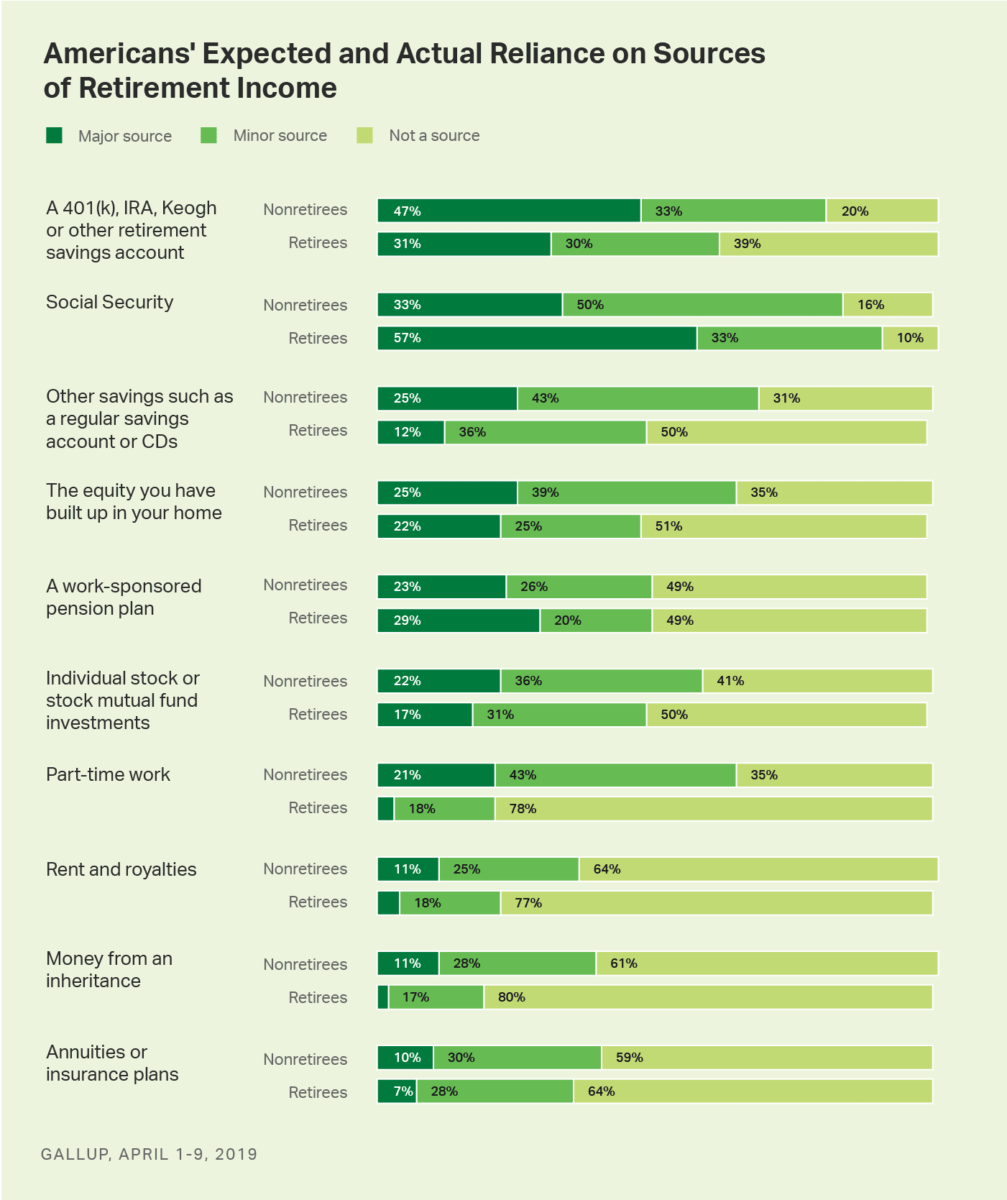

Wait, what? Americans believe in large numbers that their retirements are going to be just fine: • 15-year high 57% of non-retirees...

Wait, what? Americans believe in large numbers that their retirements are going to be just fine: • 15-year high 57% of non-retirees...

Read More

How You Can Hack Your Retirement Plan Your future self will be thankful. Bloomberg, July 8, 2019 The holiday weekend has...

Read More

How You Can Hack Your Retirement Plan Your future self will be thankful. Bloomberg, July 8, 2019 Last week, I made a...

Read More

I am participating in a panel today on retirement plans, 401Ks, Fiduciary standards, and the like. The host is Vestwell, which is...

I am participating in a panel today on retirement plans, 401Ks, Fiduciary standards, and the like. The host is Vestwell, which is...

Read More

I could not possibly be more excited to share an article with you today, from two RWM employees who are making a genuine...

I could not possibly be more excited to share an article with you today, from two RWM employees who are making a genuine...

Read More

Anthony and Dina Isola, investment advisor representatives at Ritholtz Wealth Management, talk with Bloomberg’s Scarlet Fu about...

Read More

Dina Isola, a financial advisor at RWM, is an advocate for the protection of retail investors, no matter how much money they have or what...

Read More

Dina Isola, investment advisor representative ar Ritholtz Wealth Management before Financial Services Committee Subcommittee on Investor...

Read More

Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America...

Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America...

Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America...

Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America...