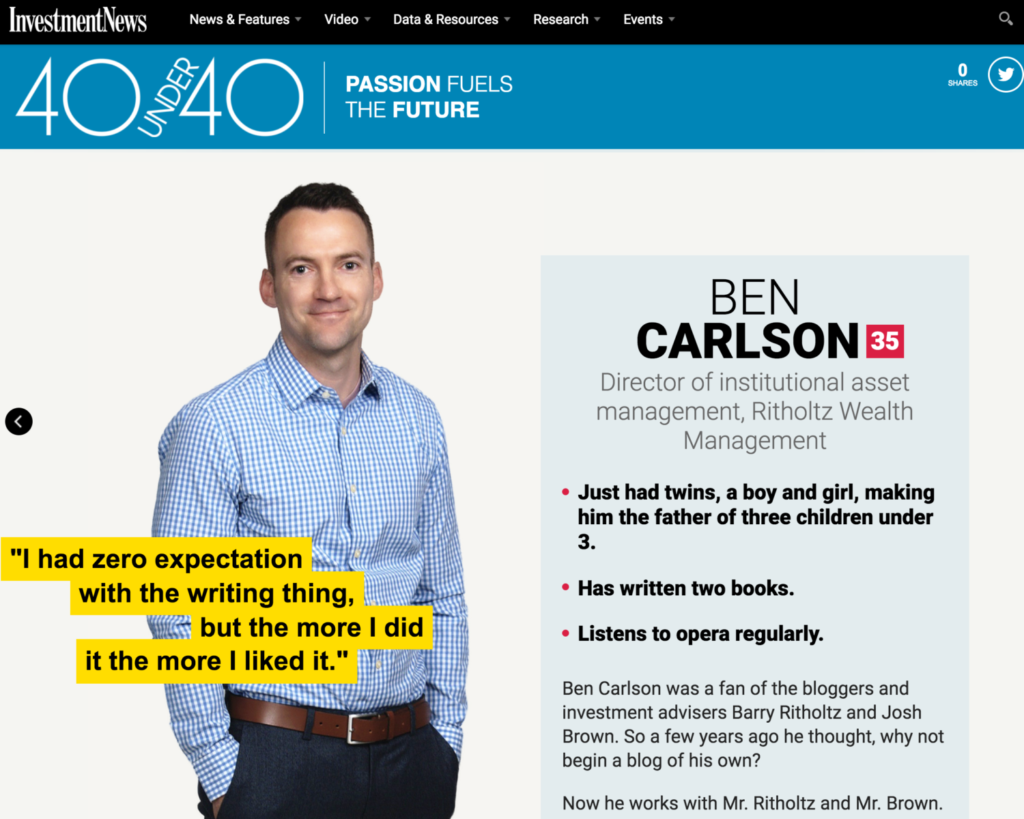

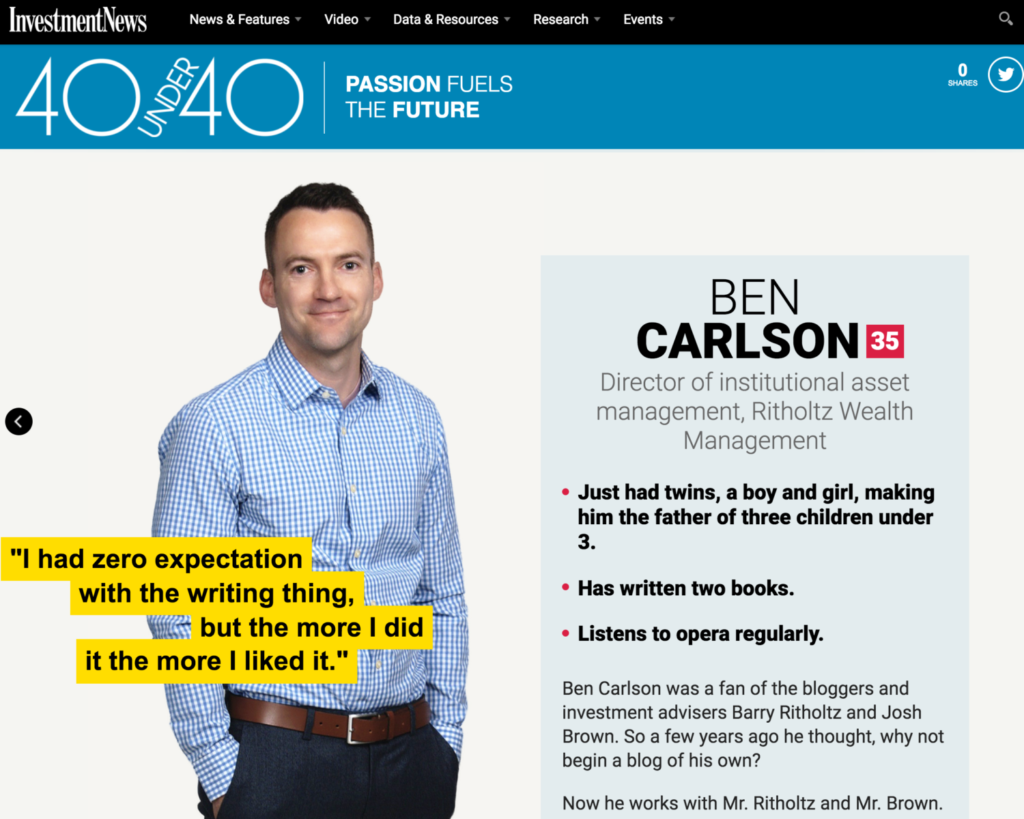

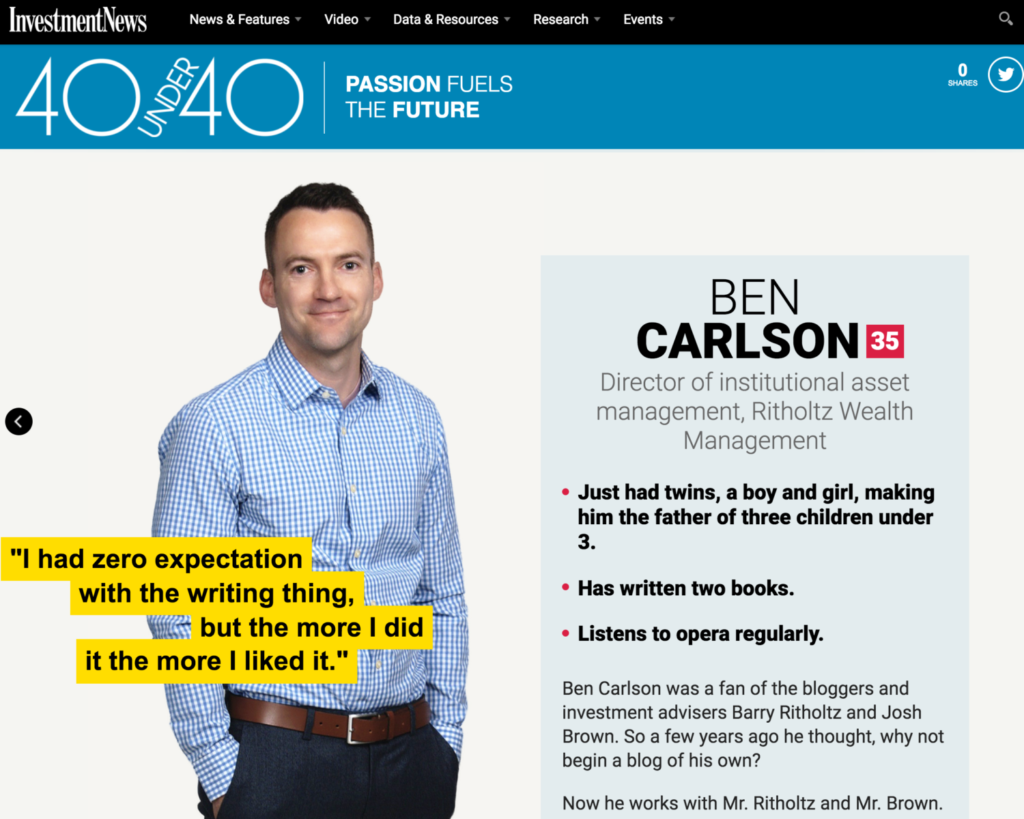

This is so cool — check out what Ben has to say about the honorific! Congrats, Ben, on a well-deserved accolade! click for...

This is so cool — check out what Ben has to say about the honorific! Congrats, Ben, on a well-deserved accolade! click for...

Read More

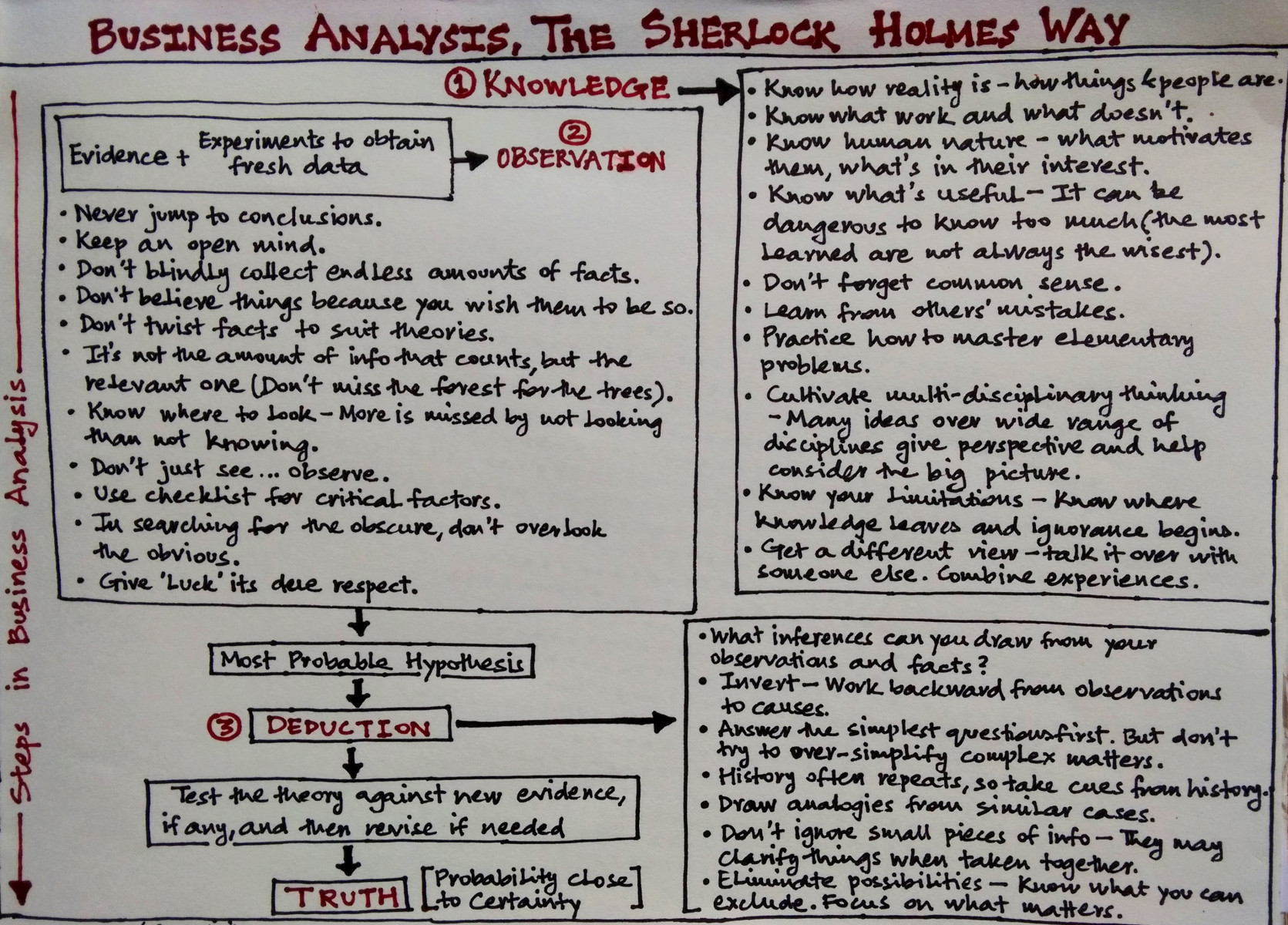

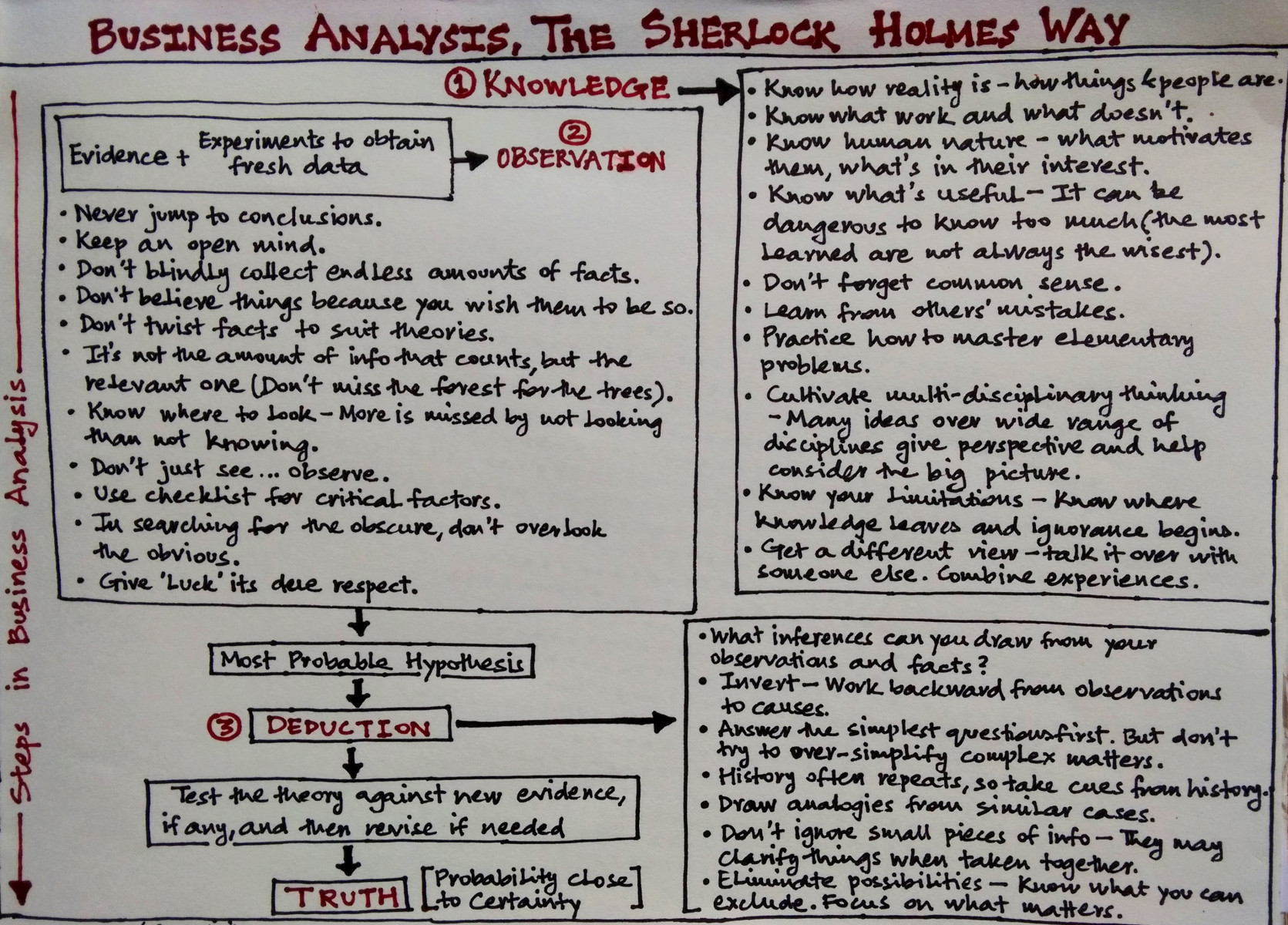

Wonderful post from Vishal Khandelwal, discussing how to approach stock analysis like Holmes: Road Map on How to Think 1. Know Human...

Wonderful post from Vishal Khandelwal, discussing how to approach stock analysis like Holmes: Road Map on How to Think 1. Know Human...

Read More

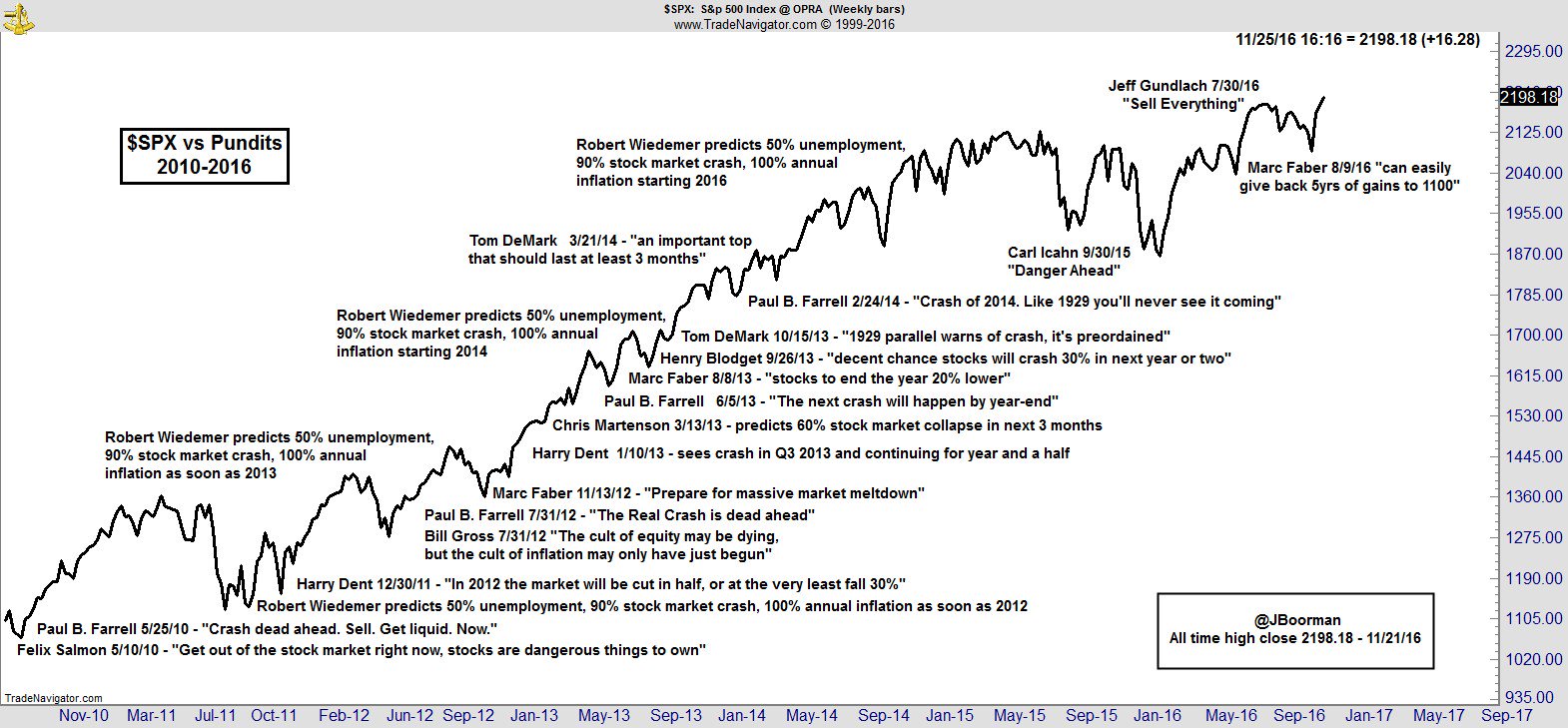

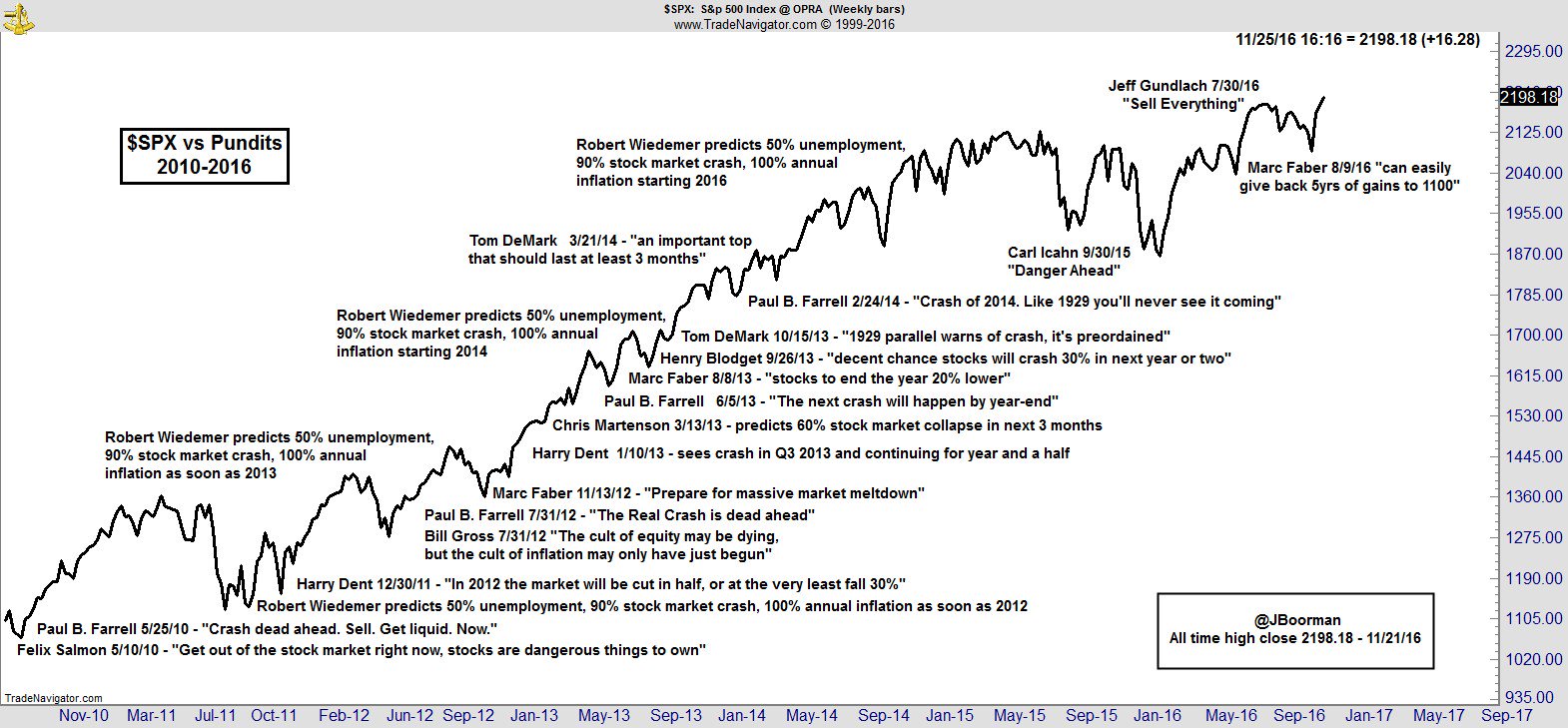

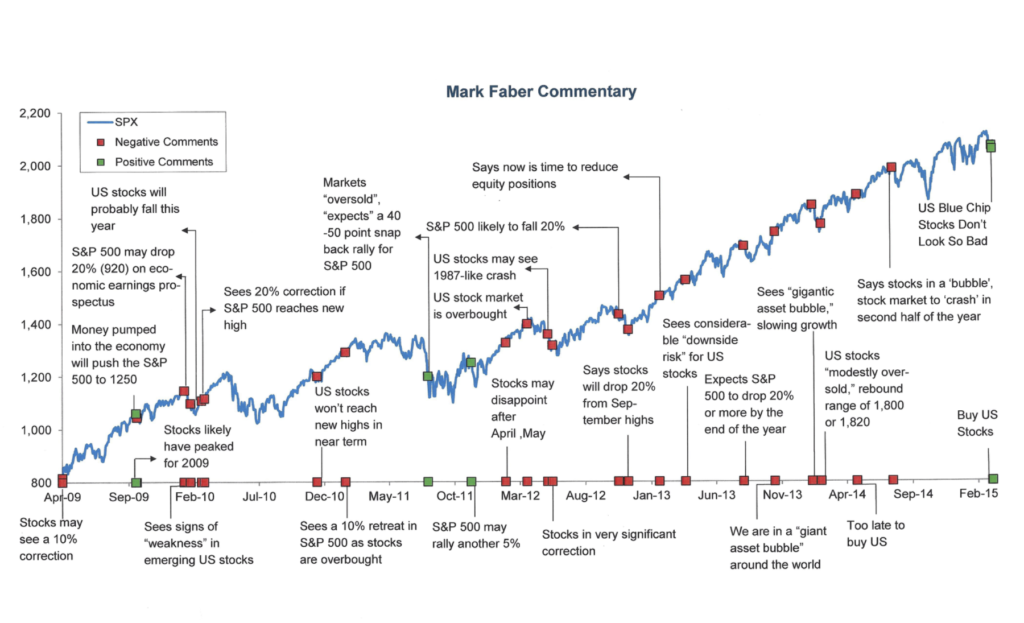

More great forecasts from the perma-doom crowd, via @JBoorman: click for ginormous graphic Source: @JBoorman

More great forecasts from the perma-doom crowd, via @JBoorman: click for ginormous graphic Source: @JBoorman

Read More

Donald Trump will be the next president of the United States. How did we get to this point? And what do we do now? President-Elect...

Read More

We are less than a month away from our first annual Evidence Based Investing Conference, coming to NYC on November 15th....

We are less than a month away from our first annual Evidence Based Investing Conference, coming to NYC on November 15th....

Read More

As this table via USA Today shows, Twitter is not monetizing its users: Company (Symbol) Market value / Revenue per user...

Read More

Bullish News From Wall Street’s Bearish Seers When the forecasters say one thing, it’s worth thinking about going in the...

Bullish News From Wall Street’s Bearish Seers When the forecasters say one thing, it’s worth thinking about going in the...

Read More

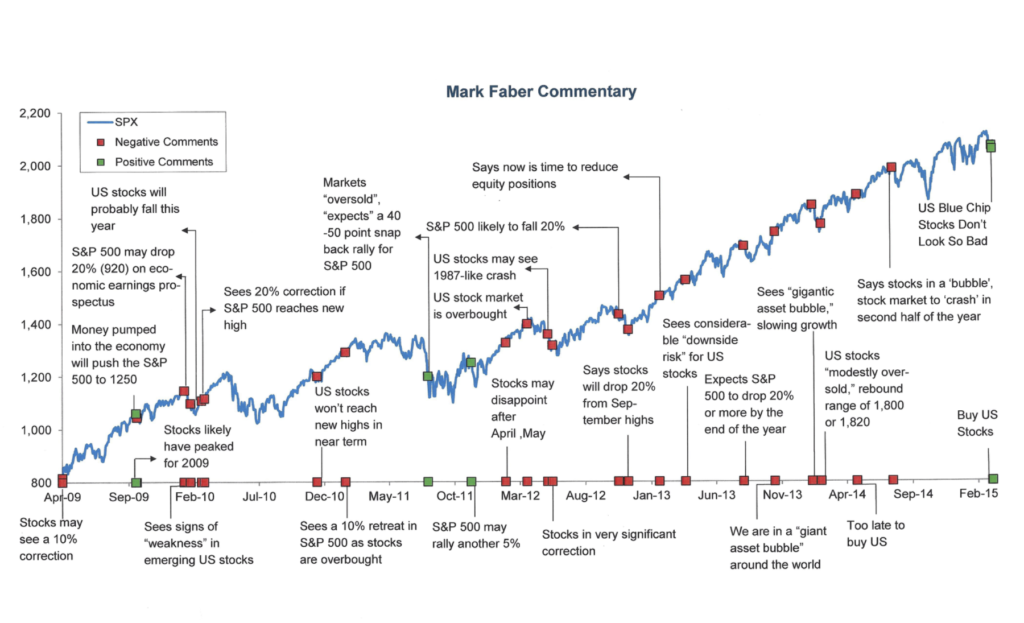

Here is what the below looks like in chart form: click for ginormous graphic Source: ? OK, let’s keep this fast and...

Here is what the below looks like in chart form: click for ginormous graphic Source: ? OK, let’s keep this fast and...

Read More

A rare condition, as described by Bloomberg: “One of the safest assumptions on Wall Street is that however high stocks have...

A rare condition, as described by Bloomberg: “One of the safest assumptions on Wall Street is that however high stocks have...

Read More

Really interesting stuff (“This is the video economists don’t want you to see!”): ‘Economics is for everyone’, argues...

Read More

This is so cool — check out what Ben has to say about the honorific! Congrats, Ben, on a well-deserved accolade! click for...

This is so cool — check out what Ben has to say about the honorific! Congrats, Ben, on a well-deserved accolade! click for...

This is so cool — check out what Ben has to say about the honorific! Congrats, Ben, on a well-deserved accolade! click for...

This is so cool — check out what Ben has to say about the honorific! Congrats, Ben, on a well-deserved accolade! click for...