"The most volatile part of the American economy has slowed significantly in the last nine months, providing a warning of both...

"The most volatile part of the American economy has slowed significantly in the last nine months, providing a warning of both...

Read More

On Sundays, I like to post some form of general trading/investing advice. It makes for a nice respite from the week’s event-driven...

Read More

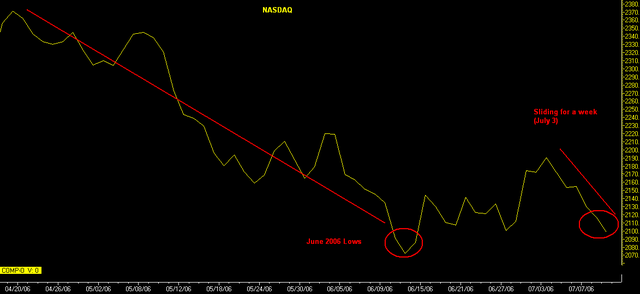

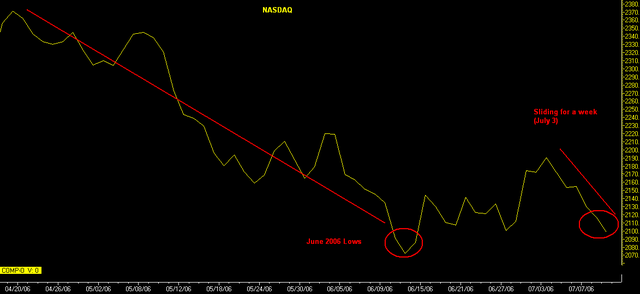

For the past 2 days, Rev Shark at Real Money has been talking about the recent action as a Capitulation. I have to disagree. Perhaps I...

For the past 2 days, Rev Shark at Real Money has been talking about the recent action as a Capitulation. I have to disagree. Perhaps I...

Read More

"Remember the wisdom of Lao Tzu: "He who knows others is wise. He who knows himself is enlightened." What do you...

Read More

I’ve been meaning to revisit a post by Doc Brett Steenbarger on the 5 defining features of "Market Pros," and the long...

Read More

This nice collection of 15 favourite investor fallacies comes to us via Incademy (a subsidiary of Global-Investor.com). "Beginners...

Read More

Interesting column by Mark Hulbert in the Sunday NYT about an econometric model I have observed over the years and have been impressed...

Interesting column by Mark Hulbert in the Sunday NYT about an econometric model I have observed over the years and have been impressed...

Read More

I had a very interesting discussion with a usually bullish (but circumspect) friend who writes me: “Man, you bears had an 11%...

Read More

Like our prior set of charts, the following VIX graph from Birinyi Associates discusses a measure of sentiment hitting an extreme measure...

Like our prior set of charts, the following VIX graph from Birinyi Associates discusses a measure of sentiment hitting an extreme measure...

Read More

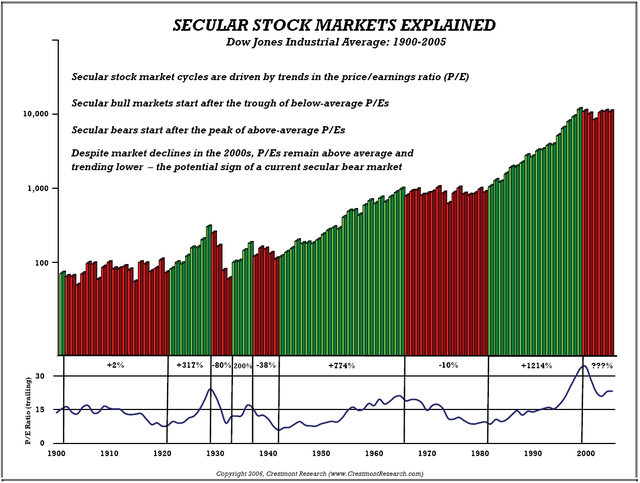

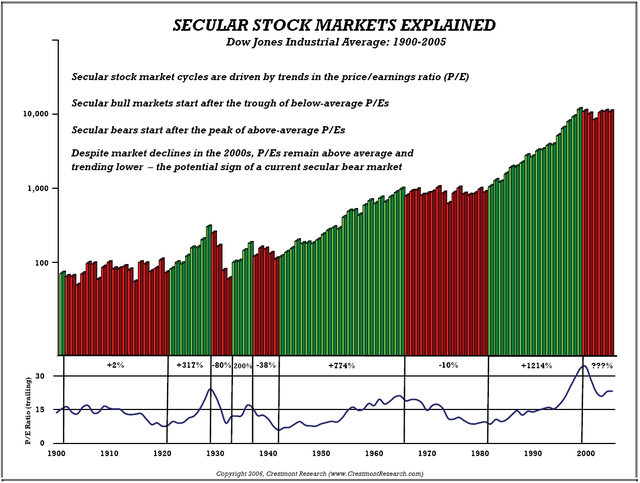

We’ve been discussing the 100 year charts that look at the secular history of Bull and Bear markets, including Adjusting Stock...

We’ve been discussing the 100 year charts that look at the secular history of Bull and Bear markets, including Adjusting Stock...

Read More

"The most volatile part of the American economy has slowed significantly in the last nine months, providing a warning of both...

"The most volatile part of the American economy has slowed significantly in the last nine months, providing a warning of both...

"The most volatile part of the American economy has slowed significantly in the last nine months, providing a warning of both...

"The most volatile part of the American economy has slowed significantly in the last nine months, providing a warning of both...